Eleanor Warnock of the Wall Street Journal reports, Japan’s GPIF Pension Fund Suffers Worst Year Since 2008 Financial Crisis:

I think a lot of people are making a big deal over nothing. A $52 billion loss is huge for North America's large pension funds but it's peanuts for the GPIF. Also, if the Caisse can come strong from a $40 billion train wreck in 2008, GPIF can easily come back from this loss in the future.

The loss GPIF recorded during its fiscal year can be explained by two factors:

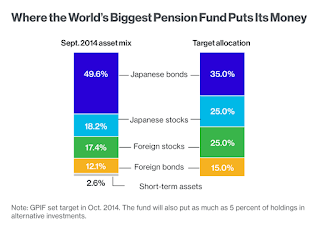

I will leave it up to you to read that article but the key here is to understand the shift in GPIF's asset allocation over the last two years (click on image):

As you can see, GPIF reduced its target weight in domestic bonds from 50% to 35% and increased its target weight in domestic and foreign stocks to 25% and slightly increased its weight in foreign bonds to 15%.

This shift in asset allocation was very sensible for the GPIF over a very long investment horizon because having 50% of its assets in Japanese bonds yielding negative interest rates isn't going to help pay for future pension liabilities that are mounting as rates sink to record lows.

Ironically, negative rates are bad news for Japan's biggest bank but they didn't really hit GPIF's domestic bond portfolio which returned 4.07% in the year ended in March as the BOJ’s asset purchases and the introduction of a negative interest-rate policy lifted bond prices.

Of course, on Friday, the Nikkei whipsawed after BOJ disappointment, the yen surged against dollar and Japanese government bonds (JGBs) sold off:

Importantly, by not acting forcibly, the BoJ basically intensified deflation in Japan because the yen surged higher which means import prices in Japan will fall further, putting more pressure the declining core CPI. It will also impact Japanese exporters like car and steel producers which isn't good for employment.

Also, as I've warned of earlier this year, the surging yen can trigger a crisis, including another Asian financial crisis which will spread throughout the world and lead to more global deflation.

At this writing, the USD/ JPY cross is hovering around 102.4, which is above the 100 level, but if it falls below this level and continues to decline, watch out, things could get very messy very fast.

A surging yen below the key 100 level isn't good news for risk assets as it will trigger massive unwind of the yen carry trade with big hedge funds and trading outfits use to leverage their positions in risk assets.

A full discussion of currency risks merits another comment. All I can say is that the GPIF's results weren't as terrible as they look given the big move in the yen and its new asset allocation.

As far as mimicking the Canada Pension Plan Investment Board (CPPIB) and the rest of Canada's large pensions allocating a big chunk of their portfolio in alternatives like private equity, real estate and increasingly in infrastructure, that all sounds great but if they don't have the right governance which allows them to manage these assets internally, then I wouldn't recommend it.

Sure, GPIF is big enough to go to the big alternatives shops like Blackstone, Carlyle, KKR, etc. and squeeze them hard on fees but this isn't the best long term approach for a mega fund of its size. before it heads into alternatives, it needs to get the governance right to attract and retain talented managers who will be able to do a lot of direct investments along with fund and co-investments.

There are a lot of moving parts now impacting the GPIF's performance, least of which is the surging yen. A full discussion on currencies will have to take place in my follow-up comment as this one is already too long.

I'd be happy to talk to the people at the GPIF to discuss this post and put them in touch with some contacts of mine, including my buddy who trades currencies and can steer them in the right direction in terms of currency hedging policy (read my follow-up comment).

Below, Bloomberg's Tom Redmond reports on why GPIF lost $52 billion during its fiscal year. He makes a big deal out of these results and says the giant fund should mimic CPPIB without understanding the right governance the latter has adopted to properly invest in alternatives.

I also embedded a Bloomberg discussion with Steven Englander, Citigoup's global head of G-10 currencies, on the Bank of Japan's latest move. A full Q&A is available here.

I fear that deflation is intensifying in Japan and the rest of Asia and I just don't understand why the BoJ didn't act more forcibly. If my worst fears come true, all pensions will get clobbered and the giant ones will see huge losses, much bigger than the $52 billion loss the GPIF recorded in its last fiscal year.

