The Canada Pension Plan Investment Board eked out a gain of 0.2 per cent in a fiscal second quarter that was tough for investors, adding $1-billion to the fund’s assets in spite of broad weakness in public and private equities as well as fixed income markets.

CPPIB’s investment returns outperformed The S&P Global LargeMidCap index, a measure of stocks CPPIB uses as 85 per cent of its benchmark reference portfolio, which fell 1.46 per cent in the quarter in Canadian-dollar terms.

But CPPIB narrowly trailed the performance of Canadian defined-benefit pension plans in the quarter, in which assets were up 0.5 per cent, according to Royal Bank of Canada’s RBC I&TS All Plan Universe. In the first nine months of the year, those pension plans have lost 13.7 per cent.

Gains in U.S. dollar-denominated investments, which were boosted by foreign exchange rates, and positive returns from energy and infrastructure investments helped keep returns positive after CPPIB lost $23-billion in the previous fiscal quarter – a period when many rival investors performed much worse. In total, over the first six months of the fiscal year, CPPIB is down about 4 per cent or $10-billion.

As of Sept. 30, CPPIB had $529-billion of assets, up 1 per cent from $523-billion in the previous quarter, as $5-billion in contributions from the Canada Pension Plan added to modest investment gains.

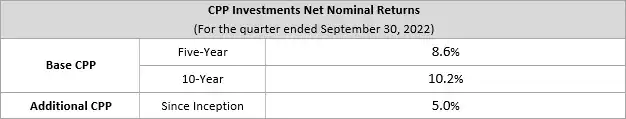

In spite of quarterly headwinds, CPPIB emphasizes its longer-term returns, and its annualized net return over 10 years is 10.1 per cent. Over five years, the net return is 8.5 per cent.

“Our portfolio remains resilient despite inflationary pressures, increases in central bank rates and the continued impact of the war in Ukraine, which resulted in the continued decline in global financial markets during the quarter,” chief executive officer John Graham said in a prepared statement.

With public markets in turmoil, and bond markets in particular on track for their worst annual performance on record, CPPIB’s exposure to private assets continued to act as a buffer preventing steeper losses. Valuations of private assets reset more slowly, helping investors like CPPIB outperform when markets are falling, though they are more slow to reap the benefits when public markets boom.

The federal government created CPPIB in 1999 to manage the Canada Pension Plan’s money, and over time the investment manager embraced active management, adding private equity, infrastructure, real estate and other specialized investments to its portfolio of stocks and bonds.

CPPIB’s second-quarter results also benefitted from gains by external investment managers in fixed income, currencies and commodities.

CPP Investments put out a press release last week stating its net assets total $529 billion at the second quarter Fiscal 2023:

Second-Quarter Performance:

- Net assets increase by $6 billion

- 10-year annualized net return of 10.1%

- Diversified portfolio resilient in the face of global headwinds

TORONTO, ON (November 10, 2022): Canada Pension Plan Investment Board (CPP Investments) ended its second quarter of fiscal 2023 on September 30, 2022, with net assets of $529 billion, compared to $523 billion at the end of the previous quarter.

The $6 billion increase in net assets for the quarter consisted of $1 billion in net income and $5 billion in net transfers from the Canada Pension Plan (CPP).

In the five-year period up to and including the second quarter of fiscal 2023, CPP Investments has contributed $169 billion in cumulative net income to the Fund, and over a 10-year period, it has contributed $303 billion to the Fund on a net basis.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved five-year and 10-year annualized net returns of 8.5% and 10.1%, respectively. For the quarter, the Fund returned 0.2%, continuing to outperform leading global indices during this period.

For the six-month fiscal year-to-date period, the Fund decreased by $10 billion consisting of a net decline in value of $22 billion after all CPP Investments costs, plus $12 billion in net CPP contributions. For the period, the Fund’s net return was negative 4.0%.

