Susan Smith wrote a special for the Globe and Mail, Canada’s pension safety net is strong but showing strains:

I completely disagree with Mr. Clausen's assertions that the debate in Canada is all wrong-- ie. defined-benefit vs defined-contribution -- and it shows me how dangerous it is to rely on these so-called experts who don't really understand what they're talking about.

Importantly, it is my contention that Canada can easily rank number 1 in the world and even overtake the mighty Dutch pensions which have a strong tradition of providing sound, secure and transparent defined-benefit plans to their citizens.

As far as Denmark, the OECD provides this information:

The brutal truth on defined-contribution plans is they cannot outperform large, well-governed defined-benefit plans. Don't be fooled by what you see in Denmark and Australia where large DC plans are run more like large DB plans. Still, given a choice between enhancing the CPP or having what they have in those countries, I would always opt for enhancing the CPP.

Is Canada's retirement system perfect? Of course not. We need real change to Canada's pension plan, change that will build on the success of our large, well-governed defined benefit plans. We also need less pension gaffes by our newly elected federal government, like the dumb, asinine, populist move to scale back the limit on TFSA contributions (that really didn't impress me).

Now that the Trudeau Liberals have "pandered to the poor," maybe they can get on to implementing real reforms, like enhancing the CPP so Ontario can drop the ORPP. I also like the fact that the federal government is courting Canada's Top Ten pensions on infrastructure, provided that these pensions remain autonomous and continue to operate at arms-length from the government.

But there are other concerns with Canada's large defined-benefit plans. Kathryn May of the Ottawa Citizen reports, Public Service pension plan faces $4.4B paper deficit that may draw critical fire:

Public Service unions will whine but they better listen carefully to me, if they want to avoid another Greece here, they better accept some form of risk sharing and realize ultra low rates are here to stay and this will decimate pensions (take the time to listen to my recent interview with Gordon Long of the Financial Repression Authority).

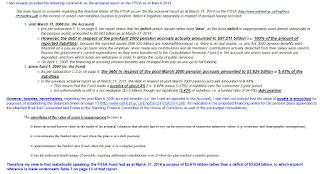

I asked Bernard Dussault, Canada's former Chief Actuary, to provide me with his thoughts on the latest report on the PSSA as of March 2014 (click on image below to read his email response):

I thank Bernard for sharing his insights and I too am not a big fan of smoothing for the reasons he cites above.

In another major move, Quebec is shaking up pension landscape with shift to going-concern funding:

I'm not sure about the pros and cons of Quebec's new pension law. On the one hand it bolsters defined-benefit plans but it also allows employers to lower their pension contributions, which can be disastrous for employees if a company goes under.

Again, go back to read my comment on introducing real change to Canada's pension plan, where I wrote the following:

As always, I welcome your feedback on these issues so feel free to email me at LKolivakis@gmail.com if you have anything to add.

Below, after announcing a possible deficit of more than $18 billion in 2016-17, the finance minister Bill Morneau defended his plans to go ahead with planned spending on top of that.

I've been warning all of you to get ready for negative rates in Canada and much higher pension deficits in the future. Still, now more than ever, we need to enhance the CPP and bolster Canada's retirement system and our future economic prosperity.

Amid all the worry about the boomer bubble, longer lifespans and uncertain economic conditions, it’s comforting to know that Canada’s retirement savings system ranks highly among its peers around the world.You can read the 2015 Mercer Global Pension Index media release here. This is old news which I covered on my blog back in October 2015 when the study first went public.

Last year Canada managed to hang on to seventh place among 25 countries in a key annual ranking of retirement systems.

The 2015 Melbourne Mercer Global Pension Index places Canada behind Denmark, the Netherlands, Australia, Sweden, Switzerland and Finland in a ranking that considers more than 40 indicators measuring the adequacy, sustainability and integrity of pension systems covering almost 60 per cent of the world’s population.

Canada’s index value was 70 – up from 69.1 – which gave it a grade of B, the same mark it received the previous year. Denmark, with a ranking of 81.7, and the Netherlands, at 80.5, were the only two countries to receive an A. Since the index started seven years ago, Canada has ranked among the top third of countries studied.