Japan’s $1.3 trillion public pension fund—the world’s largest of its kind—posted its worst performance since the 2008 global financial crisis in the fiscal year ended March on a fall in share prices world-wide and a strengthening yen.Yuko Takeo and Shigeki Nozawa of Bloomberg also report, Japan Pension Whale’s $52 Billion Loss Tied to Passive Ways:

The Government Pension Investment Fund recorded paper losses of ¥5.3 trillion ($51 billion), or a return of -3.81% on its investments, putting its total assets at ¥134.7 trillion at the end of March, the fund said Friday.

The GPIF’s results are seen as a gauge of broad market performance, as the fund owns nearly 1% of global equity markets and more than 7% of the Japanese stock market. Domestic and foreign equities comprised 44% of the portfolio at the end of March, below its 50% target weighting for the asset class, the fund said in a statement.

The GPIF isn’t the only major pension fund to struggle recently. The U.S.’s largest public pension fund, the California Public Employees’ Retirement System, or Calpers, said this month that it earned 0.6% on its investments for the fiscal year ended June 30, the second straight year the fund missed its 7.5% internal investment target. Norway’s Government Pension Fund Global had its worst performance since 2011.

Japan’s labor ministry has asked the GPIF to achieve a real investment return—accounting for a rise in wage increases—of 1.7% yearly. Though the fund’s performance for fiscal 2015 was well below that target, the fund’s average real annual performance of 2.60% over the past 15 years exceeded it.

However, because the GPIF manages reserves for Japan’s national pension plan, poor investment performance in the short term is judged harshly by the public and opposition political parties, many of whom are suspicious of financial markets. Even the timing of the announcement of the fund’s latest results had drawn criticism. Opposition politicians have pointed out that it was scheduled to come after national election earlier in the month. A loss reported before the vote could have hurt the ruling party’s showing, they said. The fund has said there was nothing political about the release date.

Domestic bonds were a bright spot in GPIF’s portfolio, even though the Bank of Japan has pursued a massive easing program in part to push Japanese investors away from domestic bonds and into higher-yielding assets. At the end of March, the fund had 37.55% of its portfolio in domestic debt—higher than the fund’s 35% asset-class allocation.

Domestic bonds returned 4.07% in the year ended in March as the BOJ’s asset purchases and the introduction of a negative interest-rate policy lifted bond prices.

Friday was a big day for the world’s largest pension fund, which posted its worst annual loss since the financial crisis and disclosed individual equity holdings for the first time. The two may be connected.So Japan's pension whale recorded a $52 billion loss (-3.81%) during its fiscal year ending at the end of March and "experts" are now giving them advice to be more active in alternatives and in hedging their foreign exchange risk.

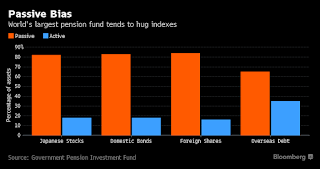

The list of domestic shares owned by Japan’s $1.3 trillion Government Pension Investment Fund hews closely to the benchmark Topix index, which isn’t that surprising for a fund where almost 80 percent of investments are passive. But it means that in market downturns like in the past year, GPIF will struggle to increase assets.

The fund recorded a 5.3 trillion yen ($52 billion) loss for the 12 months ended March, the largest decline in seven years. Japan stock holdings tumbled 10.8 percent. For Sumitomo Mitsui Asset Management Co., GPIF should branch out from hugging indexes.

“There’s more they can do,” said Masahiro Ichikawa, a senior strategist at the Tokyo-based money manager. “They should be more active with their currency hedging and their investments. They should also look to increase exposure to alternatives.”

While criticism of GPIF’s passive approach to investing isn’t new, this is the first year the fund posted a loss since it doubled its allocation to stocks in 2014 and reduced its investments in domestic bonds, which were the only asset to return a profit in the year. The fund is taking flak on both sides, from those who want to turn back the clock to when it held more bonds to people who say it should become more of a stock picker.

The Topix index fell 0.1 percent at the close in Tokyo on Monday, as the yen traded at 102.43 per dollar following a 3.1 percent jump on Friday.

For a QuickTake on Japan’s pension fund, click here.

GPIF’s investment loss of 3.8 percent was the worst since a 7.6 percent slide in the 12 months ended March 2009. The fund lost 9.6 percent on foreign shares and 3.3 percent on overseas debt, while gaining 4.1 percent on Japanese bonds. GPIF said Toyota Motor Corp. and Mitsubishi UFJ Financial Group Inc., which have the largest weightings in the Topix, were the biggest Japan stock investments as of March 31, 2015.

