Philippe Hynes, President of Tonus Capital here in Montreal, recently went on a trip with Concordia University students to meet the Oracle of Omaha. He shared his thoughts with me and his clients this morning via an email going over the meeting (added emphasis is mine):

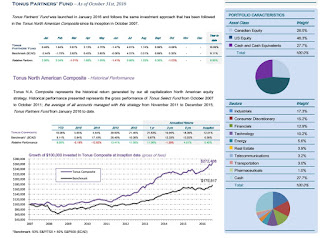

Tonus Capital is a deep value contrarian fund which takes concentrated bets. Tonus Partners' Fund which was launched in January 2016 and follows the same investment approach as Tonus North American Composite since its inception in October 2007, is up 18% YTD (click on image):

You can learn more about Tonus Capital here and review its performance here.

Now, how lucky are those Concordia students to fly over to Omaha and meet with the Oracle himself? Not only did they meet him, they spent two hours asking him all sorts of investment questions. Talk about a trip of a lifetime!

A few years ago, I cold called Geico and got as far as Debbie Bosanek, Warren Buffett's personal assistant at Berkshire Hathaway. I told her that I'd like to meet with Mr. Buffett to discuss America's looming retirement crisis. She was polite but of course declined my offer (hey, it was worth a shot!).

Three years ago, I covered Warren Buffett's pension wisdom, stating the following:

In that comment on Rhode Island, however, I criticized Buffett, his long-time partner Charlie Munger and Ted Siedle, stating this:

What else? Last year, I discussed how private equity discovered Warren Buffett, a strategy to mitigate the treacherous times that lie ahead in the industry. A lot of people don't know that some of the biggest returns at Berkshire Hathaway don't come from public markets but from private equity deals typically done through great partners like 3G Capital.

But there is no denying Warren Buffett is one of the greatest stock investors ever which is why I track Bershire's holdings closely when I go over top funds' quarterly activity (click on image):

I'll bring to your attention the positions that caught my attention. First, Buffett took a big position in Goldman Sachs (GS) in the third quarter, which was a great move from a fundamental (betting rates would rise no matter who wins election) and technical basis (click on chart):

Do you see that beautiful double bottom off the 400-week moving average? That was the time to LOAD UP on Goldman's shares (I'm sure Buffett's team loaded up before that double bottom).

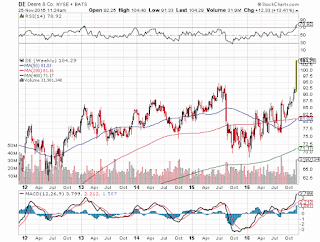

Second, Buffett made great money off Deere (DE), one of the top-performing large cap stocks in the United States which recently blew Street estimates away, sending the stock to new 52-week highs (click on image):

Now, I wouldn't touch Goldman or Deere shares here. In fact, I would be taking my profits and preparing to short them at these levels but it goes to show you, the Oracle of Omaha still has the Midas touch when it comes to picking winners (he also picks losers, like IBM and Wal Mart but shed a big stake in the giant retailer in Q3).

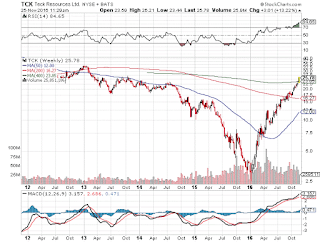

I will leave you with another chart that blew me away this year, one of Teck Resources (TCK) which hit a low of $2.56 (US) earlier this year and is now trading close to $26 dollars (US) after an incredible V-shaped recovery (click on image):

Buffett doesn't invest in resource stocks but I am sharing this with you because Daniel Brosseau and Peter Letko of Letko Brosseau & Associates -- the "Oracles of Montreal" -- had bought a huge stake in Teck late last year, added more early in the year making it their largest holding, and enjoyed huge gains on this position (they started dumping Teck in Q3 so don't bother chasing it here, I would be shorting this one in 2017).

