Janet McFarland of the Globe and Mail reports, Volatile markets, stronger loonie hurt solvency of pension plans:

The good news is the loonie is headed much lower. That little countertrend rally we saw in the first quarter in oil prices will fizzle as the U.S. dollar strengthens for the rest of the year, driving down commodity prices.

Let me take a little detour here and explain macro trends because it's important you all get it right. While the media is reporting, Strong U.S. jobs report unlikely to sway cautious Fed, and everyone is bearish on the U.S. dollar thinking the Fed won't raise rates this year, they're missing a bigger problem.

The bigger problem is this, as the U.S. dollar weakens and other currencies strengthen, it disproportionately hurts economies that are heavily reliant on exports. And many of these economies in Asia and Europe are stuck in deflation, so they can't afford tighter financial conditions that come with a strengthening currency.

The exact same thing goes for Canada. As the loonie climbs relative to the U.S. dollar, financial conditions get tighter placing more pressure on a very fragile economy that is reeling from the sharp decline in energy prices. A rise in the currency acts like a interest rate hike and lowers inflation expectations (via lower import prices), bringing the threat of global deflation closer to home.

This is why in a recent comment on Canadian banks being in big trouble, I stated this:

So, the good news for Canadian corporate pension plans is that the loonie won't keep rising and it will likely fall significantly from these levels over the rest of the year (it will likely retest its lows).

What else? The U.S. dollar will likely rise during the rest of the year. In a recent comment of mine on markets defying central bankers, I stated the following:

He said this:

But regardless of where the euro heads over the next few weeks, as it keeps rising above it's 400-day moving average, I would be piling on short positions, waiting for a sharp decline. The fact remains Euroland is mired in deflation and it can't sustain a rise in the euro.

And here is the bad news for Canadian corporate pensions and all global pensions. As the mighty greenback starts surging again, it will ease financial conditions in the rest of the world but it will mean lower commodity prices and more importantly, it will lower U.S. import prices and bring the prospect of deflation coming to America that much closer. This at a a time when the rest of the world is mired in deflation.

And the bad news for pensions? I've already stated it. Ultra low rates are here for years and the prospect of global deflation is why central banks are adopting the new negative normal. And low or negative rates mean more market volatility and higher pension deficits. If deflation sets in, it will decimate pensions.

Just look at U.S. 10-year Treasury yields declining after Friday's supposedly great jobs report. The bond market is worried about something and isn't buying the Koolaid story on the U.S. economy.

So there you have it, my thoughts on the big macro picture and how it's going to impact Canadian corporate and public pensions.

Of course, if you ask me, we need real change to Canada's retirement system. We should chuck corporate pensions altogether and enhance the CPP once and for all so companies can worry about their core business (not pensions) and Canadians can stop worrying about whether they'll have enough money to retire on, especially if their company goes bust (remember what happened to Nortel's pensioners and worse still, its disabled?).

On that note, I remind all you that I work hard to provide you with unbelievable insights on pensions and investments, bringing it all together with insights from top pension fund managers like Ron Mock or Jim Keohane, but also from any others including yours truly.

Please take the time to subscribe and donate to this blog on the right-hand side. I thank those of you who support my efforts and remind you that I am willing to discuss contract work and/or full time employment opportunities (send me an email at LKolivakis@gmail.com if you want to discuss employment opportunities).

Below, Bill Gross, Janus Global Portfolio Manager, gives his investment outlook including views on the bond market. Gross thinks a lot of bond investors suck at math but maybe they're worried about global deflation and acting accordingly, thinking more about preservation of capital, especially if another global crisis erupts.

And CNBC's (lively) Rick Santelli discusses bond prices and yields. When it comes to pension deficits, keep your eyes on bond yields, not currencies! Have a great weekend!

Canadian pension plans faced a sharp drop in solvency in the first quarter of 2016 as a result of roller-coaster equity markets and a stronger Canadian dollar.Smart hedging and "derisking" strategies might help but I have good and bad news for all these Canadian companies worried about their pension plans.

A review of 449 client pension plans by consulting firm Aon Hewitt shows the median solvency of Canadian plans hit 83.1 per cent as of March 29, down 4.5 percentage points from 87.6 per cent at the end of December. Pension plans are 100-per-cent funded when they have investment assets equal to the estimated long-term cost of providing pensions for plan members.

The median funding level for pension plans was almost 91 per cent at the start of 2015, but slid throughout 2015 as interest rates declined, and faced even sharper declines in the early part of 2016. Aon Hewitt said the median funding level dipped below 80 per cent in mid-February, but recovered ground over the past month as a result of a rally in stocks and improving bond yields.

Nonetheless, the review found only 8 per cent of pension plans were fully funded by the end of the first quarter, down from 11.8 per cent at the end of December.

Will Da Silva, Aon’s national retirement practice leader, said companies need to “use all the levers they have in their risk-management toolkit” to deal with the volatility.