Canada has the right building blocks, with Old Age Security, the Canada Pension Plan and Guaranteed Income Supplement, said Scott Clausen, a partner at Mercer Canada in Toronto, “and then it has the voluntary options on the employer side and RRSPs [registered retirement savings plans].”

“But,” he adds, “it doesn’t have a perfect system.”

Mr. Clausen said the countries that ranked at the top did so mainly because employers have stronger pension plans. Denmark, the Netherlands and Australia, which took the third spot this year, all have mandatory occupational plans. Australian employers, for example, contribute 9.5 per cent of an employee’s earnings, and that contribution is scaling up to 12 per cent over the next 10 years. Employees are also allowed to contribute.

“A lot of the debate [in Canada] is around defined-benefit versus defined-contribution plans, but that is probably the wrong debate,” Mr. Clausen said. “Denmark is largely DC and the Netherlands is largely DB. The issue is more around the level of contribution and whether a plan is mandatory.”

Private pension plans in Canada, meanwhile, are facing increased challenges. Mercer recently reported that the median solvency ratio of pension plans among its clients stood at 85 per cent at the end of 2015, down from 88 per cent at the beginning of the year.

There’s not much talk in Canada about forcing companies to contribute to mandatory plans, but the proposed Ontario Retirement Pension Plan, intended to supplement CPP for those without company plans, is a viable way to strengthen the system, Mr. Clausen believes.

“It would be good to find a solution that would enhance CPP because it is a well-run, cost-efficient system and gets to the question of how you provide for middle-income earners.”

The top-ranked countries generally benefit from their plans being administered as larger entities, which results in lower costs because of economies of scale.

One strength of Canada’s system is that company pension plans must be locked in when employees leave a job if they have not reached the minimum age for withdrawal. Some other countries, such as the United States, have no minimum withdrawal age, which means that the funds can be used before retirement.

A way to improve the Canadian system would be to raise limits on contributions to RRSPs, but Mr. Clausen pointed out that average Canadians still have a substantial amount of unused contribution room.

Encouraging people to work longer would be another index-booster, said David Knox, senior partner at Mercer Consulting in Australia and the main architect of the study. While this is expected to happen naturally because of increased lifespans, governments can also play a role, he said.

“We really need to encourage people to work longer and reduce future demands on government budgets,” Mr. Knox said. “Governments can encourage this, either directly with grants to employers, or indirectly through leading the discussion in the community. In addition, gradually increasing the eligibility age for benefits will lead to people working longer.”

He pointed out that countries ranked higher than Canada tend to have stronger regulations for protecting benefits and providing information to pension members.

In 2015, Canada’s sustainability subindex, which takes into account public debt and strains on government plans, fell to 56.2 from 58.6. The decline was largely because of increased life expectancies and a change in how the subindex is calculated, Mr. Knox said.

Canada’s integrity subindex ranking, which measures such things as governance and transparency, stayed the same, at 74.3.Countries with higher rankings tend to see more disclosure of information to plan members, such as how a plan is doing as a whole and more detail about what members can expect to receive, rather than simply reporting a lump sum of what has accrued. The integrity subindex also takes into account provisions for fraud or insolvency.

Canada’s adequacy subindex, which measures the ability of the pension system to provide adequate replacement income for lower-income and median-income individuals, was up to 79.4 from 75.

“But where you start to see some cracks in Canada’s retirement system is when you look at incomes between $50,000 and $100,000,” Mr. Clausen said. “That’s where the adequacy starts to drop in terms of lifestyles being maintained unless individuals belong to a workplace pension plan or are saving for their own retirement.”

“Canada is holding its own,” he added. “But there’s always room to improve.”

The rankings

The Melbourne Mercer Global Pension Index ranks countries using more than 40 indicators that measure the adequacy, sustainability and integrity of pension systems.

Denmark – 81.7

Netherlands – 80.5

Australia – 79.6

Sweden – 74.2

Switzerland – 74.2

Finland – 73.0

Canada – 70.0

Chile – 69.1

Britain – 65

Singapore – 64.7

Ireland – 63.1

Germany – 62.0

France – 57.4

United States – 56.3

Poland – 56.2

South Africa – 53.4

Brazil – 53.2

Austria – 52.2

Mexico – 52.1

Italy – 50.9

Indonesia – 48.2

China – 48.0

Japan – 44.1

South Korea – 43.8

India – 40.3

I completely disagree with Mr. Clausen's assertions that the debate in Canada is all wrong-- ie. defined-benefit vs defined-contribution -- and it shows me how dangerous it is to rely on these so-called experts who don't really understand what they're talking about.

