Darrell Preston of Bloomberg reports, Bill Gross’s Admonishment Supported By Illinois Pension Fund:

Of course, astute readers of this blog know my thoughts, cutting benefits and increasing contributions is the easy part. So is hiking property taxes and utility rates to fund unfunded public pensions, just like Chicago just did. Sure, it takes political courage to admit your public pensions are effectively bankrupt and require drastic measures to get them back to an acceptable funded status, but that isn't the hard part.

It's much harder introducing real change to US public pensions, change that I discussed in the New York Times three years ago when I wrote about the need for independent, qualified investment boards and governance rules that mimic what Canada's large public pensions have done.

Importantly, apart from years of mismanagement, the lack of proper governance is a huge factor as to why so many US public pensions are in such dire straits yet very few politicians are discussing this topic openly and in a constructive manner.

And instead of cutting their assumed rate of return, what are US public pensions doing? What else, they're taking more risks in alternative investments like private equity and hedge funds.

Unfortunately, that hasn't panned out too well (shocking!). Private equity's diminishing returns and hard times in Hedge Fundistan are hitting public pensions very hard.

In fact, Charles Stein of Bloomberg reports, Hedge Funds Make Last Place at $61 Billion Massachusetts Pension:

I guarantee you over the next ten years, returns on all these asset classes will be considerably lower, especially private equity. And the most important asset class for all pensions in ten years will likely be infrastructure, but even there, returns will come down as more and more pensions chase stable yield.

The crucial point I want to drive home is this: Yields are coming down hard across the investment spectrum and all pensions need to adjust to the new reality. Low returns are taking a toll on all pensions, especially US public pensions, but it's record low and negative yields that are really hurting them. There is no big illusion in the bond market; it's sending an ominous warning to all investors, prepare for lower returns ahead.

On that note, back to trading my biotech shares because when they start running, they run fast and hard and I need to capitalize on these rallies (click on image):

Sometimes I wonder how are hedge funds commanding 2 & 20 for mediocre returns when I can't get more large pensions to subscribe or donate to my blog? Oh well, go figure.

Below, once again, Bill Gross explains why bonds aren't an asset, they're a liability. I disagree with him and Gundlach on the risks of US bonds and continue to recommend them as they will remain the ultimate diversifier in a deflationary world.

Also, public pension plans from New Jersey to California are cutting their allocations to hedge funds as low returns and high fees combine to disappoint managers. Bloomberg's Charles Stein reports on "Bloomberg Markets."

Illinois’s largest public pension agrees with Bill Gross’s admonishment that it’s time to face up to the reality of lower returns and reduce assumptions about what funds can make off stocks and bonds.Bill Gross is right, low returns are taking a toll on US pensions, especially delusional public pensions that refuse to acknowledge that ultra low and even negative rates are here to stay, and that necessarily means they need to assume lower returns ahead, cut benefits and increase contributions.

Fund managers that have been counting on returns of 7 percent to 8 percent may need to adjust that to around 4 percent, Gross, who runs the $1.5 billion Janus Global Unconstrained Bond Fund, said during an Aug. 5 interview on Bloomberg TV. Public pensions, including the California Public Employees’ Retirement System, the largest in the U.S., are reporting gains of less than 1 percent for the fiscal year ended June 30.

Illinois’s largest state pension, the $43.8 billion Teachers’ Retirement System, plans to take another look at how much it assumes it will make in the coming year as part of an asset allocation study, said Richard Ingram, executive director. Currently it assumes 7.5 percent, lowered from 8 percent in June 2014. Plans for the study were in place before Gross made his remarks.

“Anybody that doesn’t consider revisiting what their assumed rate of return is would be ignoring reality,” Ingram, whose pension is 41.5 percent funded, said in a phone interview. The fund has yet to report its June 30 return.

Lowering how much pensions assume they can earn from investment of assets could put many in the difficult position of having to cut benefits or ask for increased contributions from workers and state and local governments that sponsor them or risk seeing the amount of assets needed to pay future benefits shrink. The $3.55 trillion of assets now held by public pensions is about two-thirds the amount needed to pay retirees, according to Federal Reserve data.

Since the financial crisis, the interest rates earned on bonds have remained low as stock prices have brought strong returns some years and more modest returns in other years. Calpers earned 0.6 percent in the fiscal year ended June 30, with an average gain of 5.1 percent over 10 years.

Illinois is struggling with $111 billion of pension debt, and more than half of that, or about $62 billion, is for the Teachers’ Retirement System. The partisan gridlock that spurred the longest budget impasse in state history only exacerbated the problem. Governor Bruce Rauner and lawmakers have made no progress in finding a fix for the rising liabilities that helped sink Illinois’s credit rating to the lowest of all 50 states.

Lagging Returns

Others also have reported meager returns recently, including a 0.19 percent gain for New York state’s $178.1 billion retirement system and a 1.5 percent increase in New York City’s five pension funds with $163 billion of assets, the smallest gain since 2012.

Government-retirement systems have lagged return targets after U.S. stocks declined last year and bond yields hold near record lows, leaving little to be made from fixed-income investments. Large plans have an average of 46 percent of their money in equities, with 23 percent in bonds and 31 percent in other assets such as private equity, Moody’s Investors Service said in a July 26 report, citing its review of fund disclosures.

“If investment returns suffer, you have to look at reality until we return to a more normal investment environment,” said Chris Mier, a municipal strategist with Loop Capital Markets in Chicago. “Some pensions don’t like changing those assumptions because then their liabilities increase.”

