Claire Brownell of the National Post reports, Ontario Teachers’ Pension Plan seeks foreign investments out of necessity, not lack of confidence in Canada:

Importantly, I'm still short Canada and think oil prices, the loonie and TSX are heading much lower. Canada is in for a very rude awakening, which is the real reason why Canadian pension funds are long Canadian debt.

All you Canucks drinking Kool-Aid need to read a comment by Mehran Nakhjavani of MRB Partners, aptly titled Where Are The Weakest Links Among Commodity Exporters?. I quote the following:

As far as hedge funds betting on oil, they're in for a rude awakening too. As I stated plenty of times on my blog, the real reason why oil has fallen so much is because smart money is worried that deflationary headwinds are picking up throughout the world and might eventually hit America. All these hedge funds betting on an oil revival are going to get slaughtered, prompting even more closures.

OPEC's decision to hold production unchanged just added to the woes of an already weak energy sector and risks pushing Canada's TSX much lower (TSX). And while the oil market was surprised by this decision, I agree with Mohamed El-Erian, it shouldn't have been.

El-Erian brings up great tactical and strategic reasons for OPEC's decision but he neglects an even more important one which I mentioned in my comment to his post. The real reason why OPEC kept its production unchanged is that it fears global deflation wreaking havoc on future profits.

You might be thinking if OPEC was truly worried about global deflation, then why not cut production to bring about higher oil prices? The answer is that this would encourage cheating from some members of this loose cartel but more importantly, higher oil prices would reinforce deflationary pressures, not mitigate them.

But as I stated in my comment on preparing for a deflationary boom, while lower oil prices will help temporarily boost consumption, once deflation expectations become entrenched, it's game over. Moreover, there are plenty of reasons to question the so-called "oil dividend" as high debt and soaring healthcare costs will take a bite out of it. And as Paul Krugman rightly noted on Fareed Zakaria GPS, lower oil will hurt U.S. investment as lots of shale gas projects are put on the back burner.

Getting back to Canada, the Bank of Canada now estimates the slide in oil prices will probably cut Canadian economic growth by 1/3 of a percentage point in 2015, not the 1/4 point the Bank estimated in late October, Governor Stephen Poloz told Reuters on Friday:

Steve is one of the few central bankers openly worried about the threat of deflation and he's absolutely right to worry because if deflation takes hold in Canada with household debt at a record high, it will get ugly for years, maybe even decades.

Again, the biggest reason why Canadian pension funds are long Canadian debt is because they see the writing on the wall and it ain't pretty. Also, from an asset-liability perspective, they have to be invested in Canadian bonds even though yields are at record lows.

But low yields and the prospects of a major slowdown in Canada is forcing many of Canada's large public pension funds to look elsewhere to achieve their actuarial target rate-of-return. The Canada Pension Plan Investment Board (CPPIB) is contributing more money to Australia’s Goodman Group, increasing the equity allocation to their Goodman China Logistics Holding (GCLH) joint venture by US$500 million.

Apart from China, CPPIB is also setting its sights on India’s US$1.9-trillion economy, stating “India is a key long-term growth market for CPPIB.” As I stated in my comment on CPPIB's risky bet on Brazil, emerging markets make me very nervous, especially relative to the U.S., but I am more bullish on India than China going forward (Quelle surprise! Goldman agrees with me) even if that country needs to clean up its act and fix its awful sanitation problem which has gravely damaged national health.

Below, Morgan Stanley Chief U.S. Equity Strategist Adam Parker discusses his outlook on oil on “Bloomberg Surveillance,” explaining why they upgraded their recommendation on energy stocks (XLE) and oil services shares (OIH) even though oil prices keep falling.

I completely disagree and think all these hedge funds making contrarian bets on energy, commodities and oil service stocks, are going to get their heads handed to them. And for Pete's sake, stop looking at those high dividends, these energy companies will cut them faster than you can scream "WTF?!?".

The Ontario Teachers’ Pension Plan may prefer to make its direct investments outside of Canada, but don’t interpret that as a sign the institution isn’t confident in the country’s economy, chief executive Ron Mock said on Wednesday.Ontario Teachers' recently announced that Jo Taylorhas been appointed Managing Director for Europe, Middle East and Africa (EMEA) and head of the London office:

Mr. Mock made the remarks at The Canada Summit 2014, a conference hosted by The Economist magazine in Toronto. Mr. Mock discussed the biggest opportunities and challenges facing the pension fund.