Importantly, it is my contention that Canada can easily rank number 1 in the world and even overtake the mighty Dutch pensions which have a strong tradition of providing sound, secure and transparent defined-benefit plans to their citizens.

As far as Denmark, the OECD provides this information:

The statutory occupational component of Denmark’s pension system comprises two schemes: a supplementary earnings-related plan (ATP) and the special pension (SP), both of which are of the defined contribution type. Contributions to the SP, under which members can choose their fund managers and investment portfolios, were suspended by law from 2004 to 2008.So it's true Denmark and Australia rely mostly on mandatory defined-contribution plans and they've done a great job reducing fees and delivering on their pension promise, especially in Denmark, but this doesn't mean that defined-contribution plans are the way forward for Canada.

... Occupational pension plans – almost exclusively of the defined contribution type in Denmark – have been made effectively mandatory for companies bound by industry-wide collective agreements.

The brutal truth on defined-contribution plans is they cannot outperform large, well-governed defined-benefit plans. Don't be fooled by what you see in Denmark and Australia where large DC plans are run more like large DB plans. Still, given a choice between enhancing the CPP or having what they have in those countries, I would always opt for enhancing the CPP.

Is Canada's retirement system perfect? Of course not. We need real change to Canada's pension plan, change that will build on the success of our large, well-governed defined benefit plans. We also need less pension gaffes by our newly elected federal government, like the dumb, asinine, populist move to scale back the limit on TFSA contributions (that really didn't impress me).

Now that the Trudeau Liberals have "pandered to the poor," maybe they can get on to implementing real reforms, like enhancing the CPP so Ontario can drop the ORPP. I also like the fact that the federal government is courting Canada's Top Ten pensions on infrastructure, provided that these pensions remain autonomous and continue to operate at arms-length from the government.

But there are other concerns with Canada's large defined-benefit plans. Kathryn May of the Ottawa Citizen reports, Public Service pension plan faces $4.4B paper deficit that may draw critical fire:

The latest actuarial report on the public service pension plan shows a $4.4 billion shortfall that the new Liberal government is legally bound to make up in special payments of at least $416M for 15 years.My advice to the federal government is to introduce risk-sharing to the federal Public Service pension plan (just like Ontario Teachers, HOOPP and other Ontario DB plans have done) and have the pre-2000 (notional) account to be managed by PSP Investments which manages the post-2000 fund.

This comes as the Trudeau government is already struggling to limit the deficit. Finance Minister Bill Morneau revealed that he faces an $18 billion deficit before announcing in the budget coming on March 22 any of the infrastructure measures the Liberals promised during the election campaign.

Morneau said one reason that departmental spending or direct program expenses are $1.8 billion higher than projected last fall is because of “higher projected employee pension and future benefits expenses resulting from reduced projected interest rates.”

Interest rates have been consistently lower than expected since the 2008 recession and lower rates drive up the liabilities in the government’s three pension plans — for the public service, military and RCMP.

The latest actuarial report on the public service pension plan, which is conducted every three years to assess the financial health of the plan, was completed by chief actuary Jean-Claude Ménard before the election and tabled last month. It examined the plan as of March 2014.

What it shows is a plan that is technically in surplus based on market value. However, in a bid to avoid wild swings in value because of the rise and fall of markets, the government decided to “smooth” the plan. That ‘smoothing’ of the assets puts the plan into deficit and triggers the top-up payments.

Smoothing is an accounting practice the government has adopted to protect its pension funds from absorbing big losses or gains at once and allows them to be spread out over years.

Treasury Board President Scott Brison, who is responsible for the pension plans, has the discretion to recognize the market value of the surplus and eliminate the payments but that would be contrary to accounting practices.

In an email, Treasury Board said Brison accepts the report but doesn’t indicate whether he will take the full 15 years to make the payments.

The last actuarial valuation of the plan in 2011 also found a deficit, which it recommended the government top up with special payments of $406 million a year. With the latest report, the government will be paying another $11 million a year.

As one senior bureaucrat said: “It’s a pickle. The plan is in a deficit but it’s not.”

