Kirk Falcomer of the PE Hub Network reports, PSP Investments commits €500 mln to European credit platform (added emphasis is mine):

Back in May, Nishant Kumar of Bloomberg reported, Canada Pension’s David Allen Said to Depart to Start Hedge Fund:

Prior to GoldenTree, he was an Executive Director at Morgan Stanley where he ranked as the #1 High Yield Media analyst in the US according to Institutional Investor Magazine (2002).

Allen has been busy building his team since May. He hired Matthew Courey, former head of high-yield bond trading at Credit Suisse and Joseph Novarro, the former managing partner at investment firm Renshaw Bay, to become the chief operating officer of his private debt fund.

In late September, Allen also hired Bill Ammons away from CPPIB to join his new fund:

So what do I think of this deal to seed AlbaCore Capital? A few brief thoughts:

Some other thoughts? People will say why didn't PSP just hire its own team, why seed AlbaCore Capital? Like I stated, PSP gains immediate, scalable access to European private debt markets with this seed investment and it's not paying 2 & 20 in fees or anywhere close to that amount as a seed investor. Also, this partnership will prove useful for deployment of capital in bigger deals where PSP has the size to invest directly or co-invest along with AlbaCore.

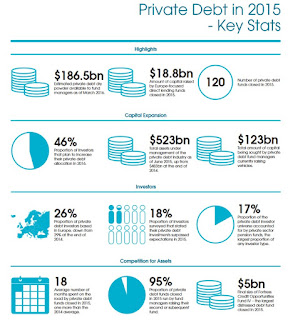

If you want to read more on the rise of private debt as an institutional asset class, click here to read an excellent report from ICG. Also, the figure below was taken from sample pages from the 2016 Prequin Global Private Debt Report (click on image):

As you can see, private debt isn't an emerging asset class, it's already here and big pensions like CPPIB and PSP Investments are going to be critical players in this space (CPPIB already is and PSP is on its way there).

There are structural factors that explain the rise of private debt as an asset class, including a slowing economy, historically low rates, bank regulations and in Europe in particular, where the banking sector is a mess and deflation and low growth are here to stay, private debt opportunities will abound especially for PSP, CPPIB and other pensions with a very long investment horizon.

Are there risks to private debt? Of course there are, especially in Europe, but if these deals are structured properly and PSP can take advantage of its long investment horizon, it will mitigate a lot of risks which impact funds with a shorter investment horizon like hedge funds and even private equity funds.

I'll leave you with some more food for thought, Carlyle is shifting its focus back to lending after its unsuccessful venture into hedge funds:

After a high level discussion with a senior manager at CPPIB, I was told that Jenkins was planning his exit for some time and that the appearance of him leaving after Mark Wiseman left to join Blackrock was "unfortunate and coincidental."

Also, this person told me Jenkins was not directly responsible for investing in Carlyle or any other fund and that these decisions are made in an investment committee which he was part of but not directly responsible for fund investments.

I apologize to Mark Jenkins if my comment added fuel to the conspiracy fire but one thing that still concerns me is all these senior people at CPPIB leaving to join established funds or to start their new fund capitalizing on their key relationships.

Sure, it's a free market and nothing says they need to stay at CPPIB or PSP for the rest of their career but the governance at these funds needs to be bolstered to make sure there is nothing remotely shady going on and that if a key manager leaves, there is ample time to ensure a successful handover of big investment portfolios.

Yes, CPPIB can handle the departure of a Wiseman, Bourbonnais, Allen, Ammons and Jenkins but if this becomes a regular occurrence, the optics don't look right and it will become a problem for the fund going forward.

One final note, as you see PSP ramping up its private debt portfolio, think about my recent comments on the Liberals attacking public pensions and the future of retirement plans.

When I say nothing compares to Canada's large, well-governed defined-benefit plans which invest directly and indirectly across public and private markets, this example of investing in private debt highlights why no defined-contribution, target date or variable benefit plan can compete with Canada's large DB plans over a long period.