GPIF’s Canadian pension peer, hailed as an example of how the Japanese fund should be run, posted a 3.4 percent return on investments for the fiscal year ended March, despite the global equity rout. The $212 billion Canada Pension Plan Investment Board had its biggest gains from private emerging market equities, real estate and infrastructure. South Korea’s national pension fund had a return rate of 2.4 percent this year as of April.

Home Bias

The Canadian retirement manager wrote in its 2016 annual report about how it had moved away from passively managing its portfolio to take advantage of its size, certainty of pension contributions and long-term investment horizon. The fund has just 19 percent of its holdings invested in Canada, whereas GPIF has 59 percent in Japanese securities.

“GPIF should invest more actively but from a long-term perspective,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co. in Tokyo. “That’s the only way they can improve their returns.”

GPIF President Norihiro Takahashi, speaking after the results announcement on Friday, said the fund planned to use its allowable deviation limits when allocating assets, in a sign he will be flexible in managing the portfolio.

In 2013, a panel handpicked by Prime Minister Shinzo Abe recommended ways to overhaul GPIF. While suggesting the fund move away from its concentrated investments in Japanese bonds, which it did the next year, the group led by Columbia University professor Takatoshi Ito said GPIF should consider increasing active management, moving some investments in-house, and tracking indexes other than the Topix as it includes stocks “lacking sufficient investment profitability.”

In-House Investments

GPIF took some suggestions on board, including adopting the JPX-Nikkei Index 400 as a new benchmark equity measure. Still, the fund’s overseers stopped short of letting the fund make in-house stock investments, a course that GPIF Chief Investment Officer Hiromichi Mizuno said would have helped cut costs and increase internal expertise.

GPIF also lost on overseas assets last fiscal year as the yen advanced 6.7 percent against the dollar, reducing the value of investments when repatriated. It wasn’t until December last year that reports said GPIF would start to hedge against currency fluctuations for a small part of its investments, a strategy called for almost a year earlier by one of its investment advisers.

“The results should lead to a debate on searching for new investments, whether it’s alternative assets, domestic small and mid-cap corporate debt, REITs or real estate,” said Akio Yoshino, chief economist at Amundi Japan Ltd. in Tokyo. “But the mainstream expectation is that GPIF probably won’t change its management direction.”

I think a lot of people are making a big deal over nothing. A $52 billion loss is huge for North America's large pension funds but it's peanuts for the GPIF. Also, if the Caisse can come strong from a $40 billion train wreck in 2008, GPIF can easily come back from this loss in the future.

The loss GPIF recorded during its fiscal year can be explained by two factors:

- A shift in its asset allocation away from domestic bonds to riskier domestic and foreign stocks.

- A surging yen which negatively impacted its foreign stock and bond holdings.

I will leave it up to you to read that article but the key here is to understand the shift in GPIF's asset allocation over the last two years (click on image):

As you can see, GPIF reduced its target weight in domestic bonds from 50% to 35% and increased its target weight in domestic and foreign stocks to 25% and slightly increased its weight in foreign bonds to 15%.

This shift in asset allocation was very sensible for the GPIF over a very long investment horizon because having 50% of its assets in Japanese bonds yielding negative interest rates isn't going to help pay for future pension liabilities that are mounting as rates sink to record lows.

Ironically, negative rates are bad news for Japan's biggest bank but they didn't really hit GPIF's domestic bond portfolio which returned 4.07% in the year ended in March as the BOJ’s asset purchases and the introduction of a negative interest-rate policy lifted bond prices.

Of course, on Friday, the Nikkei whipsawed after BOJ disappointment, the yen surged against dollar and Japanese government bonds (JGBs) sold off:

Japan shares whipsawed and the yen surged after the Bank of Japan threw markets a smaller-than-expected bone in a keenly watched decision on Friday.So what is going on? Why did the Bank of Japan not do more to raise inflation expectations? The Japan Times reprinted an article from Reuters, BOJ eases further, signals policy review as inflation target eludes:

While the BOJ eased its monetary policy further by increasing its purchases of exchange-traded funds (ETFs), it didn't change interest rates or increase the monetary base, as analysts had widely expected.

