This is a bilingual comment so bear with me. La Presse Canadienne recently reported on the compensation of the Caisse's senior managers, Combien ont gagné les patrons de la Caisse de dépôt et placement du Québec en 2016?:

In order to understand these figures, it's important to carefully read the Report of the Human Resources Committee which begins on page 93 of the Annual Report. La Caisse’s employees receive total compensation based on four components:

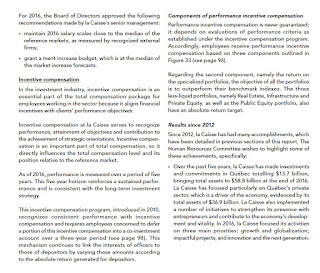

Below, I embed an extract from page 100 of the Caisse's 2016 Annual Report discussing Michael Sabia's compensation (click on image):

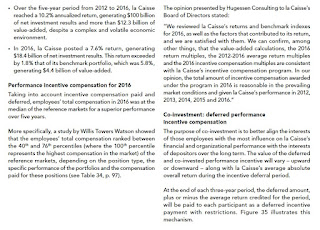

And below is figure 36 which goes over the performance components of the President and CEO's total compensation (click on image):

Also worth mentioning some added information provided on Michael Sabia's compensation:

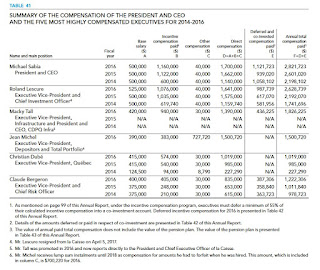

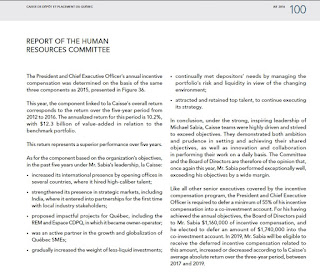

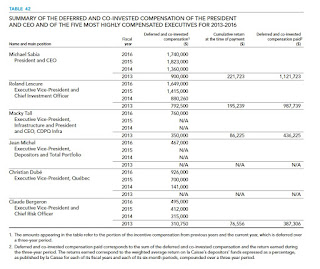

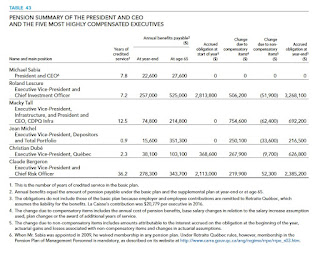

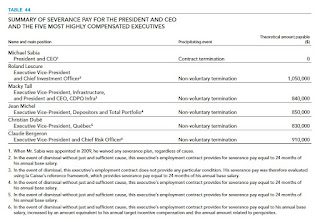

Tables 43 and 44 below provide the pension summary and severance for the president and five most highly compensated executives at the Caisse (click on images):

Table 45 below provides details of the reference markets used to reference the compensation of the president and five most highly executives of the Caisse (click on image):

Make sure you read the footnotes to these tables to understand how compensation is determined.

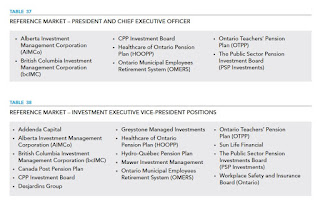

The reference markets used for the CEO and executive VPs and non-investment positions used for referencing compensation are provided in tables 37, 38, 39 and 40 below (click on images):

As you can see, I provided you with a thorough discussion on how exactly compensation is determined at the Caisse. The key points are that the incentive plan is based on five-year returns and a significant portion of total compensation for senior executives and for employees is deferred (at the end of each three-year period, the deferred amount, plus or minus the average return credited for the period, will be paid to each participant as a deferred incentive payment with restrictions).

[Note: Read my comment going over the Caisse's 2016 results.]

Obviously, any layperson, teacher or public sector employee looking at these figures and reading articles in the Journal de Montréal will think the Caisse's top executives are extremely well compensated.

And no doubt, they are, and total compensation has increased over the last few years but it's based on long-term performance and added-value over a benchmark (over the last five years) and is in line with what the Caisse's peer group doles out to its senior executives and investment professionals.

It's been a while since I last went into a full discussion on compensation at Canada's large public pension funds. Over two years ago, I discussed a list of the highest paid pension fund CEOs but I need to do a more thorough job of going over compensation to explain in great detail how it's determined and why it's important in terms of attracting and retaining top talent to do a job that is arguably far more important and difficult than most people realize.

Michael Sabia is paid very well but he's the President and CEO of the second largest pension fund in Canada, he and his senior executives have delivered on long-term performance targets and his job is arguably a lot more difficult than that of his peers because there is a political dimension to it which quite frankly is daunting at times (for example, he recently appeared in front of Quebec's National Assembly to defend the Caisse's investments in companies that are registered offshore, which by the way most funds that pensions invest in are registered in!).

