Chris Bryant of Bloomberg reports, Draghi's Pension Poison:

But make no mistake, in order to avert his worst nightmare, Mario Draghi has chosen his pension poison, and it's one that will decimate corporate and state defined-benefit plans. This is why I recently argued it's checkmate for Europe's pensions.

Of course, this is all part of a much bigger problem, the $78 trillion global pension disaster. That too isn't going away and its implications will be with us for a very long time.

Interestingly, when I discuss solutions to the global pension crisis, I refer to common sense proposals like raising the retirement age, introducing better governance at pension plans, implementing a shared-risk model which means stakeholders share the risk of the plan.

That last one doesn't sit well with public sector unions because they typically don't want to share any risk of the plan but the reality is that in an ultra low rate or negative rate environment, stakeholders will need to prepare for lower returns ahead, especially if a long bout of deflation sets in. This will decimate pensions.

And herein lies the danger. Central banks might be the only game in town but thus far their policies have largely benefited elite hedge funds, private equity funds and big Wall Street banks. Their attempt to reflate economies via the wealth effect has fallen short and the reason is simple: When wealth is increasingly concentrated in fewer and fewer hands, all that liquidity benefits fewer and fewer people.

This is why I continuously cite six structural factors that virtually ensure global deflation:

I've been to Brussels where my mother and stepfather lived for eight years (they are now living in London and their friends in Brussels are fine). It's a beautiful, quaint city full of diplomats and I felt extremely safe there. Watching the horror unfold this morning reminded me that terrorists disrupt lives by ripping apart what we hold sacred, namely, living in peace and harmony while cherishing the diversity of our pluralistic societies.

My fear now is that another poison will take over Europe, one of extreme nationalism and intolerance which plagued the continent in the past. The same thing will happen in the United States, especially under a President Donald Trump who openly discusses increasing protectionism and curbing immigration.

Don't get me wrong, the world is a dangerous place and there is a serious problem with radical Muslims who spread their poison by perverting and distorting their religion. But if we react to terrorism with policies that target groups or countries, we're going to be playing right into the hands of terrorists and right-wing extremists who will use this as fuel to fight their twisted jihadist war or to bring back the dark side of nationalism. That is one poison Europe and the rest of the world can do without.

Below, the Associated Press reports on the explosions that rocked the Brussels airport and subway system Tuesday, prompting a lockdown of the Belgian capital and heightened security across Europe.

Also, RT crosses live to Simon Marks, a freelance journalist who was an eyewitness to the metro blast in Brussels.

Lastly, EU foreign affairs chief Federica Mogherini breaks down in tears when she was speaking about the Brussels bombings. She then cut short the press conference with Jordanian Foreign Minister Nasser Judeh in Amman.

We can only pray that this isn't the new normal but I fear it already is and we better prepare for it.

Mario Draghi's latest batch of measures to boost the euro-area economy comes with a sting in the tail for companies and anyone hoping to retire comfortably one day.This is a great article which highlights the pros and cons of the ECB's quantitative easing on Europe's corporate defined-benefit plans.

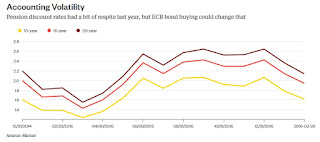

Extending quantitative easing to include non-bank corporate bonds is poised to make life even tougher for company pension plans. Record-low interest rates had already depressed bond yields, making it harder for companies to finance retirement promises made to employees. The ECB's move is likely to send company debt prices up and yields even lower, worsening their struggle (click on image).

It's a huge problem. The The first stress test of European defined-benefit and hybrid pension plans in January found a combined 428 billion-euro ($484 billion) funding shortfall euros across 17 countries. To give but one example: Lufthansa's 6.6 billion-euro pension-plan deficit is roughly the same as its market capitalization.

Rising prices boost the value of the assets pension plans use to fund retirement obligations -- a good thing. But those gains have been swamped in recent years by problems on the liability side.

Accountancy rules require companies to assess projected pension liabilities using a discount rate based on the prevailing yield of investment-grade corporate bonds. The calculations determine how much companies must set aside now to fund future obligations.

Falling bond yields result in a lower discount rate, which in turn increases the costs of meeting those obligations. In short: pension deficits get bigger.

Paul Watters, credit analyst at Standard & Poor's, estimates that a 1 percentage-point decline in the discount rate tends to increase pension obligations by about 16 percent at large companies with the most-exposed pension plans.

The ECB's timing is unfortunate as its intervention followed a period of relative respite for pension plan managers last year, when discount rates rose and deficits therefore narrowed somewhat (click on image).