The central bank said it would increase its ETF purchases so that their amount outstanding on its balance sheet would rise at an annual pace of 6 trillion yen ($56.7 billion), from 3.3 trillion yen previously.

"The message the BOJ is sending is not so much much 'whatever it takes' as 'monetary policy's pretty much played out'," said Kit Juckes, global fixed income strategist at Societe Generale.

The Japanese yen surged against the dollar after the announcement, with the dollar-yen pair falling as low as 102.85, compared with around 103.75 immediately before the decision. The pair was already volatile before the announcement, touching a session high of 105.33.

At 2:31 p.m. HK/SIN, the dollar was fetching 103.52 yen.

The benchmark Nikkei 225 whipsawed after the decision, tumbling as much as 1.66 percent immediately after the announcement. It quickly retraced the fall, but then spent the remainder of the session volleying between gains and losses. At market close, the Nikkei finished up 92.43 points, or 0.56 percent, at 16,569.27.

In the bond market, Japanese government bonds (JGBs) sold off. The yield on the benchmark 10-year JGB jumped to negative 0.169, from an earlier low of negative 0.276. Yields move inversely to bond prices. Many analysts had expected the BOJ would increase its JGB purchases.

Sean Darby, chief global equity strategist at Jefferies, said in a note that the news on the ETF purchases "should boost sentiment on stocks," but "overall monetary policy will only be marginally changed given that the BOJ's balance sheet expansion has already decelerated."

"The absence of any change on deposit rates will have disappointed those investors seeking a bolder move by the BOJ," said Darby.

Other Asian markets were nearly flat or mostly lower. The ASX 200 in Australia saw a slight gain of 5.80 points, or 0.1 percent, to 5,562.35. In South Korea, the Kospi closed down 4.91 points, or 0.24 percent, at 2,016.19. Hong Kong's Hang Seng index slipped 327.06 points, or 1.47 percent, to 21,847.28.

Chinese mainland markets were lower, with the Shanghai composite closing down 14.94 points, or 0.5 percent, at 2,979.37, while the Shenzhen composite was off by 9.44 points, or 0.48 percent, at 1,941.55.

The Bank of Japan expanded stimulus Friday by doubling its purchases of exchange-traded funds, yielding to pressure from the government and financial markets for action but disappointing investors who had set their hearts on more audacious measures.My reading is that despite improving employment gains, Japan is still stuck in its deflation rut and policymakers are increasingly worried which is why they're openly debating "radical policies" like helicopter money.

The central bank, however, said it will conduct a thorough assessment of the effects of its negative interest rate policy and massive asset-buying program in September, suggesting that a major overhaul of its stimulus program may be forthcoming.

BOJ Gov. Haruhiko Kuroda said the bank will conduct the review not because its policy tools have been exhausted, but to come up with better ways of achieving its 2 percent inflation target — keeping alive expectations for further monetary easing.

“I don’t think we’ve reached the limits both in terms of the possibility of more rate cuts and increased asset purchases,” Kuroda told reporters after the policy meeting.

“We will of course consider what to do in terms of monetary policy steps, based on the outcome of the assessment.”

Ahead of the meeting, speculation had mounted over the possibility it would take a so-called helicopter money approach that would entail more direct infusions of money into the economy.

Recently, the government downgraded its growth forecast for 2016 to 0.9 percent from 1.7 percent.

“With underlying inflation set to moderate further toward the end of the year, we think that the bank will still have to provide more easing before too long,” Marcel Thieliant of Capital Economics said in an analysis. “Overall, today’s decision was a clear disappointment,” he said.

The 7-2 central bank decision was to almost double its annual purchases of exchange traded funds to ¥6 trillion from the current ¥3.3 trillion. A fifth of that will be earmarked for companies that meet new benchmarks for investing in staffing and equipment, it said in a statement.

It also doubled the size of a U.S. dollar lending program to support Japanese companies’ operations overseas, to $24 billion.

The BOJ already is injecting about ¥80 trillion a year into the economy through asset purchases, mainly of Japanese government bonds.

The BOJ was under heavy pressure to act after earlier this week Prime Minister Shinzo Abe announced ¥28 trillion in spending initiatives to help support the sagging economic recovery led by his feeble Abenomics policies.

By coordinating its action with the big fiscal spending package, the BOJ likely aimed to maximize the effect of its measures on the world’s third-biggest economy, which is struggling to escape decades of deflation.