“They are in the bizarre situation of not being in a deficit when you look at their assets but to be consistent with accounting policy they have to make these top-up payments for what is effectively an artificial deficit.”

The shortfall also comes as the government is locked in a sensitive round of collective bargaining with federal unions.

Pensions in the public service are not negotiable. The government is responsible for them and the terms of the benefits are set by legislation. They are, however, a critical part of public servants’ overall compensation package and a shortfall could give the Liberals some leverage in negotiating a new deal.

It also raises the possibility that reported deficits will reignite complaints about the affordability and sustainability of the plans.

Robyn Benson, president of the Public Service Alliance of Canada, says the actuarial report shows the plan “remains financially viable and there is no cause for concern.”

Pensions are public servants’ most-valuable asset and they have never been under such scrutiny. The plans for Canada’s public servants, military and RCMP are the largest in the country and the government’s second biggest liability after the federal market debt.

With the deficit, the plans are 97 per cent funded, which unions argue is much better than in private sector plans, but they also know governments often look to public servants to share the pain when facing worsening economic conditions and promises to fulfill.

“The plan is in good shape and there are no risks presenting themselves but we are ever mindful of government history with the pension plan,” said Debi Daviau, president of the Professional Institute of the Public Service of Canada.

Former Treasury Board president Tony Clement introduced reforms to the plans that made public servants pay half of the contributions and boosted the retirement age.

Clement assured public servants that was the end of the pension changes even though the Conservatives were proposing “target benefit” pension plans for Canada’s Crown corporations and federally regulated industries.

The speculation among unions and retirees has long been that once Crown corporations’ pensions are converted the government will set its sights on the pensions of public servants, military and RCMP.

The appointment of Morneau to Finance has not eased those concerns.

A pension expert, Morneau was executive chair of Morneau-Shepell, Canada’s largest human resources firm and a former chair of the C.D. Howe Institute, which has been critical of the federal pensions.

Morneau-Shepell is considered one of the architects of the target benefit pension plan in New Brunswick, which allowed for the conversion of a defined benefit plan to a shared risk or target benefit plan.

At a 2013 pension conference, Morneau described defined benefit plans, which are on the “path to extinction” in the private sector, as a “public sector problem.”

He questioned their sustainability, which he argued came down to two “stark” choices. Government can continue to fund “rigid” defined benefit plans, creating labour strife and discord between the sectors and generations, or bring flexibility and consider target benefit plans where the risks of lower fund returns or unexpected longevity are shared.

At the same conference, he posed a question that has unsettled some union leaders about his appointment in Finance.

“Who believes that the average Canadian, without a defined benefit plan, and with the demonstrated capacity to save enough to support their retirement, will, over the long term agree to fund public sector pensions at a level that they can only dream about attaining themselves?”

Prior to the election, then Liberal leader Justin Trudeau told the National Association of Federal Retirees that target benefit plans can “make sense in certain circumstances.” He assured retirees, however, that the Liberals wouldn’t change or convert pension plans retroactively, but he didn’t rule out further changes to pensions.

Auditor General Michael Ferguson warned in a 2014 report that the liabilities in pension plans for public servants, military and RCMP — then $152 billion — could increase with prolonged low interest rates and employees living longer in retirement.

Public servants are already working fewer years and living longer in retirement on their pensions — about 27 years longer — than when the plans were created more than 40 years ago.

A further increase in life expectancy of one to three years could boost the plans’ actuarial obligations by between $4.2-billion and $11.7-billion. The plan has also faced the volatility of the market since the 2008 financial crisis and low interest rates, increasing the cost of pension obligations.

It has two accounts: one for employer-employee contributions made before 2000 and another for contributions after 2000. Employees who began working for government before 2000 will get payments from both accounts.

The post-2000 fund is managed by the Public Sector Pension Investment Board and the assets are invested in the market to pay the pensions of public servants, military and RCMP who won’t start retiring and collecting benefits until about 2035.

The report found the fund assets are valued at $63.1 billion compared with its $66.8 billion liability, leaving a $3.6 billion deficit. Under the rules, this deficit can be amortized over 15 years with yearly payments of $340 million.

Without “smoothing”, the fund would have a surplus $2.7 billion and Brison wouldn’t have to worry about making payments beginning in March 2016.

