The Alberta Investment Management Corporation (AIMCo) recently announced a total fund net return of 9.9% in 2014:

Also, here is a snapshot of the big picture of AIMCo's asset mix, assets under management and net investment results as of December 31, 2014 (click on image):

AIMCo's 2014 Annual Report is available on their site here. I strongly recommend you read it carefully to get a better understanding of the results across public and private markets. Also worth reading are the Chair and CEO messages.

I will bring your attention to this passage from Kevin Uebelein, AIMCo's new CEO since January 2015, in his message (added emphasis is mine):

On benchmarks, AIMCo states the following (page 33):

Here are AIMCo's benchmarks in all asset classes (click on image below from page 33):

As you can see, public market benchmarks are pretty much self-explanatory but in private markets, there is no free lunch anywhere (unlike places like PSP Investments which needs to work on its private market benchmarks, especially in real estate and natural resources).

Are AIMCo's private market benchmarks perfect? No, they're not, but the truth is private market benchmarks aren't perfect anywhere. In previous conversations I had with Leo de Bever (AIMCo's former CEO) on this topic, he admitted it's tough to benchmark private markets but he agreed with me that the benchmarks should reflect the opportunity cost of not investing in public markets plus a spread to compensate for leverage and illiquidity.

Of course, when it came down to it, Leo de Bever never recommended adding a spread to AIMCo's Private Equity benchmark (MSCI All Country World Net Total Return Index) and stated to me that "in the long-run it all works out as there are some years where public markets surge and others where they grossly under-perform private markets."

If you ask me, I actually think PSP finally got its Private Equity benchmark right (Private Equity Fund Universe and Private Equity cost of capital) but some will even argue that this doesn't reflect the true opportunity cost of investing in an illiquid investment.

The point I'm trying to make is some large Canadian funds take benchmarking their private market portfolios much more seriously than others and this is important from a risk and compensation point of view.

Anyways, enough on benchmarking private markets, maybe I will delve deeper into this topic and tie it to compensation in a future comment on Canada's pension plutocrats.

Here are the overall results for AIMCo for all its portfolios from page 34 of the Annual Report (click on image):

Keep in mind these are annualized net returns as of December 31st, 2014 for public and private market portfolios. I think this is one reason why AIMCo waits till June/ July to report its results as there is always a lag of a quarter for private market investments (valuation lag).

I emailed AIMCo's CEO, Kevin Uebelein, to discuss there results. Kevin didn't speak to me on AIMCo's 2014 results (to be fair, he wasn't the CEO at the time) but he was very responsive and directed me to Dénes Németh, Manager, Corporate Communication at AIMCo.

I actually sent an email to Dénes, Kevin and Leo de Bever asking these questions:

As for Real Estate, I appreciate Dénes's response but I caution stakeholders everywhere, Canadian residential and commercial real estate is in for a long, tough slug now that Canada's crisis is well underway and comparing opportunistic foreign real estate investments to the REALpac / IPD Canadian All Property Index – Large Institutional Subset just doesn't make sense.

Now to be fair, AIMCo's foreign real estate holdings make up roughly 20% of the Real Estate portfolio, and most of this isn't opportunistic real estate (it is core) but this is still something to keep in mind when gauging whether the real estate benchmark appropriately reflects the underlying risks of the Real Estate portfolio (another example of how private market benchmarks have to be reevaluated ever so often to determine whether they reflect real risks of underlying portfolio).

I will leave it up to my readers to carefully read AIMCo's 2014 Annual Report to get more information on their public and private investments as well as other information.

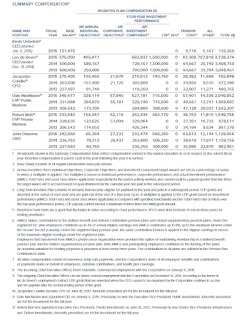

In terms of compensation, the table below from page 69 provides a summary for the compensation of AIMCo's senior officers (click on image):

As you can see, Leo de Bever, AIMCo's former CEO tops the compensation at $3,728, 374. Over the last three calendar years (2012, 2013, 2014), he made just shy of $10 million, which is considerably more than I thought he earned when I wrote the list of highest paid pension fund CEOs. Dale MacMaster, who is now AIMCo's CIO, enjoyed the second highest total compensation in 2014 of $2,049, 952.