“The BOJ believes that (today’s) monetary policy measures and the government’s initiatives will produce synergy effects on the economy,” the central bank said in a statement announcing the policy decision.

The BOJ maintained its rosy inflation forecasts for fiscal 2017 and 2018 in a quarterly review of its projections. It also left intact the time frame for hitting its price growth target, but warned uncertainties could cause delays.

The BOJ justified Friday’s monetary easing as aimed at preventing external headwinds, such as weak emerging market demand.

The recent vote by Britain to leave the European Union has added to the uncertainties clouding the global outlook at a time when Japan’s recovery remains in question.

“There is considerable uncertainty over the outlook for prices against the background of uncertainties surrounding overseas economies and global financial markets,” the central bank said.

The central bank did not change the interest it charges on policy-rate balances it holds for commercial banks, which is now at a record low minus 0.1 percent.

Financial markets seemed underwhelmed by the central bank’s modest action.

The Nikkei 225 stock index had dropped nearly 2 percent on Friday but later regained some ground to end 0.56 percent higher.

Ahead of the BOJ decision, Japan reported further signs of weakness in its economy in June, with industrial output and consumer spending falling from the year before.

Core inflation, excluding volatile food prices, dropped 0.5 percent from 0.4 percent in May, while household spending fell 2.2 percent from a year earlier.

Unemployment had fallen to 3.1 percent in June from 3.2 percent for the past several months, but tightness in the job market has not spilled into significant increases in wages that might help spur more consumer demand and encourage businesses to invest in the sort of “virtuous cycle” Abe has been promising since he took office in late 2012 under Abenomics.

Still, while industrial output fell 1.9 percent from the year before, it rose 1.9 percent from the month before, with strong shipments related to home building and other construction.

Importantly, by not acting forcibly, the BoJ basically intensified deflation in Japan because the yen surged higher which means import prices in Japan will fall further, putting more pressure the declining core CPI. It will also impact Japanese exporters like car and steel producers which isn't good for employment.

Also, as I've warned of earlier this year, the surging yen can trigger a crisis, including another Asian financial crisis which will spread throughout the world and lead to more global deflation.

At this writing, the USD/ JPY cross is hovering around 102.4, which is above the 100 level, but if it falls below this level and continues to decline, watch out, things could get very messy very fast.

A surging yen below the key 100 level isn't good news for risk assets as it will trigger massive unwind of the yen carry trade with big hedge funds and trading outfits use to leverage their positions in risk assets.

A full discussion of currency risks merits another comment. All I can say is that the GPIF's results weren't as terrible as they look given the big move in the yen and its new asset allocation.

As far as mimicking the Canada Pension Plan Investment Board (CPPIB) and the rest of Canada's large pensions allocating a big chunk of their portfolio in alternatives like private equity, real estate and increasingly in infrastructure, that all sounds great but if they don't have the right governance which allows them to manage these assets internally, then I wouldn't recommend it.

Sure, GPIF is big enough to go to the big alternatives shops like Blackstone, Carlyle, KKR, etc. and squeeze them hard on fees but this isn't the best long term approach for a mega fund of its size. before it heads into alternatives, it needs to get the governance right to attract and retain talented managers who will be able to do a lot of direct investments along with fund and co-investments.

There are a lot of moving parts now impacting the GPIF's performance, least of which is the surging yen. A full discussion on currencies will have to take place in my follow-up comment as this one is already too long.

I'd be happy to talk to the people at the GPIF to discuss this post and put them in touch with some contacts of mine, including my buddy who trades currencies and can steer them in the right direction in terms of currency hedging policy (read my follow-up comment).

Below, Bloomberg's Tom Redmond reports on why GPIF lost $52 billion during its fiscal year. He makes a big deal out of these results and says the giant fund should mimic CPPIB without understanding the right governance the latter has adopted to properly invest in alternatives.

I also embedded a Bloomberg discussion with Steven Englander, Citigoup's global head of G-10 currencies, on the Bank of Japan's latest move. A full Q&A is available here.

I fear that deflation is intensifying in Japan and the rest of Asia and I just don't understand why the BoJ didn't act more forcibly. If my worst fears come true, all pensions will get clobbered and the giant ones will see huge losses, much bigger than the $52 billion loss the GPIF recorded in its last fiscal year.