Pensions’ push into stocks and other high-risk investments have exacerbated pressures on the funds because of the “significant volatility and risk of market value loss” at a time when governments have little ability to boost contributions if returns fall short, Moody’s said in its report.

Dialing Back

Public pensions over 30-year-or-so horizons traditionally could hit targets for returns of 7 percent to 8 percent. But that was in an era before the Fed began holding down interest rates to stimulate the economy and returns in the stock market were not high enough to offset lower fixed-income investments.

Public pensions have been reducing assumed rates of returns, cutting from a median of 8 percent six years ago to 7.5 percent currently, said Keith Brainard, who tracks pensions for the National Association of State Retirement Administrators. Now “more than a handful” are below 7 percent, he said.

“We’ve seen a pronounced decline in return assumptions,” said Brainard.

Public pensions have been hurt by the Fed’s zero-rate policy that Gross says has led to “erosion at the margins of business models” such as the ones used for funding public pensions, which depend on assumptions about returns over time horizons of 30 years or more.

“Pensions have to adjust,” said Gross. “They have to have more contributions and they have to reduce benefit payments.”

Of course, astute readers of this blog know my thoughts, cutting benefits and increasing contributions is the easy part. So is hiking property taxes and utility rates to fund unfunded public pensions, just like Chicago just did. Sure, it takes political courage to admit your public pensions are effectively bankrupt and require drastic measures to get them back to an acceptable funded status, but that isn't the hard part.

It's much harder introducing real change to US public pensions, change that I discussed in the New York Times three years ago when I wrote about the need for independent, qualified investment boards and governance rules that mimic what Canada's large public pensions have done.

Importantly, apart from years of mismanagement, the lack of proper governance is a huge factor as to why so many US public pensions are in such dire straits yet very few politicians are discussing this topic openly and in a constructive manner.

And instead of cutting their assumed rate of return, what are US public pensions doing? What else, they're taking more risks in alternative investments like private equity and hedge funds.

Unfortunately, that hasn't panned out too well (shocking!). Private equity's diminishing returns and hard times in Hedge Fundistan are hitting public pensions very hard.

In fact, Charles Stein of Bloomberg reports, Hedge Funds Make Last Place at $61 Billion Massachusetts Pension:

Public pension funds have soured on hedge funds.[Note: If you are looking for a managed account platform for hedge funds, talk to the folks at Innocap here in Montreal. Ontario Teachers' Pension Plan uses their platform for its external hedge funds and they know what they're doing monitoring operational and investment risks on Teachers' behalf.]

The New Jersey Investment Council last week voted to cut its target allocation to hedge fund managers by 52 percent, following similar moves by pensions in California and New York. The institutions are disappointed by the combination of high fees and modest returns the hedge funds have delivered.

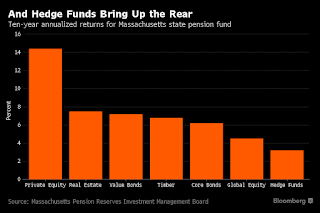

The chart below explains some of that unhappiness. In the 10-years ended June 30, the $60.6 billion Massachusetts public fund realized a 3.2 percent average annual return, net of fees, from the hedge funds in which it invests. That was the worst performance of seven asset classes the fund holds, according to data released last week for the Pension Reserves Investment Trust Fund. Private equity, with a 14.4 percent annual gain, was the top performer. The fund overall returned 5.7 percent a year.

It’s not that Massachusetts picked especially bad managers. Its hedge fund returns are roughly in line with industry averages. The fund weighted composite index created by Hedge Fund Research Inc. gained 3.6 percent a year over the same stretch.

Unlike some of its peers, Massachusetts hasn’t reduced its roughly 10 percent allocation to hedge funds. Rather, the pension in 2015 began making investments in the asset class through managed accounts rather than co-mingled accounts. The strategy has resulted in fee discounts of 40 to 50 percent, said Eric Nierenberg, who runs hedge funds for Massachusetts’ pension.

“We are hedge fund skeptics,” he said in an e-mailed statement. The investments made through the new structure have performed “considerably better” than the pension’s legacy holdings, Nierenberg said.

I guarantee you over the next ten years, returns on all these asset classes will be considerably lower, especially private equity. And the most important asset class for all pensions in ten years will likely be infrastructure, but even there, returns will come down as more and more pensions chase stable yield.

The crucial point I want to drive home is this: Yields are coming down hard across the investment spectrum and all pensions need to adjust to the new reality. Low returns are taking a toll on all pensions, especially US public pensions, but it's record low and negative yields that are really hurting them. There is no big illusion in the bond market; it's sending an ominous warning to all investors, prepare for lower returns ahead.

On that note, back to trading my biotech shares because when they start running, they run fast and hard and I need to capitalize on these rallies (click on image):

Sometimes I wonder how are hedge funds commanding 2 & 20 for mediocre returns when I can't get more large pensions to subscribe or donate to my blog? Oh well, go figure.

Below, once again, Bill Gross explains why bonds aren't an asset, they're a liability. I disagree with him and Gundlach on the risks of US bonds and continue to recommend them as they will remain the ultimate diversifier in a deflationary world.

Also, public pension plans from New Jersey to California are cutting their allocations to hedge funds as low returns and high fees combine to disappoint managers. Bloomberg's Charles Stein reports on "Bloomberg Markets."