Again, keep in mind compensation is based on rolling four-year returns over benchmarks. The fact that AIMCo underpeformed its benchmark in 2014 will have an impact on future compensation. Also, as I stated above, there's no free lunch for AIMCo's private markets managers, which makes beating their overall benchmark that much more difficult.

Let me end by showing you a picture I liked in AIMCo's Annual Report (click on image):

When I speak of the importance of diversity in the workplace, this is what I'm talking about. Not to offend anyone but I'm tired of seeing old white males leading public pension funds and hiring young white males who think and act like them. I think the image above represents the real cultural diversity of Canada and I applaud AIMCo for showing many pictures like this in the Annual Report, highlighting its commitment to real diversity.

One area where I will criticize AIMCo is that they need to do a better job communicating their results to the media. Dénes Németh, Manager, Corporate Communication at AIMCo, is a good guy and he did respond promptly to my request upon returning from his vacation, but where is the press release on results and where are the articles in Canada's major newspapers? (makes me wonder if this was deliberate because AIMCo undeprfermored its benchmark in 2014).

Still, I enjoyed reading AIMCo's 2014 Annual Report and wish Kevin Uebelein and the rest of AIMCo's senior officers and employees much success in navigating these tough markets over the next few years.

Lastly, I agree with Leo de Bever, these are dark days for Alberta’s energy industry. If anything, the outlook seems to grow more depressing by the week. I think Alberta is pretty much screwed for the next five to ten years and I blame the Harper Conservatives for putting all their focus on oil sands projects, neglecting Canada's manufacturing industry in Ontario and Quebec (I know, worked at Industry Canada for a brief stint and saw massive budget cuts at the worst possible time). Canada's leaders have learned nothing from past mistakes. That's why I'm still short Canada even if the U.S. recovery continues for now.

[To be fair, the sorry state of manufacturing in Canada isn't just about massive cutbacks from the federal government. Gary Lamphier of the Edmonton Journal makes a valid point when he shared this with me in an email: "I frankly put more blame on Canadian companies that were unwilling to innovate and spend money on new equipment when the loonie was at $1.10 US. Now they’re back to the same old game they played in the 1990s, hoping the low dollar will bail them out. So it’s the manufacturing sector itself that is largely to blame, not Harper’s government !! Now THAT is something you will NEVER hear in the Toronto-centric ‘national’ media — and I say that as a guy who spent 35 years of his life in Ontario, a big chunk of it reporting on the auto sector."]

Below, Neil Atkinson, head of analysis at Lloyd's List Intelligence, says there's way too much supply of oil chasing too little demand asOPEC shows 'no signs' of cutting production. Unfortunately, the ominous sign from commodities isn't painting a pretty picture for Canada and other commodity producers.

Hope Friday's U.S. jobs report signals a new trend for global growth but I remain cautious on commodity and energy shares and I'm increasingly worried that stocks are going to get clobbered this fall (but remain optimistic that any big dip will be bought hard as there's a lot of stimulus in the pipeline).

The net of fees return was 11.2% for pension and endowment Clients, and 4.4% for government and specialty fund Clients.AIMCo's investment performance by calendar year (net of fees) is broken down in the table below (click on image):

Annually, the board and management agree on active return targets consistent with top quartile return on active risk. Since 2009, AIMCo has earned its Clients value add of $2.5 billion net of fees.In 2014, AIMCo earned a net of fees return of 9.9%, underperforming its active return target of 10.5% by 0.6% or $401 million net of fees.