All this to say, Buffett's adage of buying fear and selling greed makes perfect sense (more in hindsight however as buying fear in the thick of things takes big cojones and deep pockets, both of which Buffett has).

Lastly, go read my recent comment on Trumping the bond market to get more of my macro thinking on bonds and the global economy and what I see lying ahead. Unlike Mr. Buffett, I don't think bond yields are too low and I'm worried as the US dollar gains steam, it will wreak havoc on emerging markets and the US economy.

Below, an incredible Bloomberg clip where Carlyle's David Rubenstein interviews Warren Buffett on The David Rubenstein Show. Take the time to watch this interview and show it to your kids and grand kids, it's really worth watching it together with them over the holiday weekend.

Hope you enjoyed this comment, as always, please remember to kindly donate or subscribe to this blog via PayPal on the top right-hand side under my picture to show your appreciation and support the work that goes into these blog comments (you need to view web version if reading it on your cell phone to see the right-hand side properly).

Have a great weekend and Happy US Thanksgiving!

I had the privilege to meet legendary investor Warren Buffett in Omaha last Friday. He occasionally meets with university students and Concordia University, where I have been teaching since 2006, was selected. For more than two hours, a group of 15 students accompanied by a few teachers could ask questions to The Oracle. I have always admired the human and professional qualities of Warren Buffett. Not only is he an outstanding investor but he is also an excellent communicator. You will find attached to this email a summary of his comments.

His thoughts coincide with our advantageous structure at Tonus Capital. As expected, Mr. Buffett mentioned that few opportunities are present on the market. He recommends to remain very patient and to have a concentrated portfolio (he would personally have only 4 or 5 stocks in his). These are exactly the advantages provided by our investment policy; namely the flexibility to hold cash and wait for great opportunities and the concentration in approximately fifteen to twenty stocks. Over the past nine years, we have been building the image and reputation of Tonus Capital and we will continue to put investors’ interest at the forefront in order to maintain your trust.

For those comfortable in French, I recommend reading the following articles published this week in journal La Presse and Les Affaires.******

Meeting with Warren Buffett in Omaha, November 18th, 2016

People

At Berkshire, there are no contracts with senior managers. Being financially independent, they are passionate and driven. For them, working for Mr. Buffett and Berkshire is the opportunity of a lifetime.

Bonds

“Interest rates are to stocks what gravity is to matter”. Mr. Buffett believes that long term interest rates are too low. He does not short sell at Berkshire but if he could he would short long-term bonds. He does not believe the stock market is currently overvalued and much prefers stocks over bonds right now. He mentions that if market participants believed that long-term rates would remain at current levels for some time, it would mean stocks are grossly undervalued. The reality is probably in between, and bonds are likely to lose some value in the future.

Active vs. passive investing

Because the market is an average, over time, both active and passive investing will yield similar (average) gross returns. To justify their higher fees, active managers must outperform over the long-term. Few will succeed, and the hard task for asset allocators (individuals, consultants, pension funds) is to identify these outperformers. Buffett considers the following factors enabling one to outperform the market:

- Being a good investor has nothing to do with IQ. It is more about emotional discipline and the talent to pick good stocks with good management. It is critical that the portfolio manager has a good temperament in order not to panic when fear prevails. Fear is very contagious in the financial markets.

- Smaller assets under management should increase the probability of outperforming. There are few great opportunities in the markets and when they arise, the manager must be quick and flexible.

- Buffet strongly believes in portfolio concentration. He would only have 4 or 5 investments in his portfolio if he was managing a smaller amount.

TechnologyFirst, let me thank Philippe Hynes for sharing his comments from this trip with me. I met Philippe last month at the first ever Montreal emerging managers conference and covered it here.

