Evelyn Cheng of CNBC reports, Nasdaq plunges 1.5%; Dow slides triple digits, clings to gains for 2015:

Shares of energy (XLE) and oil services (OIH) had a great month while biotech shares (IBB) suffered their worst month, with many big biotechs coming under pressure. It was even worse for smaller biotechs which got annihilated this week, some on bad news and others on no specific news whatsoever. They were victims of being in the wrong sector at the wrong time.

Now, everyone is talking about the "bursting of the biotech bubble" again and "sector rotation" out of "speculative junk" into "high quality names." And you will notice more and more people talking about a global economic recovery in the second half of the year and that now is the time to buy cyclical stocks like metals and mining (XME), gold (GLD), energy (XLE), and commodities (GSG), and emerging market (EEM), especially if you think the greenback will weaken further in the coming months.

My take on all this? It's all nonsense. This is all part of the "global hope trade" and as I explained in my recent comment on America's risky recovery, those who are betting big on a global recovery in the second half of the year are going to be sorely disappointed.

No doubt, there will be powerful countertrend rallies in many sectors that got killed last year and countertrend rallies in the euro but I would keep shorting these rallies. In fact, I'm sticking with my Outlook 2015 call where I stated it will be a rough and tumble year and recommended the following:

You will notice the index plunged through its 50 day exponential moving average. Technicians love this stuff, it's very "bearish" but others like me just see it as a normal correction in a long secular uptrend. The biotech selloff was much scarier last year during the big unwind but again, that big dip was bought hard and biotech shares went on to make new highs.

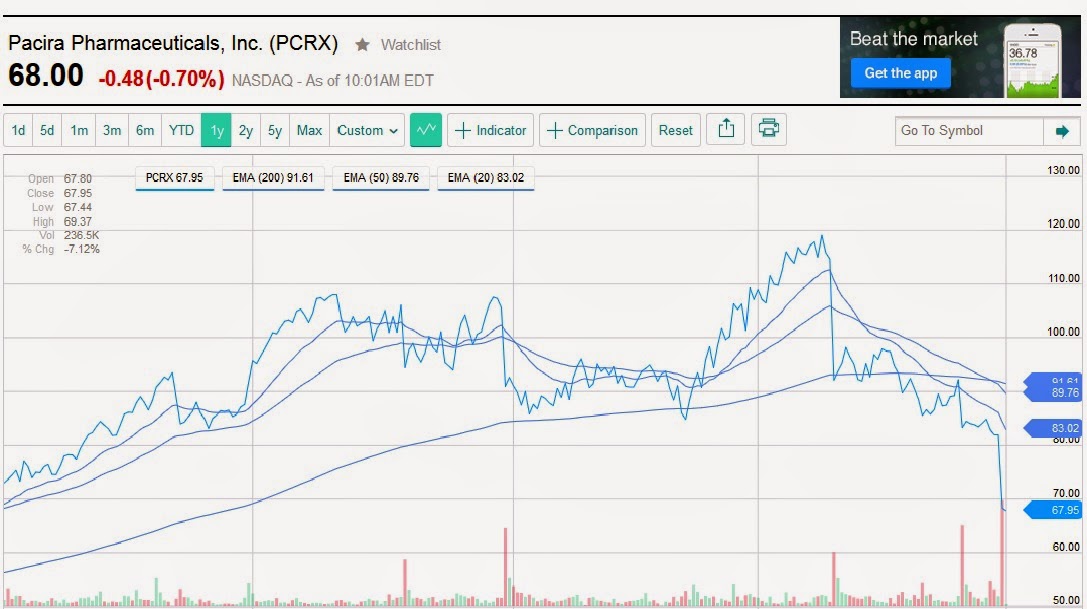

Of course, this is not to say that some biotechs ran up to the stratosphere on pure hype and hope and were cruising for a bruising. Check out the one year charts of Pacira Pharmaceuticals (PCRX) and Aerie Pharmaceuticals (AERI) below (click on images):

OUCH! One had bad earnings and the other had bad phase III results for their glaucoma drug, which goes to show you that taking stock specific risks in biotech isn't for the faint of heart because you can get destroyed on any given day.

And it's not just biotechs. Check out what happened to social media darlings Twitter (TWTR) and LinkedIn (LNKD) this week after they reported earnings which didn't meet expectations (click on image below):

I still like Twitter and think this selloff presents yet another buying opportunity for top funds, but let it settle down to mid or low 30s before you add to an existing position or initiate a new one.