The pre-2000 account is a different story. The assets in that account are notional or bookkeeping entries and are invested as if they were put into long term government bonds whose interest rates have been in a steady decline. When interest rates are low, pension liabilities increase.

The report says it has an account balance of $96.5 billion and liabilities of $97.2 billion, leaving a $681 million shortfall.Under the Public Service Superannuation Act, this actuarial shortfall can be amortized over a maximum of 15 years. That would be $65 million a year in a “time, manner and amount” determined by Brison.

Public Service unions will whine but they better listen carefully to me, if they want to avoid another Greece here, they better accept some form of risk sharing and realize ultra low rates are here to stay and this will decimate pensions (take the time to listen to my recent interview with Gordon Long of the Financial Repression Authority).

I asked Bernard Dussault, Canada's former Chief Actuary, to provide me with his thoughts on the latest report on the PSSA as of March 2014 (click on image below to read his email response):

I thank Bernard for sharing his insights and I too am not a big fan of smoothing for the reasons he cites above.

In another major move, Quebec is shaking up pension landscape with shift to going-concern funding:

In a move that has drawn significant attention in the pension community, Quebec has introduced a potential solution to a major conundrum for employers: how to keep their costly defined benefit pension plans sustainable in the long run.

Under the new legislation, the province no longer requires defined benefit plans to fund themselves based on short-term assumptions about their own finances and market volatility. Instead, they now need to fund themselves based only on long-term, less conservative assumptions.

The law, which aims to reduce contribution volatility for employers and thus make defined benefit plans more sustainable, is the first of its kind in Canada.

“It will not necessarily encourage employers to shift back to defined benefit plans but it will curb the shift from defined benefit plans to defined contribution plans or at least slow it,” says Julien Ranger, a Montreal-based partner at Osler Hoskin & Harcourt.

Solvency requirement removed

Bill 57, which took effect on Jan. 1, removes the requirement to fund private defined benefit pension plans on a solvency basis. A valuation on the basis of solvency assumes the plan folds suddenly and looks at whether or not it holds enough assets to pay out all obligations accumulated until that time immediately.

Even before the change, Quebec’s public sector plans were for the most part exempt from the solvency- funding requirement. While certain pension plans in other parts of the country are also exempt from funding their solvency deficits, Quebec was the first province to introduce that exemption across the board.

Because the solvency valuation relies on current market conditions, when interest rates are low and markets are volatile — the way they’ve been recently — it has the effect of increasing plan liabilities and deficits.

Under the new rules, employers will have to fund their plans on a going-concern basis. A going-concern valuation assumes the plan will exist indefinitely and therefore lessens the impact of short-term market fluctuations on its funded status.

The new law is a positive development because it “will allow sponsors to use less conservative, more realistic long-term assumptions when they’re determining how much money to put in their plan,” says Ranger.

Cushion for bad times

As a trade-off for eliminating the need for solvency funding, employers will have to put money in a reserve even when they’ve fully funded their plans on a going-concern basis. The requirement is the law’s so-called stabilization provision aimed at helping pension plans withstand financial shocks.

“This reserve should provide a reasonable level of security even though we’re eliminating solvency,” says Ranger.

The size of the reserve will depend on each pension plan’s investment strategy. “The riskier your assets are, the larger the margin of the provision will be,” says Jason Malone, a Montreal-based partner at Aon Hewitt.

Other factors, such as the degree to which a plan’s assets and liabilities match, may also play a role in determining the reserve’s size, says Malone, noting more details will emerge soon.

Funding the reserve will increase costs for employers; however, according to Malone, the rationale behind the bill was never to trim expenses but rather to reduce the volatility of contributions.

The stabilization provision was a response to union concerns, says Malone. “The bill was a collaboration between the unions and the employers. The employers did not want the solvency [requirement] anymore, but the unions wanted protection as well.”

While the new law aims to reduce volatility, it may lead to higher employer contributions in some cases, says Malone. For example, a plan that isn’t fully funded on a going-concern basis may see an increase in contributions this year while a plan with a low solvency ratio but relatively high funding on a going-concern basis may see a decrease in contributions.

Lower employer contributions do present potential risks, however. If the employer goes bankrupt for some reason, there could potentially be less money in the plan than there would have been under the old rules, says Gavin Benjamin, senior consulting actuary at Willis Towers Watson.