“Our portfolio remains resilient despite inflationary pressures, increases in central bank rates and the continued impact of the war in Ukraine, which resulted in the continued decline in global financial markets during the quarter,” said John Graham, President & CEO. “While we expect these conditions to persist throughout the fiscal year, our diversified investment portfolio – across asset classes and geographies – continues to create long-term value for CPP contributors and beneficiaries. Our active management strategy, designed to deliver results over the long term, remains on track as demonstrated by our strong 10-year net return of 10.1%.”

The Fund’s quarterly results were adversely affected by broad declines in global public and private equity markets and in fixed income markets. However, the decline in value was more than offset by gains in U.S. dollar-denominated private equity, real estate and credit investments, which benefitted from foreign exchange gains, and by positive returns on investments in energy and infrastructure. Gains by external investment managers in fixed income, currencies and commodities also contributed positively to results.

Performance of the Base and Additional CPP Accounts1The base CPP account ended its second quarter of fiscal 2023 on September 30, 2022, with net assets of $512 billion, compared to $509 billion at the end of the previous quarter. The $4 billion increase in assets consisted of $1 billion in net income and $3 billion in net transfers from the CPP. The base CPP account achieved a 0.2% net return for the quarter, and a five-year annualized net return of 8.6%.

The additional CPP account ended its second quarter of fiscal 2023 on September 30, 2022, with net assets of $17 billion, compared to $14 billion at the end of the previous quarter. The $2 billion increase in assets consisted of $38 million in net income and $2 billion in net transfers from the CPP. The additional CPP account achieved a 0.4% net return for the quarter, and an annualized net return 5.0% since inception in 2019.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

![net Nominal En F23q2]()

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada conducts an independent review of the sustainability of the CPP over the long term. In the most recent triennial review published in December 2019, the Chief Actuary reaffirmed that, as at December 31, 2018, both the base and additional CPP continue to be sustainable over the 75-year projection period at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2018, the base CPP account will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation, defined as the real rate of return. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Corporate developments

- Hosted nine in-person public meetings this fall – one in each province that participates in the CPP – along with a national virtual meeting, which provided an accessible forum for more contributors and beneficiaries to ask questions of our senior leaders. These meetings reflect our continued accountability to the Fund’s 21 million contributors and beneficiaries.

- Published our 2022 Report on Sustainable Investing, which focuses on three key areas: sustainability-related considerations in the investment life cycle, our net-zero commitment and how our active ownership delivers results.

Executive announcements

- Kristina Fanjoy was appointed Senior Managing Director & Chief Financial Officer. In this role, Ms. Fanjoy will be responsible for the Fund’s financial policy and reporting strategy; business planning; performance reporting and analytics; valuations, financial controls and accounting; and tax governance. Ms. Fanjoy joined CPP Investments in 2010, during which time she has taken on progressively senior roles, most recently as Managing Director and Head of Finance.

- Richard Manley was appointed Chief Sustainability Officer and will lead the further refinement and execution of a roadmap for CPP Investments to prudently navigate the global economy’s transition to address climate change, among other responsibilities. Mr. Manley joined CPP Investments in 2019 and has played a key role in evolving the integration of environmental, social and governance factors across our investment programs.He will continue to lead the Sustainable Investing group.

Second-Quarter Investment Highlights

Active Equities

- Invested US$184 million in the Hong Kong IPO of China Tourism Group Duty Free, a leading duty-free operator in China.

Credit Investments

- Expanded an existing relationship with Affirm, a U.S.-based digital and mobile-first commerce platform that provides installment loans for consumers to use at the point of sale to finance a purchase, for a committed capacity of up to US$1.2 billion in outstanding loan portfolio balance.

- Committed INR 18.5 billion (C$310 million) to the first close of Kotak Infrastructure Investment Fund (KIIF). KIIF is being raised by Kotak Investment Advisors Limited and will provide senior and secured financing to operating infrastructure projects in India.

- Invested US$75 million in a mezzanine loan backed by a Grade-A office and retail property in Shanghai.