Total pension obligations for companies in Germany's Dax had increased 24 percent to 372 billion euros in 2014 but declined by about 10 billion euros in 2015, according to Mercer, a consultancy. The funding ratio (of pension assets to obligations) improved from 61 percent to 65 percent last year.

This may all sound a bit dull, but it has important consequences for companies, investors, the economy, and of course, employees.

If companies divert capital to plug a hole in the pension fund, they have less cash to fund capital investments. A big pension deficit hanging over a company means employees are also less likely to be able to win pay increases. Widening pension deficits could therefore create a headwind to QE's effectiveness.

Credit-rating companies pay attention to pension deficits, and bigger shortfalls might prompt them to raise a flag that could feed into higher borrowing costs -- another drain on cash. Ballooning gaps also make equity investors nervous because dividend payments can come under pressure. These can counteract QE's beneficial effect of cutting bond yields and boosting equities.

What can be done, besides closing defined benefit plans to new entrants? Companies could move liabilities to an insurer via a buyout, but this would cost it money, reducing reported profit.

Regulators could create a bit of breathing space for companies by allowing them to take less rigid approach to setting pension discount rates. Where permitted, corporate pension plans should also consider diversifying further into riskier assets like property and infrastructure -- that would help in particular in Germany, where pension funds are often weighted heavily towards low-yielding bonds.

Yet until interest rates rise materially -- which seems very unlikely -- the fundamental problem isn't going to go away.

It's true that corporate pension plans would also be in serious trouble if the ECB had refused to act, and that created a deflationary spiral and pushed the continent back into recession.

Nevertheless, investors cheering Draghi's latest injection of adrenaline into the region's economy need to be alert to its side effects.

But make no mistake, in order to avert his worst nightmare, Mario Draghi has chosen his pension poison, and it's one that will decimate corporate and state defined-benefit plans. This is why I recently argued it's checkmate for Europe's pensions.

Of course, this is all part of a much bigger problem, the $78 trillion global pension disaster. That too isn't going away and its implications will be with us for a very long time.

Interestingly, when I discuss solutions to the global pension crisis, I refer to common sense proposals like raising the retirement age, introducing better governance at pension plans, implementing a shared-risk model which means stakeholders share the risk of the plan.

That last one doesn't sit well with public sector unions because they typically don't want to share any risk of the plan but the reality is that in an ultra low rate or negative rate environment, stakeholders will need to prepare for lower returns ahead, especially if a long bout of deflation sets in. This will decimate pensions.

And herein lies the danger. Central banks might be the only game in town but thus far their policies have largely benefited elite hedge funds, private equity funds and big Wall Street banks. Their attempt to reflate economies via the wealth effect has fallen short and the reason is simple: When wealth is increasingly concentrated in fewer and fewer hands, all that liquidity benefits fewer and fewer people.

This is why I continuously cite six structural factors that virtually ensure global deflation:

- The global jobs crisis

- Aging demographics

- The global pension crisis

- Rising inequality

- High and unsustainable debt

- Technological shifts

I've been to Brussels where my mother and stepfather lived for eight years (they are now living in London and their friends in Brussels are fine). It's a beautiful, quaint city full of diplomats and I felt extremely safe there. Watching the horror unfold this morning reminded me that terrorists disrupt lives by ripping apart what we hold sacred, namely, living in peace and harmony while cherishing the diversity of our pluralistic societies.

My fear now is that another poison will take over Europe, one of extreme nationalism and intolerance which plagued the continent in the past. The same thing will happen in the United States, especially under a President Donald Trump who openly discusses increasing protectionism and curbing immigration.

Don't get me wrong, the world is a dangerous place and there is a serious problem with radical Muslims who spread their poison by perverting and distorting their religion. But if we react to terrorism with policies that target groups or countries, we're going to be playing right into the hands of terrorists and right-wing extremists who will use this as fuel to fight their twisted jihadist war or to bring back the dark side of nationalism. That is one poison Europe and the rest of the world can do without.

Below, the Associated Press reports on the explosions that rocked the Brussels airport and subway system Tuesday, prompting a lockdown of the Belgian capital and heightened security across Europe.

Also, RT crosses live to Simon Marks, a freelance journalist who was an eyewitness to the metro blast in Brussels.

Lastly, EU foreign affairs chief Federica Mogherini breaks down in tears when she was speaking about the Brussels bombings. She then cut short the press conference with Jordanian Foreign Minister Nasser Judeh in Amman.

We can only pray that this isn't the new normal but I fear it already is and we better prepare for it.