“For many plan sponsors, this volatility could translate into unwanted surprises in organizations’ cash positions, as well as their financial statements,” he said in a statement.

Companies do not have to immediately fund shortfalls in their pension plans, but must record the costs in their financial statements and must contribute cash to make up the gaps if they persist over time.

Aon Hewitt said many pension plans benefited last year from the drop in the Canadian dollar because they have large holdings of U.S. and foreign investments, which were worth more in Canadian-dollar terms. But the dollar has staged a comeback in 2016 from 69 cents (U.S.) in mid-January to 77 cents by late March. The result has lowered returns on non-Canadian investments.

Ian Struthers, a partner in Aon’s investment consulting practice, said companies have to take a long view on investing and manage their exposures. While gains on foreign holdings last year were erased by the stronger loonie in the first quarter of 2016, for example, he said companies that use smart hedging and other “derisking” strategies were able to mitigate that volatility.

The good news is the loonie is headed much lower. That little countertrend rally we saw in the first quarter in oil prices will fizzle as the U.S. dollar strengthens for the rest of the year, driving down commodity prices.

Let me take a little detour here and explain macro trends because it's important you all get it right. While the media is reporting, Strong U.S. jobs report unlikely to sway cautious Fed, and everyone is bearish on the U.S. dollar thinking the Fed won't raise rates this year, they're missing a bigger problem.

The bigger problem is this, as the U.S. dollar weakens and other currencies strengthen, it disproportionately hurts economies that are heavily reliant on exports. And many of these economies in Asia and Europe are stuck in deflation, so they can't afford tighter financial conditions that come with a strengthening currency.

The exact same thing goes for Canada. As the loonie climbs relative to the U.S. dollar, financial conditions get tighter placing more pressure on a very fragile economy that is reeling from the sharp decline in energy prices. A rise in the currency acts like a interest rate hike and lowers inflation expectations (via lower import prices), bringing the threat of global deflation closer to home.

This is why in a recent comment on Canadian banks being in big trouble, I stated this:

I've long been short Canada and despite the recent pop in oil prices and the loonie, I haven't changed my mind on that macro call. I fundamentally believe the worst is yet to come for Canada because my big picture outlook for global deflation hasn't changed.And in my comment on shifting the focus on enhancing the CPP, I stated this:

And global deflation spells big trouble for all banks, not just Canadian ones. In fact, have a look at the U.S. Financial Sector ETF (XLF) and you will notice it's rising from its low in mid February but basically going nowhere as it's still below its 200-day and 400 day moving average (click on image):

Speaking at the Economic Club of New York on Tuesday, Federal Reserve Chairwoman Janet Yellen said that while the U.S. economy remains on track, the Fed still intends to pursue only a gradual increase in interest rates, stating global uncertainty justifies a slower path of rate increases.

I've already written about the sea change going on at the Fed, so none of this surprises me. Moreover, Jeffrey Gundlach, the widely followed bond king who runs DoubleLine Capital, said on Monday that an interest-rate increase by the Federal Reserve in April is "inconceivable," given lower forecasts for first-quarter GDP growth.

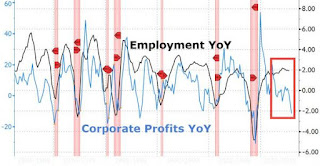

What's worrying Janet Yellen? In my opinion, global deflation coming to America. The Fed is desperately trying to talk down the U.S. dollar, especially now that a profits recession has already hit the U.S. economy, threatening future employment gains (click on image):

The latest strategic analysis from the Levy Economics Institute, Destabilizing and Unstable Economy, reveals that the US economy remains fragile because of three persistent structural issues: weak demand for US exports, fiscal conservatism, and a four-decade trend in rising income inequality. It also faces risks from stagnation in the economies of the United States’ trading partners, appreciation of the dollar, and a contraction in asset prices.

So here you have the U.S. economy slowing at a time when China, Japan and Europe remain mired in deflation, and we think little old Canada is going to do well in this environment? Sure, the lower loonie can help manufacturing exports, but if you ask me, many Canadian economists, especially bank economists, are way too optimistic on Canada's growth prospects going forward.

As far as Canadian banks, if you look at the BMO S&P/TSX Equal Weight Banks Index ETF (ZEB.TO), they too have performed better than their U.S. counterparts recently, basically bouncing up as oil prices rallied from their lows (click on image):

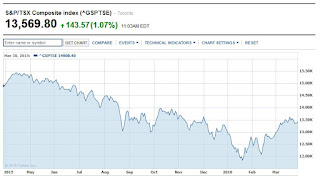

And when Canadian banks do well, the entire Canadian stock market does well (click on image):

But this countertrend rally won't be sustained as global deflation becomes more entrenched and as I've repeatedly warned you, use any spike in oil prices to short the loonie and lighten your position in energy and commodity shares.