- Invested US$115 million in the 2nd-lien term loan of HCP Global Ltd. (HCP) to support Carlyle’s acquisition of the company. HCP is a global premium cosmetics and skincare packaging manufacturer serving most of the top cosmetic companies worldwide.

Private Equity

- Committed US$300 million to Clayton, Dubilier & Rice Fund XII. Clayton, Dubilier & Rice is one of the world’s oldest private equity firms and focuses on upper middle market/large value-oriented buyouts and build-ups in North America and Western Europe.

- Completed a US$47 million co-investment alongside True North Fund VI to invest in Accion Labs. Accion is a fast-growing global product engineering and digital IT services company.

- Acquired a stake in Universal Investment Group, a leading third-party management company and fund administration service provider serving both institutional investors and asset managers across European fund markets.

- Completed a US$35 million equity co-investment alongside Carlyle Asia Partners to invest in HCP Global Ltd., a global premium cosmetics and skincare packaging manufacturer serving most of the top cosmetic companies worldwide.

- Committed US$400 million to CVC Capital Partners Asia VI. CVC Capital Partners is a leading global alternative asset manager focused on private equity, secondaries and credit.

- Invested US$316 million in several growth equity and venture capital funds and made a direct investment in a company specializing in energy storage systems. The fund investments include:

- Scale Ventures Fund VIII. Scale Ventures is a San Francisco-based venture capital firm focused on early growth-stage investments in enterprise software businesses.

- Ribbit Capital X and Ribbit Capital OB1 funds. Ribbit Capital is a leading global fintech investor focusing on sectors including lending, personal finance, insurance, financial software and cryptocurrency.

- Greenoaks Capital Fund V. Greenoaks is a San Francisco-based venture capital firm focused on growth-stage technology businesses globally.

- True Ventures Fund VIII. True Ventures is a San Francisco-based venture capital firm focused on seed and growth-stage investments across enterprise software, connected hardware, consumer brands, digital biosciences, and digital assets.

- Highland Europe Technology Growth Fund V. Highland Europe is a London, U.K.-based growth equity firm investing in growth-stage software, internet and consumer technology companies in Europe (investment made subsequent to the quarter).

- A direct investment was made into Form Energy’s US$450 million Series E funding round. The U.S.-based company develops and commercializes a new class of cost-effective, multi-day energy storage systems (investment made subsequent to the quarter).

Real Assets

- Increased our allocation by C$755 million in equity to the second tranche of the Tricon Multifamily joint venture, following the C$745 million commitment of the first tranche, for a total allocation of C$1.5 billion. Alongside Tricon Residential, the joint venture will develop 2,000-plus Class-A purpose-built rental units in the Greater Toronto Area.

- Committed €475 million to a new joint venture focused on the European hospitality sector with Hamilton – Pyramid Europe, a leading hotel operator and co-investment partner forming part of the Pyramid Global Hospitality group of companies.

- Completed a US$20 million co-investment in Fervo Energy’s Series C preferred equity raise. Fervo is a U.S.-based developer of a proprietary geothermal energy generation technology.

- Committed US$25 million to ArcTern Ventures Fund III. ArcTern is a Canadian early-stage cleantech investor founded in partnership with MaRS Discovery District.

- Committed US$30 million to Congruent Continuity Fund I. Congruent invests in cleantech start-ups in the United States.

- Committed US$30 million to Evok Innovations Fund II. Evok invests in early-stage North American cleantech companies.

- Committed €19 million to Klima Energy Transition Fund. Klima invests in later-stage venture capital and early-growth equity companies predominantly based in Europe.

- Committed an additional €475 million to the Round Hill European Student Accommodation Partnership, a joint venture with Round Hill Capital. The joint venture invests in high-quality purpose-built student accommodation in major cities across Europe.

Transaction Highlights Following the Quarter

- Acquired The W Rome hotel for €172 million as part of our joint venture with Hamilton – Pyramid Europe, a leading hotel operator and co-investment partner forming part of the Pyramid Global Hospitality group of companies.

