Paulina Pielichata of Pensions & Investments reports that Denmark's ATP tallies 27% gain in first half of 2019:

ATP is one of the best pension plans in the world (HOOPP's Jim Keohane changed their approach after visiting ATP after the tech meltdown) and it's important to understand its approach to risk which is explained in the footnotes above:

For a pension plan the size of ATP to deliver these type of returns in six months, everything has to be going right, bonds, stocks, private markets and add some leverage to the mix.

In fact, exactly a year ago, Rachel Fixsen of I&PE reported that ATP increased the leverage on its return-seeking investment portfolio in the first half of this year, as the fund as a whole took a hit from a major longevity adjustment:

In my last comment explaining how the plunge in global pension yields has negatively impacted global pensions, I stated the following in one of my recommendations:

Anyway, the Danish pension system is still one of the best in the world and a big reason for that is that ATP has always been run very well, properly managing assets with liabilities.

I'll leave you with some food for thought. Jim Keohane, HOOPP's CEO and smartest guy in the room who will be retiring at the end of the year, once told me that "HOOPP will never buy negative-yielding assets."

But it's obvious by looking at ATP's results for the first half of the year that they bought tons of negative-yielding sovereign bonds and made a killing on them, just as other bond investors did.

Now, the question is did ATP buy them because of normal hedging activity or did they make the right tactical call in their return seeking portfolio?

I don't know but either way, ATP hit a grand slam in H1 2019, an outsized gain which they obtained mostly through their fixed income investments and leverage.

However, what worries me going forward is something Jim Bianco of Bianco Research posted on LinkedIn today:

ATP's CEO Bo Foged is right: "Uncertainties regarding the development in both the interest and equities markets require ... that we continue with disciplined risk management and portfolio construction. This is essential for our ability to also produce satisfactory results in the long term."

Take the time to carefully read ATP's Interim Report for H1 2019 here and you will find a lot more great information I simply couldn't cover in detail here.

Lastly, it's also worth noting ATP Private Equity Partners, the private equity arm of ATP, was ranked by Preqin as the most reliably top-performing fund-of-funds manager. The alternatives data provider ranked funds-of-funds managers by how often their funds delivered top-quartile performance.

Below, Jim Bianco, president and founder of Bianco Research, talks about bond markets, the global economy and Federal Reserve policy. He speaks with Bloomberg's Shery Ahn and Paul Allen on "Bloomberg Daybreak: Australia."

ATP, Hilleroed, Denmark, posted a 26.9% return on its investment portfolio for the six months ended June 30, owing the outsized gain to falling interest rates and positive performance of the fund's foreign and domestic equity strategies.ATP put out a press release going over its first half returns:

An update Wednesday said the pension fund's net increase equaled 24.8 billion Danish kroner ($3.7 billion), compared with a return of 2.7%, or a rise of 3.2 billion kroner, for the six months ended June 30, 2018.

Assets increased 12% to 880.8 billion kroner from Dec. 31, and grew 12% over the first half of 2018

The fund's investment portfolio is split according to risk factors. As of June 30, equity risk factor accounted for 42% of the portfolio; interest rate risk factor, 33%; inflation risk factor, 17%; and the remaining 8% was attributable to other risk factors. For the three months ended June 30, the biggest contributing asset class was government and mortgage bonds at 14.5 billion kroner.

While the return was "highly satisfactory," ATP CEO Bo Foged said in a news release, "Uncertainties regarding the development in both the interest and equities markets require ... that we continue with disciplined risk management and portfolio construction. This is essential for our ability to also produce satisfactory results in the long term."

International and listed Danish equities gained 5.9 billion kroner and 4.4 billion kroner, respectively. Mr. Foged said in a telephone interview about half of profits came from U.S. equity. Emerging market equity yielded about a fifth of the fund's profits, he said.

Private equity added 1.9 billion kroner, while real estate and infrastructure each gained 1.2 billion kroner. Credit contributed 2.7 billion kroner, and inflation-related instruments added 2.6 billion kroner. Other investments added 347 million kroner.

H1 was dominated by declining interest rates, both in the US and Europe, and by upticks in global equity markets. The hedging portfolio covered increasing guaranteed pensions and the investment portfolio realised a return of DKK 29.6bn before expenses and tax.I downloaded ATP's Interim Report for H1 2019 here and read through it. It provides a lot of great information but here are the highlights:

Primarily government and mortgage bonds and international and Danish listed equities contributed to the historically high return for H1, contributing, respectively, DKK 14.5bn, DKK 6.0bn and DKK 4.4bn.