Again, if you have anything to add, shoot me an email at LKolivakis@gmail.com and I'll be glad to share your insights. Please remember to kindly donate or subscribe to this blog on the top right-hand side under my picture and support my efforts in bringing you the very best insights on pensions and investments.

Below, David Brackett, co-chief executive officer at Antares Capital, discusses the rapid rise of non-bank lenders in the wake of increased regulation on US banks. He speaks with Bloomberg's David Westin on "Bloomberg Daybreak: Americas" (read my comment on CPPIB bringing good things to life for a background).

Also, KKR Credit co-head Nat Zilkha (Jenkins' counterpart at KKR) discusses opportunities in credit. He speaks with Erik Schatzker from the Capitalize for Kids Investors Conference in Toronto on "Bloomberg Markets."

Very interesting discussion on global credit opportunities. Zero Hedge brought it to my attention in a comment on KKR calling the top in high yield credit. Zilkha states that KKR has monetized on a lot of distressed energy bonds it acquired earlier this year (smart move).

Canada’s Public Sector Pension Investment Board (PSP Investments) has committed €500 million ($735 million) in seed capital to a new European credit platform. The platform, created by David Allen‘s AlbaCore Capital, will focus on private and public credit markets where there are inefficiencies in pricing, including high yield, leveraged loans and direct lending. PSP said it may deploy more capital in partnership with AlbaCore for specific deal opportunities. PSP launched a private debt strategy in November 2015. Earlier this year, the pension fund hired Oliver Duff to lead its strategy in Europe.So who is David Allen and why is PSP seeding his new fund, AlbaCore Capital, with such as substantial investment?

PRESS RELEASE

PSP Investments commits €500 million in newly-created European credit platform AlbaCore

Seed Investment in AlbaCore to Add to PSP Investments’ Existing Private Debt Activities in Europe

MONTRÉAL and LONDON, Nov. 1, 2016 /CNW Telbec/ – The Public Sector Pension Investment Board (“PSP Investments”), one of Canada’s largest pension investment managers, announced today a €500 million seed investment commitment made by an affiliate of PSP Investments in a new specialist European credit platform promoted by AlbaCore Capital Limited (“AlbaCore”), recently formed by David Allen. This is one of the largest commitments PSP Investments has made to an external strategy. AlbaCore intends to focus on private and public credit markets where there are significant inefficiencies in pricing, including European high yield, leveraged loans and direct lending. PSP Investments may deploy further capital in partnership with AlbaCore in certain substantial investment opportunities in Europe.

“PSP Investments sees great opportunity in the European credit market and, as such, entered the market earlier this year with the hiring of Oliver Duff to lead our European private debt activities, which focus on sponsor-financed acquisitions, first liens, second liens and other debt instruments across the capital structure,” said David Scudellari, Senior Vice President and Head of Principal Debt and Credit Investments at PSP Investments. “With its expertise and extensive network of relationships, the portfolio team working for AlbaCore is well positioned to source bespoke, attractive transactions that will add to our existing activities,” Mr. Scudellari added.

Private Debt is PSP Investments’ newest asset class. It was created in November 2015 with the objective to deploy over C$5 billion (over €3.4 billion) in debt financings globally. Since inception, the team has committed to over 20 transactions in North America and deployed C$2.4 billion (€1.6 billion). Oliver Duff joined PSP Investments’ London office in September 2016 with the mandate to develop the organization’s presence in the European leverage finance market, build relationships with local partners and contribute to achieving PSP Investments’ deployment goal.

About PSP Investments

The Public Sector Pension Investment Board (PSP Investments) is one of Canada’s largest pension investment managers with C$116.8 billion of net assets under management as at March 31, 2016. It manages a diversified global portfolio composed of investments in public financial markets, private equity, real estate, infrastructure, natural resources and private debt. Established in 1999, PSP Investments manages net contributions to the pension funds of the federal Public Service, the Canadian Armed Forces, the Royal Canadian Mounted Police and the Reserve Force. Headquartered in Ottawa, PSP Investments has its principal business office in Montréal and offices in New York and London. For more information, visit investpsp.com or follow Twitter @InvestPSP.