- Invested INR 3,575 million (C$60 million) in National Highways Infra Trust, an infrastructure investment trust sponsored by the National Highways Authority of India.

- Invested US$200 million in an asset-purchasing vehicle with Gordon Brothers to acquire asset-backed loans originated by the company. Gordon Brothers is a global advisory, restructuring and investment firm.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2022, the Fund totalled $529 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Alright, I wasn't going to go through CPP Investments' quarterly report but it's a bit slow these days in the Canadian pension world so let me briefly go through it.

First, I will repeat what I often state, I don't think it's constructive looking at quarterly or even semi-annual results of pensions. When discussing the performance of large pension funds, you really need to look at long-term results, meaning 5 and 10-year annualized returns.

On this front, CPP Investments is doing very well:

In the five-year period up to and including the second quarter of fiscal 2023, CPP Investments has contributed $169 billion in cumulative net income to the Fund, and over a 10-year period, it has contributed $303 billion to the Fund on a net basis.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved five-year and 10-year annualized net returns of 8.5% and 10.1%, respectively. For the quarter, the Fund returned 0.2%, continuing to outperform leading global indices during this period.

Now, for the quarter, the Fund returned 0.2%, continuing to outperform leading global indices during this period but it underperformed the0.5% gain Canadian defined-benefit plans delivered during this period, according to Royal Bank of Canada’s RBC I&TS All Plan Universe (see Globe article above).

Why is this? Well, it all comes down to the asset mix. The bulk of the CPP Fund's assets (97%) remain in base CPP which is partially funded whereas the rest (3%) of the total assets are in additional CPP which is fully funded.

The funding details between base and additional CPP accounts are worth understanding:

Federal and provincial governments decided in 2016 to expand the Canada Pension Plan (CPP) to provide enhanced future benefits for workers. The increased contributions and associated benefits are referred to as additional CPP, whereas the historic contributions and associated benefits are referred to as the base CPP. In coming decades, this means that CPP benefits in retirement could replace approximately one-third of a person’s income compared to the current level of approximately one-quarter, up to a certain limit.

CPP Investments received the first additional CPP contribution amounts in January 2019. As a result, there are now two accounts – one for the base CPP and another for the additional CPP contributions. Both accounts have the full advantage of CPP Investments’ global network, expertise, investment strategies and risk governance framework. Our strategy is to build a single, resilient CPP Fund with a view to the strong performance of, and fairness between, both accounts.

Additional CPP and base CPP rely on the importance of investment income in the program’s total revenues over time.

The additional CPP is required to be a “fully funded” pension plan. As such, assets are targeted to equal or exceed the present value of benefits. This includes payments to retirees as well as benefits that contributors have earned to date. When fully mature, investment income is expected to represent about 70% of the additional CPP’s total revenues (investment income plus contributions).

As a result, a fully funded plan is directly sensitive to:

- any changes in the assumed rate of return on investments; and

- any difference in the returns achieved, compared to those expected.

The base CPP is a “partially funded” plan. To maintain a stable contribution rate, the Chief Actuary estimates that income earned from investments will represent about 40% of the base CPP’s total revenues when it is in its mature state.

The base CPP is sensitive to demographic factors like life expectancy, birth rate and immigration rates. It can also be affected by economic changes, including the level of employment and rate of real (i.e., after inflation) wage growth.

Most important, a partially funded plan is less sensitive to investment returns than a fully funded plan.

Contribution rates

For both the base CPP and the additional CPP, contributions are set such that current investments plus future contributions are expected to fully pay for all benefits today and in the future. At the same time, we seek to maintain a stable contribution rate for current and future contributors.

The 30th Actuarial Report on the Canada Pension Plan – based on the status of the Fund as at Dec. 31, 2018 – details return-on-investment assumptions over the 75-year period from 2018:

- the base CPP account will earn an average annual net real rate of return of 3.95%; and

- the more conservatively invested additional CPP account will earn an average annual net real rate of return of 3.38%.