”We have achieved a highly satisfactory return for ATP’s members. Uncertainties regarding the development in both the interest and equities markets require, however, that we continue with disciplined risk management and portfolio construction. This is essential for our ability to also produce satisfactory results in the long term,” says Bo Foged, CEO of ATP.

Over the past five years, ATP has realised an average annual return of 16.4 per cent relative to the bonus potential. In H1 2019 ATP realised a return of 32.1 per cent *). The investment portfolio has realised positive returns in 17 of the previous 20 quarters.

*) For an in-depth understanding of ATP’s investment approach, risk and performance, please see ATP’s annual report for 2018, for example pages 39-42.

Hedging protects pension guarantees

Hedging of the guaranteed pensions is designed to ensure that members receive the pensions promised, regardless of whether interest rates rise or fall. Due to interest rate drops for Danish and European government bonds with long residual maturity, the value of guaranteed pensions increased in H1. Similarly, the hedging portfolio realised a positive return. In total, hedging activities achieved a result of DKK (1.1)bn. The result equals 0.1 per cent of the guaranteed pensions, meaning that the hedging worked as intended.

Life expectancy update

Primarily motivated by a small drop in life expectancy in Denmark, ATP has adjusted its long-term life expectancy development prognosis. The adjustment results in a transfer of DKK 3.2bn from guaranteed benefits to the bonus potential. 65-year-old members are currently expected to live to an average of 87 years.

The result for the period

The interim result was DKK 27.5bn. At the end of H1 2019, the bonus potential (ATP’s free reserves) totalled DKK 120bn, equal to a 15.7 per cent over-hedging relative to guaranteed pensions of DKK 761bn. ATP’s aggregate assets amounted to DKK 881bn.

ATP is one of the best pension plans in the world (HOOPP's Jim Keohane changed their approach after visiting ATP after the tech meltdown) and it's important to understand its approach to risk which is explained in the footnotes above:

- The investment portfolio follows a risk-based investing approach, the focus of which is on risk rather than on the amount of DKK invested. The investment portfolio, as a general rule, consists of funds from the bonus potential. Funds not tied up in the hedging portfolio as a result of the use of derivative financial instruments are available for investment in the investment portfolio on market terms. In practice, this means that the investment portfolio can operate with a higher statement of financial position (market value end of H1 2019 of DKK 337.3bn) than the bonus potential, but within the same risk budget.

- Risk-adjusted return is a return measure similar to the Sharpe ratio, which expresses the relationship between actual return and expected market risk of the portfolio, i.e. a measurement to show whether the risk utilisation is efficient. Expected market risk modelling is based on historic observations going back to the beginning of 2008.

For a pension plan the size of ATP to deliver these type of returns in six months, everything has to be going right, bonds, stocks, private markets and add some leverage to the mix.

In fact, exactly a year ago, Rachel Fixsen of I&PE reported that ATP increased the leverage on its return-seeking investment portfolio in the first half of this year, as the fund as a whole took a hit from a major longevity adjustment:

In its interim report, the statutory pension scheme reported a rise in total assets to DKK783.8bn (€105bn) at the end of June, from DKK768.6bn at the end of December.It's obvious that just like Christian Hyldahl, his successor Bo Foged, runs a very tight ship at ATP.

Chief executive Christian Hyldahl (Bo Foged's predecessor) told IPE that ATP had “increased risk by 10% in the first half” for the fund’s DKK100bn leveraged investment portfolio, which consists of reserves for bonus payments.

ATP increases the firepower of its investment portfolio by borrowing from its DKK683.9bn hedging portfolio at an interest rate of 3%, and on top of that by using derivatives.

Over the past two years, the leverage from the internal loan has increased to 3x from 2x, ATP said, with derivatives boosting the gearing on top of this.

Before tax and expenses, ATP said it made a 3.4% return, or DKK4.1bn, on its investment portfolio between January and June.

ATP’s return on total assets was 2.9%, according to the Danish regulator’s performance measure, designed to allow comparability between pension funds.

Private equity was ATP’s biggest contributor, returning DKK1.8bn, followed by infrastructure with a DKK1.5bn gain. Listed international equities made a DKK2.1bn loss in the period.

As announced at the end of June, ATP set aside an extra DKK20bn because of a change in its long-term forecast of life expectancy, transferring this amount from the bonus potential to the hedging portfolio.

After this update, ATP said its results for the first half were negative by DKK17.7bn.

Hyldahl said that despite this major adjustment to longevity provisions, he believed the pension fund would manage to keep up with future changes to expected lifespans.