I think what happened in Canada at the start of the year was a classic rotation into energy and commodity shares by global asset allocators who thought the loonie was cheap and these shares will bounce, which they did.

Now, if you're betting on a global recovery, you should continue buying Canadian banks, energy and commodity shares. If you think it's going to fizzle out in the second half of the year, stay away or sell these shares. This is all part of a global RISK ON/ RISK OFF trade that dominates markets.

When it comes to shorting Canada, however, I prefer shorting the loonie than Canadian banks. If global deflation sets in, the new negative normal will hit all countries, including Canada and the United States, placing huge pressure on all banks to deliver the return on equity (ROE) targets of the past.

[...] once Canada's real estate market implodes, I guarantee you Bank of Canada Governor Stephen Poloz will be going negative and not waiting to see what happens with federal spending on infrastructure. He might even move rates to negative a lot sooner if oil prices keep declining or crash.I've said it before and I'll say it again, the loonie is a petro currency. Period. If global deflation becomes more entrenched, which remains my primary macro call, then oil prices are headed lower and will stay low for a very long time. And the lower oil prices will drag down the loonie, maybe not to 59 cents as some Australian economist claimed earlier this year, but easily to 66, 68 or 70 cents.

So, the good news for Canadian corporate pension plans is that the loonie won't keep rising and it will likely fall significantly from these levels over the rest of the year (it will likely retest its lows).

What else? The U.S. dollar will likely rise during the rest of the year. In a recent comment of mine on markets defying central bankers, I stated the following:

If you think the recent plunge in Valeant's shares was bad, wait till you see the plunge in many energy and commodity names after this countertrend rally fizzles (many of these stocks will retest their lows; just look at the recent action of Peabody Energy). It will be brutal and many institutional and retail investors will get slaughtered.This morning after the U.S. jobs report, I updated that chart on the EUR/USD and asked a buddy of mine who trades currencies if he thinks it's a screaming short (click on image):

And the same goes for all these commodity and emerging market stocks and currencies. Their appreciation relative to the USD, just like that of the euro and yen, won't last for long.

In fact, have a look at this chart of the EUR/USD (click on image):

Euro bulls will tell you it's getting ready for a major breakout but I doubt it will go over its 400-day moving average and I think it's a screaming short at these levels.

He said this:

"I think the market is caught short the euro and they will have stops at 1.1525 so wait for those to get triggered, maybe get it as high as 1.17 and then short it. Fundamentally it's a short but I think market positioning is the problem."It helps to have friends who trade currencies for a living because they provide you with insights above and beyond fundamentals.

But regardless of where the euro heads over the next few weeks, as it keeps rising above it's 400-day moving average, I would be piling on short positions, waiting for a sharp decline. The fact remains Euroland is mired in deflation and it can't sustain a rise in the euro.

And here is the bad news for Canadian corporate pensions and all global pensions. As the mighty greenback starts surging again, it will ease financial conditions in the rest of the world but it will mean lower commodity prices and more importantly, it will lower U.S. import prices and bring the prospect of deflation coming to America that much closer. This at a a time when the rest of the world is mired in deflation.

And the bad news for pensions? I've already stated it. Ultra low rates are here for years and the prospect of global deflation is why central banks are adopting the new negative normal. And low or negative rates mean more market volatility and higher pension deficits. If deflation sets in, it will decimate pensions.

Just look at U.S. 10-year Treasury yields declining after Friday's supposedly great jobs report. The bond market is worried about something and isn't buying the Koolaid story on the U.S. economy.

So there you have it, my thoughts on the big macro picture and how it's going to impact Canadian corporate and public pensions.

Of course, if you ask me, we need real change to Canada's retirement system. We should chuck corporate pensions altogether and enhance the CPP once and for all so companies can worry about their core business (not pensions) and Canadians can stop worrying about whether they'll have enough money to retire on, especially if their company goes bust (remember what happened to Nortel's pensioners and worse still, its disabled?).

On that note, I remind all you that I work hard to provide you with unbelievable insights on pensions and investments, bringing it all together with insights from top pension fund managers like Ron Mock or Jim Keohane, but also from any others including yours truly.

Please take the time to subscribe and donate to this blog on the right-hand side. I thank those of you who support my efforts and remind you that I am willing to discuss contract work and/or full time employment opportunities (send me an email at LKolivakis@gmail.com if you want to discuss employment opportunities).

Below, Bill Gross, Janus Global Portfolio Manager, gives his investment outlook including views on the bond market. Gross thinks a lot of bond investors suck at math but maybe they're worried about global deflation and acting accordingly, thinking more about preservation of capital, especially if another global crisis erupts.

And CNBC's (lively) Rick Santelli discusses bond prices and yields. When it comes to pension deficits, keep your eyes on bond yields, not currencies! Have a great weekend!