But there are other big tech stocks that are doing great this year. Check out the charts on Amazon (AMZN), Netflix (NFLX), Apple (AAPL) and even Microsoft (MSFT) and you will be very impressed. Amazon and Netflix in particular are killing it so far this year but I wouldn't touch either of them now, the big money has been made.

Then there is the interesting case of Voltari Corporation (VLTC). This piece of crap ran up from 60 cents to over 20$ in a few trading days as news broke that Carl Icahn increased his stake (click on image below):

I tweeted on Twitter and StockTwits to short it at $20, calling it the "mother of all Icahn pump and DUMPS!". I think it's heading back to pennies where it belongs but only after the momos let go of it (and they will). Welcome to the whacky world of stocks where you'll see all sorts of nonsense as regulators sleep on the job.

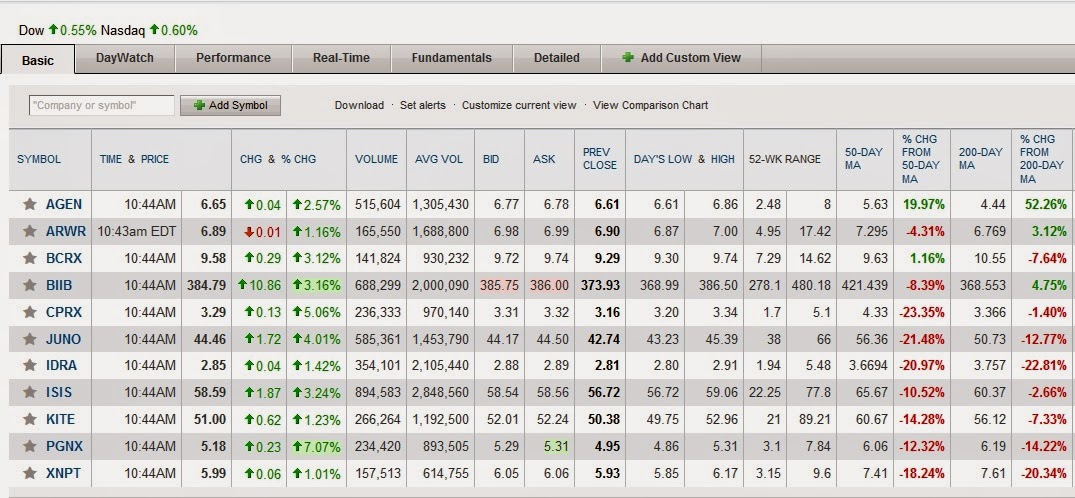

Let me end this brief comment by sharing some of the biotech names I like and trade (click on image below). But remember what I wrote above, taking stock specific risk in biotech (and sometimes even ETF risk!) isn't for the faint of heart and it can be particularly devastating so don't risk more than you can afford to lose!

Below, Corey Davis, specialty pharmaceuticals analyst at Canaccord Genuity, tells CNBC biotech's "great run" will continue despite a bumpy April and Gilead's earnings put a floor in the biotech space.

I also embedded the opening scene from one of my favorite movies, Gladiator, which captures how I feel after a rough and tumble week trading biotechs. Enjoy your weekend and the big boxing match on Saturday night and please remember to kindly subscribe and/or donate to my blog via PayPal on the top right-hand side under the click my ads picture. Thank you!

U.S. stocks closed down more than 1 percent on the last day of trade for April as investors weighed mixed economic data and continued weakness in the dollar.It's been a rough week so let me walk you through it going over what I see trading these crazy schizoid markets. First, the rally in crude oil (USO) has been bolstered by talk of a global economic recovery, which sent many oil drilling and service shares surging on Thursday (click on image):

The major indices closed below their 50-day moving averages.

The Nasdaq closed down 82.22 points, or 1.64 percent, at 4,941.42, recovering slightly from a 2 percent dip. Biotechs weighed on the index, with the iShares Nasdaq Biotechnology ETF (IBB) ending more than 3 percent lower.

The Dow Jones Industrial Average closed down 195.01 points, or 1.08 percent, at 17,840.52, with Apple down 2.7 percent as the greatest laggard. American Express, Wal-Mart and Coca-Cola were the only blue chips advancers.

The blue chip index clung to gains of 0.10 percent for 2015. Earlier, the index lost more than 250 points to temporarily wipe out gains for the year.

The S&P 500 closed down 21.34 points, or 1.01 percent, at 2,085.51, with information technology leading all 10 sectors lower.