“We make adjustments when we have new data coming in, and normally this is plus or minus one billion kroner – but what we have done just now was a major redesign,” he said.

In its interim report, ATP said the standards it used to estimate future pension liabilities are more conservative than both EIOPA’s yield curve and the Danish regulator’s life expectancy model.

If both of these external measures had been used, it said its guaranteed pensions would have been DKK67.7bn lower at the end of June – and the bonus potential correspondingly higher.

In my last comment explaining how the plunge in global pension yields has negatively impacted global pensions, I stated the following in one of my recommendations:

Third, the Canada model needs to go global. It used to be the Dutch and Danes had the best pension systems but I think they went overboard and destroyed their pension systems by discounting their liabilities to the risk-free long bond rate. The insanity of negative rates can remain with us for a long time, and if you're not reasonable in the way you discount future liabilities, you risk imposing overly arduous conditions on your public pensions. This is what happened to the mighty Dutch pension system and I think they ruined a really great system imposing these harsh regulations. Worse still, as discussed below, by imposing overly arduous pension regulations, you risk exacerbating the problem by forcing pensions to "de-risk" and keep on buying more negative-yielding sovereign debt. That's just insane! (of course, as Jim Bianco of Bianco Research points out, “owners of these bonds have been seeing huge price increases,”which is why that near $17 trillion pile of negative-yielding global debt is a cash cow for some bond investors).I'm not sure if the Danes went overboard in marking their pension liabilities like the Dutch but it's clear that they both have great pension systems which are a bit too aggressively regulated (in my humble opinion). And quite often, more regulations aren't good for pensions, especially when they are forced to do wonky things, like buy negative-yielding bonds.

Anyway, the Danish pension system is still one of the best in the world and a big reason for that is that ATP has always been run very well, properly managing assets with liabilities.

I'll leave you with some food for thought. Jim Keohane, HOOPP's CEO and smartest guy in the room who will be retiring at the end of the year, once told me that "HOOPP will never buy negative-yielding assets."

But it's obvious by looking at ATP's results for the first half of the year that they bought tons of negative-yielding sovereign bonds and made a killing on them, just as other bond investors did.

Now, the question is did ATP buy them because of normal hedging activity or did they make the right tactical call in their return seeking portfolio?

I don't know but either way, ATP hit a grand slam in H1 2019, an outsized gain which they obtained mostly through their fixed income investments and leverage.

However, what worries me going forward is something Jim Bianco of Bianco Research posted on LinkedIn today:

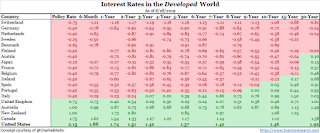

This morning the yield of 30-yr Italian bonds fell below the funds rate. This means the Fed is now in charge of the single highest interest rate in the developed world.My response to Jim's comment:

US 3m (FF proxy) and LT rates are the highest among developed countries going back at least 50 years.

--------------------

Jay,

Your fed funds rate is now the single highest interest rate in the developed world. Market measures, like the yield curve, are saying this is wrong.

Are you sure you have the correct policy? What set of economic indicators suggest this is correct?

Without a good explanation, Dudley's opinion piece, combined with comment made by Harkin (Philly Fed) and Mester (Cleveland Fed) can be interpreted as the Fed is violating its congressional mandate and attempting to "screw" Trump.

Year to date, the S&P 500 is up 15%, led by Technology and Real Estate shares that are up 25%. Only sector that is down is Energy, down 2%. And yet here we are pounding the table for the Fed to cut rates by 50 basis points in September because negative rates have taken over the world. If the Fed starts slashing rates, it will cross the Rubicon...there will be no return.If rates keep plunging, get ready for a lot more volatility in the last quarter of the year, and global pensions are going to be in big trouble, some more than others and some will require a bailout if another major crisis hits us.

ATP's CEO Bo Foged is right: "Uncertainties regarding the development in both the interest and equities markets require ... that we continue with disciplined risk management and portfolio construction. This is essential for our ability to also produce satisfactory results in the long term."

Take the time to carefully read ATP's Interim Report for H1 2019 here and you will find a lot more great information I simply couldn't cover in detail here.

Lastly, it's also worth noting ATP Private Equity Partners, the private equity arm of ATP, was ranked by Preqin as the most reliably top-performing fund-of-funds manager. The alternatives data provider ranked funds-of-funds managers by how often their funds delivered top-quartile performance.

Below, Jim Bianco, president and founder of Bianco Research, talks about bond markets, the global economy and Federal Reserve policy. He speaks with Bloomberg's Shery Ahn and Paul Allen on "Bloomberg Daybreak: Australia."