About AlbaCore

AlbaCore’s specialist European credit platform is focused on opportunities across European corporate credit markets. The platform’s selection process is based on fundamental research focusing on capital preservation and total return.

Back in May, Nishant Kumar of Bloomberg reported, Canada Pension’s David Allen Said to Depart to Start Hedge Fund:

David Allen, a money manager in London at the $212 billion Canada Pension Plan Investment Board, is leaving to start his own hedge fund, according to a person with knowledge of the matter.Obviously David Allen is extremely qualified to run a credit fund. Before leaving CPPIB where he racked up huge gains running their European credit portfolio, he worked at GoldenTree Asset Management where he was a member of the Global Investment Committee, Portfolio Manager for US Media, Telecom, Gaming Partner and Head of European Investments (he founded GoldenTree's European office).

Allen, who is a managing director responsible for credit investments, will leave Canada’s largest pension fund on Friday and start his own investment firm later this year, said the person who asked not to be identified because the information is private.

The money manager established and managed a credit opportunities fund that has invested more than 9 billion Canadian dollars ($6.9 billion) since he joined the firm in 2010, the person said. The fund returned an annualized 15.3 percent over the last six years, they said.

Allen declined to comment, while Mei Mavin, a spokeswoman for the pension firm, confirmed his departure. “We thank David for his many contributions to CPPIB and wish him all the very best on his new endeavors, ” she said in an e-mailed statement.

Allen was a partner and head of European investments at GoldenTree Asset Management in London before joining the pension fund.

Prior to GoldenTree, he was an Executive Director at Morgan Stanley where he ranked as the #1 High Yield Media analyst in the US according to Institutional Investor Magazine (2002).

Allen has been busy building his team since May. He hired Matthew Courey, former head of high-yield bond trading at Credit Suisse and Joseph Novarro, the former managing partner at investment firm Renshaw Bay, to become the chief operating officer of his private debt fund.

In late September, Allen also hired Bill Ammons away from CPPIB to join his new fund:

Former Canada Pension Plan Investment Board fund manager Bill Ammons has joined David Allen’s new credit startup AlbaCore Capital as a founding partner and portfolio manager.The four founding partners of AlbaCore Capital are featured in the picture above which was taken from their LinkedIn profiles.

The new fund is planning to commence operations by the end of the year, according to Reuters. Ammons worked for Allen when they were both portfolio managers at CPPIB.

Allen was a managing director responsible for credit investments at CPPIB, which manages some $217 billion and is Canada’s largest pension fund, before leaving in May of this year to start his own shop in London.

Ammons joined CPPIB in 2010 and worked on its European credit investment team, Reuters noted. He managed a European sub-investment grade credit portfolio investing in leveraged loans, high yield, mezzanine, PIK, converts and distressed positions across the primary, secondary and private credit markets, according to his LinkedIn profile.

Beforehand, he was part of BofAML’s restructuring and leveraged finance team in London, and was previously on the leveraged finance team at Wachovia.

He comes aboard AlbaCore alongside Matthew Courey, who was head of high-yield bond trading at Credit Suisse, and Joseph Novarro, who was managing partner at money manager Renshaw Bay and joins the firm as COO. Both are also founding partners, and the four will reportedly form the nucleus of AlbaCore’s investment and management committees.

David O’Neill, former head of European institutional equity trading for KCG Holdings, also recently joined AlbaCore recently as head of operations and risk management.

Based in London and founded in early June 2016, AlbaCore’s initial size is unknown and details about the strategy or strategies it will pursue remain sparse beyond a concentration in European private and public credit opportunities.

So what do I think of this deal to seed AlbaCore Capital? A few brief thoughts:

- I like this deal for a lot of reasons. No question that David Allen and Bill Ammons are excellent at what they do which is why they posted solid numbers while working at CPPIB. Will they keep delivering 15% annualized at AlbaCore? I strongly doubt it but even if they deliver 10% + with low volatility and correlation to stocks and bonds, that will be great for PSP and its members. That all remains to be seen as markets will be far more challenging in the next five to ten years.