"Yesterday's weak earnings and today's light unemployment figure have got the market worried that the Fed's going to raise rates and the underlying economy is not as strong as everyone had hoped," said Kim Forrest, senior equity analyst at Fort Pitt Capital.

Wednesday's weaker-than-expected first-quarter GDP report and Fed meeting statement that removed all calendar references to a rate hike also put investors on edge ahead of a key economic indicator—April's jobs report due next Friday. The data could indicate a pickup in the second quarter and bring a rate hike sooner rather than later.

"We haven't seen yet a whole lot of evidence of things really turning around in April," said Bill Stone, chief investment strategist at PNC Asset Management. He still expects low- to mid- single-digit growth for 2015.

On Thursday, weekly jobless claims came in at 262,000, a 15-year low. U.S. personal income was flat in March, and consumer spending up just 0.3 percent when adjusted for inflation.

April's Chicago Purchasing Managers' Index (PMI) read was 52.3, topping expectations.

"Overall the data has been much weaker. It is still way too early to say you're going to see spectacular growth in the second quarter," said Krishna Memani, CIO of Oppenheimer Funds. "Clearly the bond market is not helping but the bond market is not the primary driver of equities."

Longer-dated U.S. Treasury yields held near highs as European bond yields climbed.

Earlier, U.S. stocks briefly halved losses as investors found some relief from news of progress towards a deal on Greece. An International Monetary Fund spokesman said the fund does not expect the country to exit the euro zone.

Meanwhile, Greece's government signaled the biggest concessions so far as crunch talks with lenders on a cash-for-reforms package started in earnest, while trying to assure leftist supporters it had not abandoned its anti-austerity principles.

The Athens stock exchange closed up 3 percent, with most European equities ending mildly higher.

The market was "at a recovery" from morning lows, said Tim Courtney, CIO at Exencial Wealth Advisors. "Part of it is what's coming out of Greece. What I think is moving the market today and last week is, where the good news is going to come from."

Corporate results have tended to beat estimates on earnings per share but miss on revenue.

Rising rates and lowered earnings expectations for stocks trading at high multiples makes the market "vulnerable," said Bruce Bittles, chief investment strategist at RW Baird.

Analysts noted Thursday's decline did not not indicate a significant selloff as the major indices came off high levels and traders took profits on the last day of trading for the month.

"It's nothing more than a normal, modest correction," said Paul Nolte, portfolio manager at Kingsview Asset Management. "Volume hasn't picked up."

"You need a clear reporting of earnings (at these multiples) that propels stocks higher," said Art Hogan, chief market strategist at Wunderlich Securities, noting that the U.S. dollar remained in focus.

The U.S dollar held lower against major world currencies after the euro traded above $1.12 for the first time in two months on Wednesday.

"Certainly the change in the direction of the dollar has caused a lot of anxiousness," Bittles said.

"I think the biggest meaning in the euro being strong is (ECB President Mario) Draghi's plan isn't working," said Marc Chaikin, CEO of Chaikin Analytics. "It's a negative for the U.S. economy as well because it takes off the table the whole notion of global expansion."

But some currency strategists say the euro's strength may be temporary.

German bund yields surged on Thursday, following a strong rally on Wednesday. U.S. Treasury yields also continued to trade higher, with the benchmark 10-year note yield hitting 2.10 percent on Thursday.

Investors also attempted to interpret Wednesday's Fed statement which removed all calendar references on the timing of a rate hike. Officials have indicated a desire to raise rates at some point this year, with the market now anticipating an increase possibly in September.

The markets "seem to be concerned about when that may take place," said Ryan Larson, head of U.S. equity trading at RBC Global Asset Management (U.S.). "The data has been good enough to confirm that we continue to improve but not enough for the Fed to move aggressively."

On Wednesday, official data showed gross domestic product in the U.S. expanded at an only 0.2 percent annual rate, on Wednesday. That was a big step down from the fourth quarter's 2.2 percent pace and marked the weakest reading in a year.

Major earnings on Thursday included Exxon Mobil, Colgate-Palmolive, ConocoPhillips, CME Group, Viacom, Imax and Beazer Homes before market open.

Exxon Mobil posted first-quarter earnings that declined sharply from a year ago but handily beat expectations on both the top and bottom lines.

AIG, Visa, LinkedIn, Western Union and Dreamworks Animation are due after the bell.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 14.

About three stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 1.0 billion and a composite volume of 4.4 billion in the close.