Public markets investments performed strong with public equities contributing $369 million and fixed income adding $167 million to value add. Private market investments also demonstrated strong returns in certain asset classes with real estate generating $145 million.

The primary driver of underperformance in 2014 may be attributed to losses incurred by AIMCo’s global tactical asset allocation strategy and the revaluation of certain prior year investments. In addition, certain illiquid asset classes lagged behind the very strong performance of their listed benchmarks, a not unexpected outcome given the diversification rationale for investment in these asset classes.

Also, here is a snapshot of the big picture of AIMCo's asset mix, assets under management and net investment results as of December 31, 2014 (click on image):

AIMCo's 2014 Annual Report is available on their site here. I strongly recommend you read it carefully to get a better understanding of the results across public and private markets. Also worth reading are the Chair and CEO messages.

I will bring your attention to this passage from Kevin Uebelein, AIMCo's new CEO since January 2015, in his message (added emphasis is mine):

Our commitment is to be both client dedicated and performance driven in all aspects of our business, always seeking continuous incremental improvement. Ultimately it is to be truly world-class, not only in benchmarking our returns but in all facets of our business compared to the best asset managers wherever they may exist. We will do this in a spirit of collaboration internally with all employees, and with our clients and all stakeholders.Similar to the Caisse, AIMCo has many clients but the points I highlighted have to do with benchmarking returns and liability-driven investments. Benchmarking in particular is one area where AIMCo excels relative to most of its larger Canadian peers. It's not perfect, however, but still better than most other large pension funds and there is definitely no free lunch in private market benchmarks.

AIMCo remains committed to seek out the best investment opportunities for our clients with careful consideration of their unique liability and risk-return profiles. We will strive to be a transparent and trusted advisor and will work closely to understand client needs. We will match those needs to our capabilities and ensure that long-term stakeholder obligations are satisfied.

On benchmarks, AIMCo states the following (page 33):

AIMCo’s performance benchmarks measure what our Clients could earn by passively implementing their investment policy with bond and stock market index investments. The incremental return above what markets provide measures the contribution of active management, referred to as value add.

The selection of appropriate benchmarks is important in investment management. Done properly, it ensures alignment of the Client’s risk and return objectives to the investment strategy of the asset manager. Public market investment benchmarks comprise all of the attributes of an unbiased effective measure – transparent, stable, and investable. Illiquid asset classes are more difficult to benchmark given the lack of readily available comparison data for the physical assets invested in and due to the fact that by their very nature, these investments are expected to provide an illiquidity premium relative to the nearest listed proxy.

AIMCo and its Clients work together to identify the most appropriate benchmarks against which performance should be measured

Here are AIMCo's benchmarks in all asset classes (click on image below from page 33):

As you can see, public market benchmarks are pretty much self-explanatory but in private markets, there is no free lunch anywhere (unlike places like PSP Investments which needs to work on its private market benchmarks, especially in real estate and natural resources).

Are AIMCo's private market benchmarks perfect? No, they're not, but the truth is private market benchmarks aren't perfect anywhere. In previous conversations I had with Leo de Bever (AIMCo's former CEO) on this topic, he admitted it's tough to benchmark private markets but he agreed with me that the benchmarks should reflect the opportunity cost of not investing in public markets plus a spread to compensate for leverage and illiquidity.

Of course, when it came down to it, Leo de Bever never recommended adding a spread to AIMCo's Private Equity benchmark (MSCI All Country World Net Total Return Index) and stated to me that "in the long-run it all works out as there are some years where public markets surge and others where they grossly under-perform private markets."

If you ask me, I actually think PSP finally got its Private Equity benchmark right (Private Equity Fund Universe and Private Equity cost of capital) but some will even argue that this doesn't reflect the true opportunity cost of investing in an illiquid investment.

The point I'm trying to make is some large Canadian funds take benchmarking their private market portfolios much more seriously than others and this is important from a risk and compensation point of view.

Anyways, enough on benchmarking private markets, maybe I will delve deeper into this topic and tie it to compensation in a future comment on Canada's pension plutocrats.