In the early 2000s, the teachers’ pension plan shifted away from a traditional mix of bonds and equities into direct, private investments, a move Canada’s other major pension plans followed. Mr. Mock, who has been on the job for about a year, said the shift in strategy was necessary to generate the returns it needed to provide retirement income for 300,000 working and retired teachers.

Today, about 70% of the pension fund’s direct, private investments are outside Canada, Mr. Mock said. But he also pointed out Canadian pension funds are the largest holders of the country’s debt.

That should put to rest any concerns the pension plans are worried about Canada’s future, Mr. Mock said. “If that’s not a vote of confidence, I don’t know what is.”

The strategy has come with challenges. Mr. Mock said one of the biggest difficulties is navigating the legal systems and governance requirements of foreign countries when buying large stakes in their companies.

Mr. Mock cited Asian companies that have not yet gone public among investment opportunities he’s keeping an eye on. He said the pension fund doesn’t typically make venture capital investments in Canadian companies because those types of investments are generally in the tens of thousands of dollars, while he’s looking to invest hundreds of millions at a time.

“As a fiduciary, we really do have to focus on earning the returns on behalf of the teachers,” he said.

Another opportunity he’s keeping his eye on is infrastructure investments in Europe and Canada. He said pension funds have a role to play in helping Canada address its crumbling infrastructure problem over the next 10 years.

“I think that is a vital opportunity in Canada,” he said.

In his new role, Mr. Taylor retains primary responsibility for Teachers' Private Capital and private equity investments in the region while assuming oversight for the full cycle of opportunity origination, analysis, value creation and execution of investment activities across asset classes.So what do I make of Ron Mock's comments at The Canada Summit 2014? To be honest, not much. What do you expect him to say? He is the head of a major Canadian public pension fund and doesn't have the freedom to say what I write on my blog, which he reads religiously.

In addition to setting the tone and direction of Teachers' investment activities in the EMEA market, Mr. Taylor, who joined the organization in 2012, will guide all advisory relationships within the region and becomes a member of Teachers' Investment Committee.

"Jo's expanded role reflects our commitment to growing our global presence and deepening our long-term relationships with our partners in key markets. His experience, relationship-building skills and his deal and market knowledge make him the ideal person for this new position," said Neil Petroff, Teachers' Executive Vice-President and Chief Investment Officer.

Teachers' will be opening an expanded London office at Portman Square in 2015 to accommodate a larger, multi-asset-class team. Teachers' established its London office in 2007. It has a diverse portfolio of assets in the region valued at approximately $21 billion as of December 31, 2013.

Importantly, I'm still short Canada and think oil prices, the loonie and TSX are heading much lower. Canada is in for a very rude awakening, which is the real reason why Canadian pension funds are long Canadian debt.

All you Canucks drinking Kool-Aid need to read a comment by Mehran Nakhjavani of MRB Partners, aptly titled Where Are The Weakest Links Among Commodity Exporters?. I quote the following:

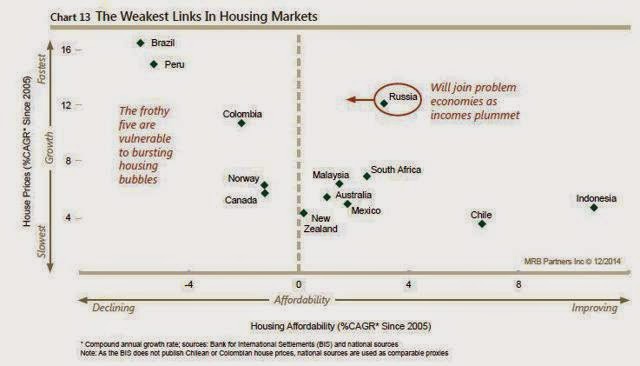

As commodity prices revert to their long-term decline in real prices, the implications are generally bleak for commodity exporters. The virtuous cycle that propelled their assets higher during the boom now threatens to become a vicious cycle of weakening currencies, rising import prices, headwinds to consumption and investment growth and the potential for asset bubbles to burst (click on image below).But skeptics abound. People will ask me: "what about Canadian banks and all those hedge funds betting the "OPEC-led" oil rout is near an end?" What about them? I prefer big U.S. banks over Canadian banks going forward and think the divergence in the economic outlook warrants such a bias. Moreover, Canadian banks are very exposed to the oil and commodity rout through their capital markets operations (drastic cut in underwriting fees).

