Benefits Canada reports, OMERS enters into infrastructure investment in Chile:

Canada's large pensions have a long love affair with Chile. In fact, it was over ten years ago that a consortium led by Brookfield Asset Management, which included Canada Pension Plan Investment Board (CPPIB), British Columbia Investment Management Corporation (bcIMC) and another institutional investor, entered into a definitive agreement to acquire in Chile 92% of the shares of HQI Transelec Chile S.A. ("Transelec"), the largest electricity transmission company in Chile, from Hydro-Quebec International Inc. for US$1.55 billion. The consortium also took steps to acquire the remaining 8% of Transelec in a separate transaction.

Ontario Teachers' has major stakes in two Chilean water utilities and last year made a $1.35 billion bet on Latin American infrastructure in a partnership with CPPIB and Latin American infrastructure group IDEAL, an infrastructure development and operating company that is among the holdings of Mexican billionaire Carlos Slim.

That toll road deal was CPPIB’s first infrastructure investment in Mexico, but there are others in South America including two in Chile, and a gas pipeline in Peru.

Back in 2012, CPPIB committed $1.14 billion to acquire about half ownership in five major toll roads in Chile, part of its strategy of making long-term investments to support future benefit payments.

So what is it about Chile that attracts so much attention from Canada's large pensions? For this, let's examine a recent article by Nathaniel Parish Flannery of Forbes, How Will Chile's Economy Perform In 2017?:

We all remember the boom-bust story of Brazil. In 2013, I asked whether Eike Batista burned Ontario Teachers' and a year later, I covered CPPIB's risky bet on Brazil. Whether it's Brazil, Mexico, Columbia, Chile, Peru or Argentina, investing in Latin America is risky business. You absolutely need the right partners to deal with thorny political and regulatory risks.

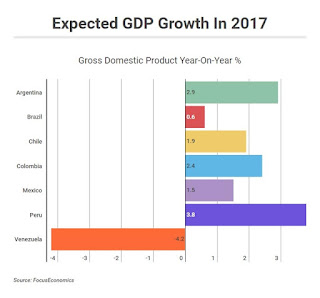

But there's no denying that things are changing for the better in Latin America where growth projections and inflation expectations are relatively high compared to the G7 developed economies.

Still, there is cause for concern. Emerging markets in Latin America are inextricably linked to China and there are economic and demographic factors that can hamper future growth. In his new book, behind Upside: Profiting From the Profound Demographic Shifts Ahead, demographer Kenneth W. Gronbach outlines some of his concerns:

What else concerns me? Samuel Gregg of the American Spectator reports the model in Chile is under siege:

However, as I keep stressing on this blog, Canada's large pensions have a very long investment horizon, if they're making long-term infrastructure investments in Chile, Mexico and elsewhere in Latin America, it's because they believe they can manage the political, regulatory and currency risks and come out ahead as these investments will offer them stable returns over the long run.

I'll put it to you this way, Canada's large pensions aren't buying infrastructure stakes in airports, ports, toll roads or natural gas, electric transmission utilities to flip them a year later. Sure, if some entity offers them an attractive price, they will sell these assets on occasion, but they typically want to keep them on their books for a long time because it's part of their strategy to meet long-dated liabilities with as much certainty as possible.

Below, at Americas Society/Council of the Americas' Latin American Cities Conference last year, the head of Chile's Central Bank, Rodrigo Vergara, outlined the country's economic priorities to achieve an economic growth of 3.5 percent for the next ten years.

I personally think Chile will be lucky to achieve this target annualized growth rate over the next ten years but listen carefully to his comments, he discusses the aging of the population and other factors that can influence growth.

More worrisome, thousands of students took to the streets of Santiago recently to protest against an education reform bill, which they argue will fail to overhaul Chile's expensive education system.

These images remind me of what goes on in Greece when students protest in the streets of Athens. For the sake of Canada's pensioners, let's hope Chile's economic fate is far better than that of my ancestral home.