Here are the overall results for AIMCo for all its portfolios from page 34 of the Annual Report (click on image):

Keep in mind these are annualized net returns as of December 31st, 2014 for public and private market portfolios. I think this is one reason why AIMCo waits till June/ July to report its results as there is always a lag of a quarter for private market investments (valuation lag).

I emailed AIMCo's CEO, Kevin Uebelein, to discuss there results. Kevin didn't speak to me on AIMCo's 2014 results (to be fair, he wasn't the CEO at the time) but he was very responsive and directed me to Dénes Németh, Manager, Corporate Communication at AIMCo.

I actually sent an email to Dénes, Kevin and Leo de Bever asking these questions:

1) Why exactly did AIMCo underperform its benchmark in 2014? What repricing of which assets?Dénes was kind enough to follow up with these answers:

2) Performance of private equity is NOT clear. On one table (p. 34) with all the asset classes it is 11.9% vs benchmark of 13.5% but then on p. 38 it says private equity returned 21.7% outperforming its benchmark by 8.1%...very confusing!

3) AIMCo is now making opportunistic real estate investments outside of Canada (small percentage) but using a Canadian AAA real estate index?

Copied Leo de Bever here as he was the CEO in 2014. Also, with Alberta oil revenues falling fast, how will this impact AIMCo?

1) Why exactly did AIMCo underperform its benchmark in 2014? What repricing of which assets?A few comments on those answers. Basically, Relationship Investing and especially Venture Capital really underperformed, hurting the overall (aggregate) net returns in Private Equity. I was never a big fan of Canadian venture capital (or VC in general) and have seen huge losses in this space while working as a senior economist at the Business Development Bank of Canada. I even told Leo de Bever about this and he agreed with me that VC is a tough gig but "AIMCo was investing in late stage VC".

As discussed elsewhere in the Annual Report, AIMCo’s illiquid investment classes such as Infrastructure, Timber and Private Equity use Public Market benchmarks. Combined, these asset classes account for approximately $7.5 billion or 9% of our AUM. The Public Market benchmarks experienced strong performance during the relevant period, resulting in a corresponding underperformance of the illiquid asset classes. We are continually reviewing our methods of measuring performance and in 2015 have undertaken a review of certain of our illiquid benchmarks in collaboration with our clients.

AIMCo holds illiquid investment in certain insurance-linked assets. These assets were revalued in 2014 for a number of reasons, including updated information, better clarity on the application of accounting principles and the increasing sophistication of the relevant market.

2) Performance of private equity is NOT clear. On one table (p. 34) with all the asset classes it is 11.9% vs benchmark of 13.5% but then on p. 38 it says private equity returned 21.7% outperforming its benchmark by 8.1%...very confusing!

The $3.3 billion Private Equity asset class noted on Page 34 is an aggregated total comprising three main strategies – Private Equity Investments, as well as, AIMCo’s Relationship Investing and Venture Capital. The aggregate return of 11.9% does not provide a true picture of how each strategy performed, so to provide the reader additional detail, we chose to break out the MD&A by specific strategy on Page 39. I appreciate how it can be confusing, so in future reports we will consider adding a line to clarify.

3) AIMCo is now making opportunistic real estate investments outside of Canada (small percentage) but using a Canadian AAA real estate index?

We invest opportunistically in real estate in foreign markets as an alternative to investing in Canada. We use the REALpac / IPD Canadian All Property Index – Large Institutional Subset to judge the performance of those foreign assets against what we would have earned had we instead invested within Canada.

As for Real Estate, I appreciate Dénes's response but I caution stakeholders everywhere, Canadian residential and commercial real estate is in for a long, tough slug now that Canada's crisis is well underway and comparing opportunistic foreign real estate investments to the REALpac / IPD Canadian All Property Index – Large Institutional Subset just doesn't make sense.