In housing markets, five economies stand out as the "weakest links" among commodity exporters by virtue of the fact that house prices have been rising faster than household income over the past decade. Such multi-year declines in housing affordability have proven to be excellent markers for housing crises in the past, for example in Japan prior to 1990 and in the U.S. in the run-up to 2007. The "frothy five" are Brazil, Peru, Colombia, Norway and Canada.

As far as hedge funds betting on oil, they're in for a rude awakening too. As I stated plenty of times on my blog, the real reason why oil has fallen so much is because smart money is worried that deflationary headwinds are picking up throughout the world and might eventually hit America. All these hedge funds betting on an oil revival are going to get slaughtered, prompting even more closures.

OPEC's decision to hold production unchanged just added to the woes of an already weak energy sector and risks pushing Canada's TSX much lower (TSX). And while the oil market was surprised by this decision, I agree with Mohamed El-Erian, it shouldn't have been.

El-Erian brings up great tactical and strategic reasons for OPEC's decision but he neglects an even more important one which I mentioned in my comment to his post. The real reason why OPEC kept its production unchanged is that it fears global deflation wreaking havoc on future profits.

You might be thinking if OPEC was truly worried about global deflation, then why not cut production to bring about higher oil prices? The answer is that this would encourage cheating from some members of this loose cartel but more importantly, higher oil prices would reinforce deflationary pressures, not mitigate them.

But as I stated in my comment on preparing for a deflationary boom, while lower oil prices will help temporarily boost consumption, once deflation expectations become entrenched, it's game over. Moreover, there are plenty of reasons to question the so-called "oil dividend" as high debt and soaring healthcare costs will take a bite out of it. And as Paul Krugman rightly noted on Fareed Zakaria GPS, lower oil will hurt U.S. investment as lots of shale gas projects are put on the back burner.

Getting back to Canada, the Bank of Canada now estimates the slide in oil prices will probably cut Canadian economic growth by 1/3 of a percentage point in 2015, not the 1/4 point the Bank estimated in late October, Governor Stephen Poloz told Reuters on Friday:

He was speaking on the sidelines of an International Monetary Fund forum in Santiago two days after he held the central bank's policy rate steady at 1 percent. In the interest rate decision, he pointed to the stimulative impact of U.S. economic strength but also to the chilling effect on Canada, a major oil exporter, of cheaper crude.Steve Poloz is one of the smartest and nicest guys I ever worked with. I publicly hailed his nomination knowing full well Canada was in for difficult times ahead.

"When we're predicting growth somewhere between 2 and 2.5 percent, 0.3 (the percentage point reduction from oil) or thereabouts is an important factor. That's downside risk," Poloz said in Santiago.

Steve is one of the few central bankers openly worried about the threat of deflation and he's absolutely right to worry because if deflation takes hold in Canada with household debt at a record high, it will get ugly for years, maybe even decades.

Again, the biggest reason why Canadian pension funds are long Canadian debt is because they see the writing on the wall and it ain't pretty. Also, from an asset-liability perspective, they have to be invested in Canadian bonds even though yields are at record lows.

But low yields and the prospects of a major slowdown in Canada is forcing many of Canada's large public pension funds to look elsewhere to achieve their actuarial target rate-of-return. The Canada Pension Plan Investment Board (CPPIB) is contributing more money to Australia’s Goodman Group, increasing the equity allocation to their Goodman China Logistics Holding (GCLH) joint venture by US$500 million.

Apart from China, CPPIB is also setting its sights on India’s US$1.9-trillion economy, stating “India is a key long-term growth market for CPPIB.” As I stated in my comment on CPPIB's risky bet on Brazil, emerging markets make me very nervous, especially relative to the U.S., but I am more bullish on India than China going forward (Quelle surprise! Goldman agrees with me) even if that country needs to clean up its act and fix its awful sanitation problem which has gravely damaged national health.

Below, Morgan Stanley Chief U.S. Equity Strategist Adam Parker discusses his outlook on oil on “Bloomberg Surveillance,” explaining why they upgraded their recommendation on energy stocks (XLE) and oil services shares (OIH) even though oil prices keep falling.

I completely disagree and think all these hedge funds making contrarian bets on energy, commodities and oil service stocks, are going to get their heads handed to them. And for Pete's sake, stop looking at those high dividends, these energy companies will cut them faster than you can scream "WTF?!?".