Borealis Infrastructure, the infrastructure investment manager of the Ontario Municipal Employees Retirement System, has signed an agreement to acquire a 34.6 per cent stake in a liquified natural gas company based in Chile.You can read OMERS's press release on this deal here, but it basically goes over the same things mentioned above.

The remaining stakeholders in GNL Quintero S.A. include Enagás, a large builder and operator of regasification plants and pipeline systems and Empresa Nacional del Petróleo, Chile’s state-owned energy company. As part of the transaction, OMERS has agreed to grant Enagás a 12-month call option for five per cent of its shares.

“Today marks not only our first direct infrastructure investment in Chile, but also signals our entrance into South America,” said Ralph Berg, executive vice-president and global head of infrastructure at OMERS Private Markets.

“GNLQ is a well-managed, world-class asset that aligns closely with our ongoing effort to diversify our global portfolio of core infrastructure holdings — and pay pensions to our members. We look forward to working constructively with our fellow GNLQ shareholders, GNLQ management and all local stakeholders in the years ahead.”

Located northwest of Santiago, Chile, GNLQ is a land-based terminal dedicated to the receiving, unloading, storage and regasification of up to 15 million cubic meters per day of liquefied natural gas. It’s focused on providing clean, efficient and safe energy to markets, which include residential and industrial users, power generators and the transportation sector.

Since it commenced operations, GNLQ has served nine gas-fired power plants, two refineries, 450 industries, more than 700,000 commercial and residential customers and 7,000 commercial vehicles. As well, the terminal has dispatched more than 40,000 liquefied natural gas tanker trucks to serve customers that aren’t connected to the pipeline grid, through satellite regasification units located up to 1,000 kilometres away from the facility.

Canada's large pensions have a long love affair with Chile. In fact, it was over ten years ago that a consortium led by Brookfield Asset Management, which included Canada Pension Plan Investment Board (CPPIB), British Columbia Investment Management Corporation (bcIMC) and another institutional investor, entered into a definitive agreement to acquire in Chile 92% of the shares of HQI Transelec Chile S.A. ("Transelec"), the largest electricity transmission company in Chile, from Hydro-Quebec International Inc. for US$1.55 billion. The consortium also took steps to acquire the remaining 8% of Transelec in a separate transaction.

Ontario Teachers' has major stakes in two Chilean water utilities and last year made a $1.35 billion bet on Latin American infrastructure in a partnership with CPPIB and Latin American infrastructure group IDEAL, an infrastructure development and operating company that is among the holdings of Mexican billionaire Carlos Slim.

That toll road deal was CPPIB’s first infrastructure investment in Mexico, but there are others in South America including two in Chile, and a gas pipeline in Peru.

Back in 2012, CPPIB committed $1.14 billion to acquire about half ownership in five major toll roads in Chile, part of its strategy of making long-term investments to support future benefit payments.

So what is it about Chile that attracts so much attention from Canada's large pensions? For this, let's examine a recent article by Nathaniel Parish Flannery of Forbes, How Will Chile's Economy Perform In 2017?:

Since the 1990s Chile has earned a reputation for being the best managed economy in Latin America. Policymakers built up strong institutions, developed new industries and helped foster more than two decades of impressive growth. Although copper mining is still the backbone of Chile's economy companies such as FirstSolar and SunEdison have invested heavily in the country's burgeoning solar energy sector.Chile does have a great reputation but this article highlights the main risks of investing in infrastructure in Latin America or elsewhere, namely, political and regulatory risks.

Still despite its sizable upside, Chile is still defined by extraordinarily high levels of inequality and in recent years has been rocked by a number of massive and sometimes violent protests. Voters have grown disenchanted with current left-of-center president Michelle Bachelet (who also served a previous term as president from 2006 to 2010). Voters will elect Chile’s new president in November 2017. With Bachelet so unpopular right now the election will be worth watching. Voters could choose right-of-center billionaire businessman Sebastian Piñera who served as president from 2010 to 2014 and placed his assets in a blind trust. (Forbes estimates Piñera’s assets are worth $2.7 billion. He is the wealthiest top-level politician in Latin America.)