As for the rest of the Caisse's top executives, they too are paid well but in line with their peer group (and even below) and it's important to understand they have huge responsibilities and very difficult objectives to achieve.

Lastly, one person who is missing from this list is Daniel Fournier, the Chairman and CEO of the Caisse's real estate subsidiary, Ivanhoé Cambridge (click on image):

Mr. Fournier is also a member of the Board of Otéra Capital, a CDPQ’s subsidiary specialized in commercial real estate financing and for which he is responsible. He reports to his own board, not Michael Sabia.

There are no public reports going over compensation at Ivanhoé Cambridge but given that real estate is the most important asset class at the Caisse, and that long-term performance has been stellar in this asset class, I wouldn't be surprised if Daniel Fournier gets paid even more than Michael Sabia (just a guess here but he has huge responsibilities).

Anyway, these are my comments on compensation at the Caisse. Just like in other large shops, the top executives make the most because they have the most responsibility.

This comment is to provide many of you with more details on how compensation is determined at Canada's second largest pension fund and if you go over the annual reports of other large Canadian pensions, you will find a similar thorough discussion on compensation.

One thing I would like these big public pensions to provide is information on the median compensation of top executives relative to median compensation of the rest of the employees at these funds and how this ratio has varied over time.

Once again, if you have anything to add, feel free to email me at LKolivakis@gmail.com.

Below, Michael Sabia recently took part in a panel on competitiveness moderated by Giles Gherson, Deputy Minister, Ontario Ministry of Economic Development and Growth, Ontario Ministry of Research, Innovation and Science. Interesting discussion, take the time to watch it, and listen to Michael's comments.

Les six principaux dirigeants de la Caisse de dépôt et placement du Québec (CDPQ) se sont partagé près de 11 millions $ en rémunération totale l'an dernier, indique le rapport annuel de l'institution dévoilé mardi.Below, I translate the key takeaways:

C'est un peu plus que les quelque 10,7 millions $ en salaires qui avaient été octroyés en 2015.

Son président et chef de la direction, Michael Sabia, a touché un total de 2,82 millions $, en hausse de 8,5 pour cent. Ce montant tient compte du versement d'une rémunération incitative différée de 1,12 million $. En 2013, M. Sabia avait choisi de différer 900 000 $, une somme qui a évolué en fonction de la performance de la Caisse sur trois ans, ce qui lui a permis de réaliser un rendement de 221 723 $.

L'an dernier, M. Sabia a décidé de différer 1,74 million $.

Celui qui était jusqu'à tout récemment premier vice-président et chef des placements, Roland Lescure, arrive au deuxième rang au chapitre du salaire global, avec 2,62 millions $, en hausse de 20 pour cent.

M. Lescure, qui a quitté ses fonctions au début du mois pour se joindre à la campagne du candidat à la présidentielle française Emmanuel Macron, a touché une somme différée de 987 739 $.

En 2016, la Caisse a affiché un rendement de 7,6 pour cent, soit 18,4 milliards $, dépassant son indice de référence fixé à 5,8 pour cent. Sur cinq ans, il s'agissait toutefois de la moins bonne performance annuelle du bas de laine des Québécois.

Sur cinq ans, le rendement de la CDPQ a été de 10,2 pour cent, soit 1,1 point de pourcentage de plus que son indice de référence.

Au total, les employés de l'investisseur institutionnel ont touché des primes de 59 millions $, en hausse de 21 pour cent par rapport à l'an dernier. La Caisse justifie cette progression par son rendement sur cinq ans ainsi qu'une "valeur ajoutée" de 12,3 milliards $ générée l'an dernier.

L'ensemble des employés ont choisi de différer jusqu'en 2019 une somme de 32 millions $.

- According to the latest annual report which came out last Tuesday, the top six directors at the Caisse were compensated a total of $11 million in 2016, a bit more than the $10.7 million they received in total compensation in 2015.

- Michael Sabia, the President and CEO, received a total of $2.82 million in 2016, up 8.5 per cent from the previous year. This amount includes the payment of a deferred incentive fee of $1.12 million. In 2013, Mr. Sabia chose to defer $900,000, a sum that evolved based on the Caisse's performance over three years, resulting in a return of $221,723. Last year, Mr. Sabia decided to defer $1.74 million.

- Roland Lescure who up until recently was the CIO of the Caisse, came in second in the overall compensation at $2.62 million, up 20 per cent from the previous year. Mr. Lescure, who left office earlier last month to join the campaign of French presidential candidate Emmanuel Macron, received a deferred sum of $987,739.

- In 2016, the Caisse posted a return of 7.6 per cent, or $ 18.4 billion, exceeding its benchmark of 5.8 per cent. Over five years, however, it was the worst annual performance of the Fund. Over five years, the Caisse's performance was 10.2 per cent, 1.1 percentage points more than its benchmark.

- In total, the Caisse's employees received $59 million in compensation in 2016, up 21 per cent from the previous year. The Caisse justifies this increase by its five-year return and a "value added" of $12.3 billion generated last year. All employees chose to defer a total of $32 million in compensation until 2019.