Both assumed rates of return are over and above the rate of Canadian consumer price inflation, after all investment costs.

Understanding the difference between additional and base CPP also helps to understand the difference in benchmarks used to measure their performance:

CPP Investments uses performance benchmarks at the total portfolio (Fund level) to objectively measure and evaluate investment performance. Our benchmarks are our Reference Portfolios for base CPP and additional CPP and are a representation of the passive public investment alternatives that the Fund might otherwise hold. The Reference Portfolios provide a clear benchmark for long-term total returns on the additional CPP and base CPP Investment Portfolios. The Reference Portfolios differ between the additional CPP and base CPP accounts to reflect the different risk levels prudently targeted for each of their long-term investment portfolios. For the base CPP, CPP Investments has adopted a Reference Portfolio of 85% global equity/15% nominal bonds issued by Canadian governments. For the additional CPP account, CPP Investments has adopted a Reference Portfolio of 50% global equity/50% nominal bonds issued by Canadian governments.

All these details can be found on CPP Investments' website at the Frequently Asked Questions section.

Why am I bringing this up? In order to understand the difference in performance between the typical Canadian defined-benefit plan as measured by the Royal Bank of Canada’s RBC I&TS All Plan Universe and that of the CPP Fund, it's best to use the additional CPP which is fully funded and more conservative in its asset allocation (Reference Portfolio of 50% global equity/50% nominal bonds issued by Canadian governments).

The typical plan has a 60/40 split between global equities (mostly US) and bonds but if you look at the performance of base CPP for fiscal Q2 (0.4%), it's closer in line with the 0.5% performance delivered by the Royal Bank of Canada’s RBC I&TS All Plan Universe during that period.

Anyway, here are the highlights from CPP Investments' Fiscal Q2 2023 (thank you Frank Switzer):

Again the most important thing to remember is long-term performance is well above the actuarial hurdle rate and active management is working, adding meaningful value-add over the Reference Portfolio over the long run.

Yes, the CPP Fund is down 4% over its two fiscal quarters but this is truly meaningless when you look at the long run and it's a lot better than the typical pensions which are far more exposed to the vagaries of public markets.

Having said this, so far fiscal Q3 looks good for stocks and bonds so we shall see what next quarter brings for the CPP Fund (it will be volatile in public markets).

Let me also publicly congratulate Kristina Fanjoy and Richard Manley for their well deserved appointments.

Lastly, Senator Clement Gignac contacted me early this morning asking me if I was aware of Finance Canada's decision to cease the issuance of real return bonds (RRBs).

I told him yes, I was aware, our former colleague Stefane Marion wrote a comment on this here and I thought it was a hasty decision which wasn't made with proper consultation (where is Michael Sabia??).

Sure, the Bank of Canada put out a summary of comments but where does it stand on this issue and where do our large pension funds stand?

Here is what Senator Gignac posted on Linkedin:

Finance Canada's decision to cease issuance of Real Return Bond ( RRBs): A premature and very questionable decision according to Canadian Bond Investors Association representing more than 50 biggest institutional players in Canada with assets exceeding 1.2 $Trillion! As mentioned recently by Stefane Marion, Chief economist of National Bank, Canada will suddenly become the only country among G-7 to cease issuance of this long-term financial instrument bought mostly by pension funds and insurance companies to protect themselves against inflation risk! Just curious to know if Bank of Canada is really on board with this bold decision since RRBs have been launched in 1991 after the BOC has adopted a new 2% inflation target! In order to be transparent and protect the BOC credibility, I have asked the Government to release publicly the BOC's opinion about this Finance dept. decision. Stay tuned!

Please Find below my intervention ( in French) at the Senate this afternoon related to this topic!

Watch his intervention below in French and if you have anything to add on this matter, please contact me. Thank you!