- Was this deal cooking for a while? I believe so and think PSP's President and CEO, André Bourbonnais who was David Allen's boss at CPPIB, was in talks about this deal ever since Allen departed CPPIB. In fact, I wouldn't be surprised if Bourbonnais prodded Allen to leave CPPIB, promising him he would seed his new fund or Allen confidentially told him he wanted to start this new fund and would love to have PSP as a seed investor (it helps to have friends in high places). Either way, seed deals of this size don't happen on a whim.

- I'm not sure if it's technically a hedge fund (the release calls it a credit "platform") but seeding this new fund with such a sizable commitment comes with risks and benefits. The risks are the fund will flop spectacularly and PSP will deeply regret its decision to back it up with such a hefty commitment. But if it succeeds, PSP will enjoy the benefits of being an anchor investor, which means it won't be paying 2 & 20 in fees (not even close) and if it has an equity stake (not sure it does), it will make money off that too (or do some sort of revenue sharing). The specific terms of the deal were not disclosed but I'm sure they were mutually beneficial to both parties.

- Other specifics were not disclosed as well like the specific breakdown of investment activities and geographic exposure within Europe. That likely remains to be determined as AlbaCore will invest opportunistically as opportunities arise in high yield, leveraged loans and direct lending. For PSP, it gains meaningful, scalable access immediately to very qualified portfolio managers who are very much in tune with what is happening in European credit markets.

- This deal represents a significant push for PSP in private debt, a new asset class that makes perfect sense, especially when the economy is slowing and banks aren't lending. Oliver Duff who leads PSP's European private debt activities and reports to David Scudellari, Senior Vice President and Head of Principal Debt and Credit Investments at PSP, is very qualified and will use this investment to deploy more capital in partnership with AlbaCore for specific sizable deal opportunities.

- European debt markets are challenging to say the least but that is why it helps to have partners who understand these challenges and can seize opportunities as well as advise PSP as bigger opportunities arise.

Some other thoughts? People will say why didn't PSP just hire its own team, why seed AlbaCore Capital? Like I stated, PSP gains immediate, scalable access to European private debt markets with this seed investment and it's not paying 2 & 20 in fees or anywhere close to that amount as a seed investor. Also, this partnership will prove useful for deployment of capital in bigger deals where PSP has the size to invest directly or co-invest along with AlbaCore.

If you want to read more on the rise of private debt as an institutional asset class, click here to read an excellent report from ICG. Also, the figure below was taken from sample pages from the 2016 Prequin Global Private Debt Report (click on image):

As you can see, private debt isn't an emerging asset class, it's already here and big pensions like CPPIB and PSP Investments are going to be critical players in this space (CPPIB already is and PSP is on its way there).

There are structural factors that explain the rise of private debt as an asset class, including a slowing economy, historically low rates, bank regulations and in Europe in particular, where the banking sector is a mess and deflation and low growth are here to stay, private debt opportunities will abound especially for PSP, CPPIB and other pensions with a very long investment horizon.

Are there risks to private debt? Of course there are, especially in Europe, but if these deals are structured properly and PSP can take advantage of its long investment horizon, it will mitigate a lot of risks which impact funds with a shorter investment horizon like hedge funds and even private equity funds.

I'll leave you with some more food for thought, Carlyle is shifting its focus back to lending after its unsuccessful venture into hedge funds:

Carlyle’s first big investment in a hedge fund firm was Claren Road Asset Management, which was founded by four star Citigroup traders in December 2010. Carlyle took a majority stake. A few months later, it bought a stake in the Emerging Sovereign Group (E.S.G.), which started with a seed investment from Julian H. Robertson, the billionaire investor.A little side note, when I covered the big executive shakeup at CPPIB, I stated Mark Jenkins might have approached Carlyle being disappointed that he wasn't named CPPIB's new CEO and there may have been a conflict of interest as he was responsible for private markets at CPPIB.

It was part of a bigger push by Carlyle to branch out before its initial public offering in 2012. Soon after, it bought a stake in Vermillion Asset Management, a commodities investment manager. Other private equity firms like Blackstone have followed similar strategies, buying hedge fund stakes, as have the family investment offices of extremely wealthy people, like that of the Alphabet chairman, Eric E. Schmidt.