In order to understand these figures, it's important to carefully read the Report of the Human Resources Committee which begins on page 93 of the Annual Report. La Caisse’s employees receive total compensation based on four components:

- Base salary

- Incentive compensation

- Pension plan

- Benefits

Below, I embed an extract from page 100 of the Caisse's 2016 Annual Report discussing Michael Sabia's compensation (click on image):

And below is figure 36 which goes over the performance components of the President and CEO's total compensation (click on image):

Also worth mentioning some added information provided on Michael Sabia's compensation:

- The compensation and other employment conditions of the President and Chief Executive Officer are based on parameters set by the government after consultation with the Board of Directors.

- In accordance with his request, Mr. Sabia has received no salary increase since he was appointed in 2009. In 2016, Mr. Sabia’s base salary remained unchanged at $500,000.

- In 2016, Mr. Sabia received his deferred incentive compensation amount for 2013. The amount of this deferred incentive compensation totalled $1,121,723 and included the return credited since 2013.

- When he was appointed in 2009, Mr. Sabia waived membership in any pension plan. He also waived any severance pay, regardless of the cause. Even so, given that membership in the basic pension plan is mandatory under the provisions of the Pension Plan of Management Personnel (under Retraite Québec rules), Mr. Sabia is obliged to be a member despite his waiver. In 2016, contributions to the mandatory basic plan represented an annual cost to la Caisse of $20,779.

Tables 43 and 44 below provide the pension summary and severance for the president and five most highly compensated executives at the Caisse (click on images):

Table 45 below provides details of the reference markets used to reference the compensation of the president and five most highly executives of the Caisse (click on image):

Make sure you read the footnotes to these tables to understand how compensation is determined.

The reference markets used for the CEO and executive VPs and non-investment positions used for referencing compensation are provided in tables 37, 38, 39 and 40 below (click on images):

As you can see, I provided you with a thorough discussion on how exactly compensation is determined at the Caisse. The key points are that the incentive plan is based on five-year returns and a significant portion of total compensation for senior executives and for employees is deferred (at the end of each three-year period, the deferred amount, plus or minus the average return credited for the period, will be paid to each participant as a deferred incentive payment with restrictions).

[Note: Read my comment going over the Caisse's 2016 results.]

Obviously, any layperson, teacher or public sector employee looking at these figures and reading articles in the Journal de Montréal will think the Caisse's top executives are extremely well compensated.

And no doubt, they are, and total compensation has increased over the last few years but it's based on long-term performance and added-value over a benchmark (over the last five years) and is in line with what the Caisse's peer group doles out to its senior executives and investment professionals.

It's been a while since I last went into a full discussion on compensation at Canada's large public pension funds. Over two years ago, I discussed a list of the highest paid pension fund CEOs but I need to do a more thorough job of going over compensation to explain in great detail how it's determined and why it's important in terms of attracting and retaining top talent to do a job that is arguably far more important and difficult than most people realize.

Michael Sabia is paid very well but he's the President and CEO of the second largest pension fund in Canada, he and his senior executives have delivered on long-term performance targets and his job is arguably a lot more difficult than that of his peers because there is a political dimension to it which quite frankly is daunting at times (for example, he recently appeared in front of Quebec's National Assembly to defend the Caisse's investments in companies that are registered offshore, which by the way most funds that pensions invest in are registered in!).

As for the rest of the Caisse's top executives, they too are paid well but in line with their peer group (and even below) and it's important to understand they have huge responsibilities and very difficult objectives to achieve.

Lastly, one person who is missing from this list is Daniel Fournier, the Chairman and CEO of the Caisse's real estate subsidiary, Ivanhoé Cambridge (click on image):

Mr. Fournier is also a member of the Board of Otéra Capital, a CDPQ’s subsidiary specialized in commercial real estate financing and for which he is responsible. He reports to his own board, not Michael Sabia.

There are no public reports going over compensation at Ivanhoé Cambridge but given that real estate is the most important asset class at the Caisse, and that long-term performance has been stellar in this asset class, I wouldn't be surprised if Daniel Fournier gets paid even more than Michael Sabia (just a guess here but he has huge responsibilities).

Anyway, these are my comments on compensation at the Caisse. Just like in other large shops, the top executives make the most because they have the most responsibility.

This comment is to provide many of you with more details on how compensation is determined at Canada's second largest pension fund and if you go over the annual reports of other large Canadian pensions, you will find a similar thorough discussion on compensation.

One thing I would like these big public pensions to provide is information on the median compensation of top executives relative to median compensation of the rest of the employees at these funds and how this ratio has varied over time.

Once again, if you have anything to add, feel free to email me at LKolivakis@gmail.com.

Below, Michael Sabia recently took part in a panel on competitiveness moderated by Giles Gherson, Deputy Minister, Ontario Ministry of Economic Development and Growth, Ontario Ministry of Research, Innovation and Science. Interesting discussion, take the time to watch it, and listen to Michael's comments.