Crude oil futures settled up 1.79 percent at $59.63 a barrel on the New York Mercantile Exchange. Gold futures settled down $27.60 at $1,182.40 an ounce.

Shares of energy (XLE) and oil services (OIH) had a great month while biotech shares (IBB) suffered their worst month, with many big biotechs coming under pressure. It was even worse for smaller biotechs which got annihilated this week, some on bad news and others on no specific news whatsoever. They were victims of being in the wrong sector at the wrong time.

Now, everyone is talking about the "bursting of the biotech bubble" again and "sector rotation" out of "speculative junk" into "high quality names." And you will notice more and more people talking about a global economic recovery in the second half of the year and that now is the time to buy cyclical stocks like metals and mining (XME), gold (GLD), energy (XLE), and commodities (GSG), and emerging market (EEM), especially if you think the greenback will weaken further in the coming months.

My take on all this? It's all nonsense. This is all part of the "global hope trade" and as I explained in my recent comment on America's risky recovery, those who are betting big on a global recovery in the second half of the year are going to be sorely disappointed.

No doubt, there will be powerful countertrend rallies in many sectors that got killed last year and countertrend rallies in the euro but I would keep shorting these rallies. In fact, I'm sticking with my Outlook 2015 call where I stated it will be a rough and tumble year and recommended the following:

In this environment, investors should overweight small caps (IWM), technology (QQQ or XLK) and biotech shares (IBB or XBI) and keep steering clear of energy (XLE), materials (XLB) and commodities (GSG). And even though deflationary headwinds will pick up in 2015, I'm less bullish on utilities (XLU) and healthcare (XLV) because valuations are getting out of whack after a huge run-up last year.Now, I made a mistake with healthcare (XLV) because I realized after there are some big biotechs in the top holdings of this ETF, but I still prefer playing the pure biotech indexes. Have a look below at the one year chart of the iShares Nasdaq Biotechnology (click on image):

You will notice the index plunged through its 50 day exponential moving average. Technicians love this stuff, it's very "bearish" but others like me just see it as a normal correction in a long secular uptrend. The biotech selloff was much scarier last year during the big unwind but again, that big dip was bought hard and biotech shares went on to make new highs.

Of course, this is not to say that some biotechs ran up to the stratosphere on pure hype and hope and were cruising for a bruising. Check out the one year charts of Pacira Pharmaceuticals (PCRX) and Aerie Pharmaceuticals (AERI) below (click on images):

OUCH! One had bad earnings and the other had bad phase III results for their glaucoma drug, which goes to show you that taking stock specific risks in biotech isn't for the faint of heart because you can get destroyed on any given day.

And it's not just biotechs. Check out what happened to social media darlings Twitter (TWTR) and LinkedIn (LNKD) this week after they reported earnings which didn't meet expectations (click on image below):

I still like Twitter and think this selloff presents yet another buying opportunity for top funds, but let it settle down to mid or low 30s before you add to an existing position or initiate a new one.

But there are other big tech stocks that are doing great this year. Check out the charts on Amazon (AMZN), Netflix (NFLX), Apple (AAPL) and even Microsoft (MSFT) and you will be very impressed. Amazon and Netflix in particular are killing it so far this year but I wouldn't touch either of them now, the big money has been made.

Then there is the interesting case of Voltari Corporation (VLTC). This piece of crap ran up from 60 cents to over 20$ in a few trading days as news broke that Carl Icahn increased his stake (click on image below):

I tweeted on Twitter and StockTwits to short it at $20, calling it the "mother of all Icahn pump and DUMPS!". I think it's heading back to pennies where it belongs but only after the momos let go of it (and they will). Welcome to the whacky world of stocks where you'll see all sorts of nonsense as regulators sleep on the job.

Let me end this brief comment by sharing some of the biotech names I like and trade (click on image below). But remember what I wrote above, taking stock specific risk in biotech (and sometimes even ETF risk!) isn't for the faint of heart and it can be particularly devastating so don't risk more than you can afford to lose!

Below, Corey Davis, specialty pharmaceuticals analyst at Canaccord Genuity, tells CNBC biotech's "great run" will continue despite a bumpy April and Gilead's earnings put a floor in the biotech space.

I also embedded the opening scene from one of my favorite movies, Gladiator, which captures how I feel after a rough and tumble week trading biotechs. Enjoy your weekend and the big boxing match on Saturday night and please remember to kindly subscribe and/or donate to my blog via PayPal on the top right-hand side under the click my ads picture. Thank you!