But over the last two years, nearly $8 billion has flowed out of Claren Road. It is bracing for another $1 billion to be withdrawn in the next few quarters. This year, it announced plans to cut ties with E.S.G., selling its majority stake in the $3.5 billion hedge fund. Last year, Carlyle split with the Vermillion founders Chris Nygaard and Andrew Gilbert after deciding to redirect the business toward commodity financing and away from managing money. By the end of the year, its assets in hedge funds are expected to total just $1 billion.

Now, Carlyle will focus on another part of its global markets strategies business: lending. It will focus on private lending to companies, buying distressed debt from companies in sectors like energy, and investing in complex pooled investments like collateralized loan obligations, stepping into the business as banks retrench after the financial crisis. Last month, it hired Mark Jenkins from the Canada Pension Plan Investment Board. Mr. Jenkins helped expand the pension fund’s direct lending.

Carlyle may still face challenges in its global markets strategies unit, and its pivot to lending from hedge funds has been met with some skepticism. During a phone call with analysts after its third-quarter earnings announcement this week, an analyst from JPMorgan Chase questioned whether Carlyle’s experiment in hedge funds might be repeated in its new venture into lending.

“I think in hindsight, you were late to hedge funds, made significant investments and it didn’t end well,” the analyst said, adding, “Why is this different?”

In response, Mr. Conway emphasized that Carlyle had better expertise in private markets, its traditional business, than in the public markets in which its hedge fund investments were mainly invested.

Christopher W. Ullman, a spokesman for the firm said: “We’re building on well-established firmwide strengths. This is a long-term strategic commitment. Credit is an attractive asset class and always will be.”

After a high level discussion with a senior manager at CPPIB, I was told that Jenkins was planning his exit for some time and that the appearance of him leaving after Mark Wiseman left to join Blackrock was "unfortunate and coincidental."

Also, this person told me Jenkins was not directly responsible for investing in Carlyle or any other fund and that these decisions are made in an investment committee which he was part of but not directly responsible for fund investments.

I apologize to Mark Jenkins if my comment added fuel to the conspiracy fire but one thing that still concerns me is all these senior people at CPPIB leaving to join established funds or to start their new fund capitalizing on their key relationships.

Sure, it's a free market and nothing says they need to stay at CPPIB or PSP for the rest of their career but the governance at these funds needs to be bolstered to make sure there is nothing remotely shady going on and that if a key manager leaves, there is ample time to ensure a successful handover of big investment portfolios.

Yes, CPPIB can handle the departure of a Wiseman, Bourbonnais, Allen, Ammons and Jenkins but if this becomes a regular occurrence, the optics don't look right and it will become a problem for the fund going forward.

One final note, as you see PSP ramping up its private debt portfolio, think about my recent comments on the Liberals attacking public pensions and the future of retirement plans.

When I say nothing compares to Canada's large, well-governed defined-benefit plans which invest directly and indirectly across public and private markets, this example of investing in private debt highlights why no defined-contribution, target date or variable benefit plan can compete with Canada's large DB plans over a long period.

Again, if you have anything to add, shoot me an email at LKolivakis@gmail.com and I'll be glad to share your insights. Please remember to kindly donate or subscribe to this blog on the top right-hand side under my picture and support my efforts in bringing you the very best insights on pensions and investments.

Below, David Brackett, co-chief executive officer at Antares Capital, discusses the rapid rise of non-bank lenders in the wake of increased regulation on US banks. He speaks with Bloomberg's David Westin on "Bloomberg Daybreak: Americas" (read my comment on CPPIB bringing good things to life for a background).

Also, KKR Credit co-head Nat Zilkha (Jenkins' counterpart at KKR) discusses opportunities in credit. He speaks with Erik Schatzker from the Capitalize for Kids Investors Conference in Toronto on "Bloomberg Markets."

Very interesting discussion on global credit opportunities. Zero Hedge brought it to my attention in a comment on KKR calling the top in high yield credit. Zilkha states that KKR has monetized on a lot of distressed energy bonds it acquired earlier this year (smart move).