With so much unrest bubbling under the surface of Chile's well-polished veneer of stability and civility, voters could also turn to a candidate who is more independent from the political establishment. Already this year companies such as BHP Billiton have been affected by labor unrest and a longstanding conflict with the country's Mapuche indigenous group continues to simmer. To get a sense of what people can expect from Chile's economy in 2017, I reached out to Michael Baney, a Latin America expert and senior analyst at Allan & Associates, a boutique political risk consultancy.

Nathaniel Parish Flannery: What can we expect in terms of GDP growth in Chile this year? Some economists are estimating growth is going to be a bit slower than what we've seen over the last few years. Do you seen any causes for concern?

Michael Baney: A few days ago, Chile’s central bank revised its growth projection range down to 1% to 2%, largely based on concerns over the impact of a recent strike at Escondida, the world’s largest copper mine. Chile's economy is heavily dependent production and export of the red metal: copper and copper products account for just under half of its exports, with China being by far its largest trading partner.

Even if growth in Chile reaches 2% this year, it would still be far more sluggish than what was seen during the height of the global commodities boom. Back in 2004, growth reached 7%, for example, and after it dipped during the financial crisis, it recovered to 5.8% in 2011 and 2012.

Such were the boom days for Chile and much of Latin America, a key source of raw materials. Those days are definitively over, however, and while 2% growth isn’t terrible for a country as wealthy as Chile, it will likely be some time before rates reach their former highs. One bright spot for Chile is that the copper glut appears to be coming to an end, which may attract further mining investment, although part of the reason for the recent increase in copper prices is concerns about labor unrest in Chile itself.

Parish Flannery: Chilean voters are going to head to the ballot box again. What's at stake in the upcoming election? Do you think we are going to see a surprise ending?

Baney: The past year has been marked by major protests against the administration of President Michelle Bachelet, whose approval ratings have hovered around 25%. Bachelet can’t run again this year, and probably wouldn’t want to even if she could. While the country has yet to hold primary elections, leftist senator Alejandro Guillier and conservative former president Sebastián Piñera are shaping up to be the main two contenders for the presidency. Piñera has led in several polls, but after Brexit, the Colombian peace referendum, and the election of Donald Trump, I think we’ve all learned to be somewhat skeptical of political polling data.

One thing to watch is the congressional elections. Chile used to have a strange electoral system that had the effect of deadlocking the congress between the two main coalitions no matter who won the most votes. A constitutional reform made with the intent of finally completing Chile’s long transition to full democracy abolished that system, however, and this will be the first congressional election run without it.

Interestingly, the election comes at a time when party affiliation is at a low and general disgust with politics is at a high. While we may not see any surprises during this electoral cycle, the reform would make it easier for an anti-system populist from outside the two main coalitions to gain a foothold in congress, much like has been seen elsewhere in the world. It would be ironic if the reform meant to fully democratize Chile helped lead to the rise of a candidate with questionable respect for democratic institutions.

Parish Flannery: As we look ahead in 2017 are there any particular political risk flash-points that you think merit attention?

Baney: The past month has seen a major escalation of the conflict between the state and radical Mapuche groups. The Mapuche are an indigenous group in who live in the heart of southern Chile’s timber region, and some Mapuche organizations have hijacked logging trucks, burned millions of dollars’ worth of equipment and structures, and threatened to attack hydroelectric dams. A few weeks ago, one Mapuche group destroyed 19 parked trucks, a warehouse, and several pieces of industrial equipment owned by a logistics company in what was the most significant such attack the country has seen in decades. Chile has a reputation for being among the safest and most stable countries in Latin America, but it is far from being without risks.

We all remember the boom-bust story of Brazil. In 2013, I asked whether Eike Batista burned Ontario Teachers' and a year later, I covered CPPIB's risky bet on Brazil. Whether it's Brazil, Mexico, Columbia, Chile, Peru or Argentina, investing in Latin America is risky business. You absolutely need the right partners to deal with thorny political and regulatory risks.