Now to be fair, AIMCo's foreign real estate holdings make up roughly 20% of the Real Estate portfolio, and most of this isn't opportunistic real estate (it is core) but this is still something to keep in mind when gauging whether the real estate benchmark appropriately reflects the underlying risks of the Real Estate portfolio (another example of how private market benchmarks have to be reevaluated ever so often to determine whether they reflect real risks of underlying portfolio).

I will leave it up to my readers to carefully read AIMCo's 2014 Annual Report to get more information on their public and private investments as well as other information.

In terms of compensation, the table below from page 69 provides a summary for the compensation of AIMCo's senior officers (click on image):

As you can see, Leo de Bever, AIMCo's former CEO tops the compensation at $3,728, 374. Over the last three calendar years (2012, 2013, 2014), he made just shy of $10 million, which is considerably more than I thought he earned when I wrote the list of highest paid pension fund CEOs. Dale MacMaster, who is now AIMCo's CIO, enjoyed the second highest total compensation in 2014 of $2,049, 952.

Again, keep in mind compensation is based on rolling four-year returns over benchmarks. The fact that AIMCo underpeformed its benchmark in 2014 will have an impact on future compensation. Also, as I stated above, there's no free lunch for AIMCo's private markets managers, which makes beating their overall benchmark that much more difficult.

Let me end by showing you a picture I liked in AIMCo's Annual Report (click on image):

When I speak of the importance of diversity in the workplace, this is what I'm talking about. Not to offend anyone but I'm tired of seeing old white males leading public pension funds and hiring young white males who think and act like them. I think the image above represents the real cultural diversity of Canada and I applaud AIMCo for showing many pictures like this in the Annual Report, highlighting its commitment to real diversity.

One area where I will criticize AIMCo is that they need to do a better job communicating their results to the media. Dénes Németh, Manager, Corporate Communication at AIMCo, is a good guy and he did respond promptly to my request upon returning from his vacation, but where is the press release on results and where are the articles in Canada's major newspapers? (makes me wonder if this was deliberate because AIMCo undeprfermored its benchmark in 2014).

Still, I enjoyed reading AIMCo's 2014 Annual Report and wish Kevin Uebelein and the rest of AIMCo's senior officers and employees much success in navigating these tough markets over the next few years.

Lastly, I agree with Leo de Bever, these are dark days for Alberta’s energy industry. If anything, the outlook seems to grow more depressing by the week. I think Alberta is pretty much screwed for the next five to ten years and I blame the Harper Conservatives for putting all their focus on oil sands projects, neglecting Canada's manufacturing industry in Ontario and Quebec (I know, worked at Industry Canada for a brief stint and saw massive budget cuts at the worst possible time). Canada's leaders have learned nothing from past mistakes. That's why I'm still short Canada even if the U.S. recovery continues for now.

[To be fair, the sorry state of manufacturing in Canada isn't just about massive cutbacks from the federal government. Gary Lamphier of the Edmonton Journal makes a valid point when he shared this with me in an email: "I frankly put more blame on Canadian companies that were unwilling to innovate and spend money on new equipment when the loonie was at $1.10 US. Now they’re back to the same old game they played in the 1990s, hoping the low dollar will bail them out. So it’s the manufacturing sector itself that is largely to blame, not Harper’s government !! Now THAT is something you will NEVER hear in the Toronto-centric ‘national’ media — and I say that as a guy who spent 35 years of his life in Ontario, a big chunk of it reporting on the auto sector."]

Below, Neil Atkinson, head of analysis at Lloyd's List Intelligence, says there's way too much supply of oil chasing too little demand asOPEC shows 'no signs' of cutting production. Unfortunately, the ominous sign from commodities isn't painting a pretty picture for Canada and other commodity producers.

Hope Friday's U.S. jobs report signals a new trend for global growth but I remain cautious on commodity and energy shares and I'm increasingly worried that stocks are going to get clobbered this fall (but remain optimistic that any big dip will be bought hard as there's a lot of stimulus in the pipeline).