“In other words, [if] the employer isn’t there to fund the deficit, then you’re looking at members potentially receiving reduced benefits,” says Benjamin, something he admits is a remote possibility.

Less frequent valuations

The new development also eliminates, at least in certain instances, the need for annual actuarial valuations.

If a plan is at least 90% funded on a going-concern basis on the date of the valuation, that appraisal will be good for three years, says Marco Dickner, a Montreal-based senior consultant and retirement practice leader at Willis Towers Watson. If the funded ratio is less than that, the plan sponsor will still have to file a valuation the following year.

The change gives sponsors more certainty because each time they get a new valuation, they’re subject to new employer contributions, says Dickner.

More surplus clarity

Another change introduced by the new law is a clarification of who has access to surplus funds resulting from excess employer contributions in the case of a plan windup.

The old law didn’t stipulate whether the employer or employees should get the surplus, meaning the issue could end up in court, says Dickner.

“The most likely scenario [was] that you would have to share the surplus with the employees. Employers had no incentive to put too much money because if something was to happen and they were to terminate their plan, access to that surplus was really uncertain.”

Now, employers will have easier access the surplus if the plan folds and the text allows for it, says Dickner.

When plans have a surplus on an ongoing basis, employers have the option of taking a break from making contributions, says Dickner. That was also true under the old rules.

Lower payouts to members

The new law also affects the minimum rights employees have when they leave their jobs and, therefore, their pension plans.

When employees leave the plan, they can choose to receive a lump sum reflecting the value they’ve accrued. Plan sponsors now have the option to pay the transfer value based on the solvency ratio of the plan. As a result, they no longer have to provide a 100% payout if the plan isn’t fully funded on a solvency basis, says Dickner. For example, if the plan is at 90% funding on a solvency basis, the employee will receive 90% of the commuted value.

That aspect of the law will affect even employers with plans registered outside of Quebec but that have some plan members in that province. That’s because the province of employment dictates minimum payout rights while the province of registration stipulates solvency funding rules, says Dickner.

Will other provinces follow suit?Bernard Dussault shared this with me: "What I see in the new Quebec pension valuation rules much pleases me, as it goes much along the lines of my proposed financing policy for DB plans, with the exception that it required the maintenance of a contingency reserve built from members’ contributions."

As Quebec’s employers deal with the new law, Ontario is considering changes to its own pension rules.

The Ministry of Finance recently announced on its website that it “will initiate, on an expedited basis, a review of the current solvency funding rules for defined benefit pension plans, focusing on plan sustainability, affordability and benefit security. To provide private-sector sponsors with immediate assistance in the face of persistently low interest rates, the government intends to offer temporary solvency funding relief.”

But whether Ontario will follow Quebec’s lead and when that might happen is hard to predict, says Dickner.

Get a PDF of this article.

I'm not sure about the pros and cons of Quebec's new pension law. On the one hand it bolsters defined-benefit plans but it also allows employers to lower their pension contributions, which can be disastrous for employees if a company goes under.

Again, go back to read my comment on introducing real change to Canada's pension plan, where I wrote the following:

In my ideal world, we wouldn't have company pension plans. That's right, no more Bell, Bombardier, CN or other company defined-benefit plans which are disappearing fast as companies look to offload retirement risk. The CPP would cover all Canadians regardless of where they work, we would enhance it and bolster its governance. The pension contributions can be managed by the CPPIB or we can follow the Swedish model and create several large "CPPIBs". We would save huge on administrative costs and make sure everyone has a safe, secure pension they can count on for life.Unless we get companies out of managing pensions and enhance the CPP (or QPP in Quebec) so that all Canadians working in the private sector are fully backstopped by the federal government when it comes to their pension (not their company's fortunes), then all these changes to our laws governing pensions are merely cosmetic and will do nothing to bolster our retirement system.

As always, I welcome your feedback on these issues so feel free to email me at LKolivakis@gmail.com if you have anything to add.

Below, after announcing a possible deficit of more than $18 billion in 2016-17, the finance minister Bill Morneau defended his plans to go ahead with planned spending on top of that.

I've been warning all of you to get ready for negative rates in Canada and much higher pension deficits in the future. Still, now more than ever, we need to enhance the CPP and bolster Canada's retirement system and our future economic prosperity.