But there's no denying that things are changing for the better in Latin America where growth projections and inflation expectations are relatively high compared to the G7 developed economies.

Still, there is cause for concern. Emerging markets in Latin America are inextricably linked to China and there are economic and demographic factors that can hamper future growth. In his new book, behind Upside: Profiting From the Profound Demographic Shifts Ahead, demographer Kenneth W. Gronbach outlines some of his concerns:

Gronbach also looks at trends shaping the rest of the planet. He offers a fascinating analysis on China, including the problem of a profound gender imbalance with far more men than women. He expresses concern over the impact of aging rates in Latin America. Access to information is a global shift —in the era of Big Data, we have more power than ever to read the numbers as we chart our future course. Gronbach is a well qualified, highly engaging guide.I've covered Chile's Pension Crunch when I went over the global pension crunch last year. These are serious structural issues that Chile and others need to address or else they will impact long-term growth.

What else concerns me? Samuel Gregg of the American Spectator reports the model in Chile is under siege:

Whenever anyone thinks of economic success stories, Latin America doesn’t exactly leap to mind. For the most part, modern Latin American economies have been characterized by corruption, cronyism, statism, populism, boom-bust cycles, failed reform efforts, and colossal meltdowns. There is, however, one major exception to that rule — Chile.As you can read, the stakes are high for this year's elections in Chile, and you can be sure Canada's large pensions will be following political developments there very closely.

Beginning with General Pinochet’s military regime in 1973 and continuing after the 1990 transition to democracy, Chile’s economy underwent significant liberalization. Today, Chile is officially classified as a developed country. And the benefits have encompassed the less well-off. As the World Bank stated in 2016:The percentage of the population considered poor (those who live on US$ 2.5 per day) declined from 7.7 percent in 2003 to 2.0 percent in 2014, and moderate poverty (US$ 4 per day) fell from 20.6 percent to 6.8 percent during the same period. Moreover, between 2003 and 2014, the average income of the poorest 40 percent of the population increased by 4.9 percent, a figure considerably above the average income growth of the population as a whole (3.3 percent).Some nations would kill for these numbers. They are primarily the result of Chile embracing free trade, labor market deregulation, anti-inflationary policies, large-scale privatizations, and strong private property protections.

Undergirding this has been the long-term commitment by intellectuals, such as those associated with the think-tank Libertad y Desarrollo, to making tough-minded and in-depth arguments for market economies and their institutional prerequisites such as rule of law. Above all, many Chileans decided decades ago to stop blaming “the North” and mysterious “interests” “out there” for the country’s problems.

All these hard-won achievements, however, are now under threat. Since 2014, President Michelle Bachelet’s center-left administration has sought to undermine what Chileans call “the model.”

In the name of equality (by which they mean the equalization of starting points and results), Bachelet’s government is trying to turn Chile into a European social democracy. The fact that social democracies are faltering everywhere in Western Europe isn’t, apparently, a relevant consideration.

As I learned during a recent visit to Chile, the word used to describe this dismantling project is retroexcavadora (literally, “backhoe”). It was first used by a left-wing senator, Jaime Quintana, in March 2014 to explain how the government would root out the Chilean model’s political and economic foundations.

In 2016, for example, Chile’s labor market laws were changed to make it harder for businesses to let employees go. The same legislation forbids companies from extending benefits to workers who don’t belong to unions. It also privileges unions as the main bargaining unit, regardless of whether individual workers actually want to belong to them. So much for the right of free association. Instead, it’s back to the redundant “capital-and-labor” logic of the 19th century.

Chile’s educational institutions are also under assault. This involves a concerted drive by Bachelet’s government to undercut a largely user-pays, demand-driven higher education system. The goal is to extend “free” higher education to ever-increasing numbers of students. How this “free” learning will be paid for is, at best, unclear.

Accompanying this measure are efforts to diminish parental choice, private schools, and Chile’s voucher system. Vouchers, it appears, have produced good outcomes for Chilean students across socioeconomic levels. They have also boosted private school attendance. By 2011, about 40 percent of Chilean students from the lower income bracket went to private schools.

Again, however, what matters to the Chilean left is the ideological priority of equalization and its distrust of non-public institutions. Free choice is out. Leveling down is in.

The Bachelet government’s number-one target, however, is Chile’s constitution. First approved via referendum in 1980 and considerably modified through referenda and legislation since then, the Chilean left has never accepted its legitimacy. That’s partly because the constitution was implemented under Pinochet. But it’s also because Chile’s constitution limits state power in ways which are anathema to the left.

Their long-term goal is a new constitution: one that waters-down the present constitution’s strong guarantees of private property and the commitment to the Catholic principle of subsidiarity, which pervades the text. Subsidiarity’s decentralizing implications are especially important, because they ensure that Chile’s constitution attaches a higher premium to limited government than your average Latin American country.

There’s considerable evidence that Bachelet’s government is trying to rig the consultative process for the drafting of a new constitution. Moreover, based upon what Bachelet ministers have said, their preferred arrangements would take Chile closer to the constitutions adopted by left-populist governments in countries like Ecuador and Bolivia in recent years. A quick glance at these documents soon indicates that they are the polar opposite of Chile’s present constitutional provisions — not least because they amount to institutionalized populism.

Retroexcavadora, however, is now encountering problems. Just five minutes of conversation with Chilean parents soon reveals just how they resent the government’s willingness to sacrifice educational choice and quality of education to the god of equality. Angry parents means angry — and motivated — voters.

Another difficulty is that President Bachelet herself is caught up in a series of corruption scandals involving family members. Although Bachelet was once very popular, her approval ratings presently linger in the mid-20 percentiles.

Nor is a perceptible decline in economic conditions helping Bachelet’s government. Chile’s unemployment rate, for instance, is now 6.4 percent. That’s up from 5.8 percent a year ago. In 2016, the Chilean economy expanded at the anemic European-like growth-rate of 1.6 percent, down from 2.3 percent in 2015. This year’s growth projections aren’t that great either.

The question of whether retroexcavadora succeeds, however, ultimately depends on presidential and legislative elections due at the end of 2017. The constitution bars Bachelet from seeking another consecutive term. But it does allow her predecessor, the conservative pro-market Sebastian Pinera, to run. And running he is.

It’s too early to predict the likely outcome. Yet one thing is certain. If Chilean voters decide they want to maintain the model, Chile will continue to show that Latin America nations aren’t doomed to become Argentina, let alone left-populist disasters like Venezuela. On the other hand, if Chileans effectively endorse retroexcavadora, Latin America risks losing the example that shows the entire continent the politics and rhetoric of envy need not be its future.

For 647 million Latin Americans, the stakes couldn’t be higher.

However, as I keep stressing on this blog, Canada's large pensions have a very long investment horizon, if they're making long-term infrastructure investments in Chile, Mexico and elsewhere in Latin America, it's because they believe they can manage the political, regulatory and currency risks and come out ahead as these investments will offer them stable returns over the long run.

I'll put it to you this way, Canada's large pensions aren't buying infrastructure stakes in airports, ports, toll roads or natural gas, electric transmission utilities to flip them a year later. Sure, if some entity offers them an attractive price, they will sell these assets on occasion, but they typically want to keep them on their books for a long time because it's part of their strategy to meet long-dated liabilities with as much certainty as possible.

Below, at Americas Society/Council of the Americas' Latin American Cities Conference last year, the head of Chile's Central Bank, Rodrigo Vergara, outlined the country's economic priorities to achieve an economic growth of 3.5 percent for the next ten years.

I personally think Chile will be lucky to achieve this target annualized growth rate over the next ten years but listen carefully to his comments, he discusses the aging of the population and other factors that can influence growth.

More worrisome, thousands of students took to the streets of Santiago recently to protest against an education reform bill, which they argue will fail to overhaul Chile's expensive education system.

These images remind me of what goes on in Greece when students protest in the streets of Athens. For the sake of Canada's pensioners, let's hope Chile's economic fate is far better than that of my ancestral home.