Many think that computers will replace humans in finance (and in many other sectors). Computers’ advantage lies in their speed. Buffett thinks that the majority of these high frequency and algorithmic funds use the same strategy and make very similar trades which will likely lead to more volatility as they simultaneously try to unwind their trades. Fundamental investors with a good temperament should be able to take advantage of the opportunities created by such volatility. Buffett does not believe that computers can determine the durability of the long-term competitive advantages of a company nor can it assess the motivation and passion of management. Given fundamental analysis is not about speed, he does not believe computers will replace analysts.

National debt

As long as the Federal Reserve can print bank notes, Mr. Buffett does not believe that the national debt is a problem in the United States (but other problems could emerge from printing currency, namely, inflation). He thinks that health care costs, now representing 17% of GDP, are a bigger issue.

Tonus Capital is a deep value contrarian fund which takes concentrated bets. Tonus Partners' Fund which was launched in January 2016 and follows the same investment approach as Tonus North American Composite since its inception in October 2007, is up 18% YTD (click on image):

You can learn more about Tonus Capital here and review its performance here.

Now, how lucky are those Concordia students to fly over to Omaha and meet with the Oracle himself? Not only did they meet him, they spent two hours asking him all sorts of investment questions. Talk about a trip of a lifetime!

A few years ago, I cold called Geico and got as far as Debbie Bosanek, Warren Buffett's personal assistant at Berkshire Hathaway. I told her that I'd like to meet with Mr. Buffett to discuss America's looming retirement crisis. She was polite but of course declined my offer (hey, it was worth a shot!).

Three years ago, I covered Warren Buffett's pension wisdom, stating the following:

Clearly Buffett foresaw the looming public pension catastrophe but does this mean he's against well-governed defined benefit plans?I've also covered why Rhode Island recently met Warren Buffett (not literally, more like his warning) when it decided to shut down its hedge fund program. October was the worst month for hedge funds in terms of redemptions and we'll see if this trend continues in the new year.

I'm not sure. When I recently covered Warren Buffett's pension strategy, I stated the following:What does the article say about Buffett's strategy for managing the defined-benefit plans Bershire inherited through acquisitions? First and most important, there is no talk of switching people out of defined-benefit to defined-contribution plans. Buffett plans to honor those commitments (Interestingly, I've tracked a lot of activity on my blog from Omaha, Nebraska over the last few years. Could it be the Oracle of Omaha?).

Second, fees matter a lot and Buffett isn't going to waste his time farming out the bulk of these pension assets to outside managers using useless investment consultants when he has the expertise to manage them in-house There is no mention of allocating money to hedge funds or private equity funds either. Again, fees matter a lot to Buffett and so does liquidity and performance. He is handily winning on a wager he made in 2008 with Protégé Partners, a fund of hedge funds manager, betting the S&P500 would beat a group of hedge fund managers selected by Protégé.

Third, Buffett and his team are not just great stock pickers, they also know how to engage in more sophisticated derivatives strategies. Buffett might have called derivatives "financial weapons of mass destruction," but the truth is Berkshire made a killing on the same long-term option strategy that allowed HOOPP to gain 17% in 2012.

Fourth, and hardly surprising, Buffett is not bullish on bonds given the current near record low interest rates. In this regard, he joins pensions that are massively betting on a rise in interest rates. This is understandable given that Buffett made his fortune picking great companies and he prefers stocks over bonds in the long-run. He thinks market timing is a loser's proposition and many long-term investors (like Doug Pearce at bcIMC) agree with him.

Keep in mind, however, that Buffett enjoyed the greatest bull market in stocks and never managed money during a prolonged debt deflation cycle (doubt he will ever see one in his lifetime). Also, the Fed's quantitative easing (QE) policy has been a boon for risk assets and I'm seeing a lot of activity in the stock market reminiscent of the 1999 liquidity melt-up in tech stocks. Momentum chasers trading high-beta stocks are loving it but be careful as the market's darkest days might be ahead.

In that comment on Rhode Island, however, I criticized Buffett, his long-time partner Charlie Munger and Ted Siedle, stating this:

Trust me, I am no fan of hedge funds, think the bulk (90%++) of them stink, charging outrageous "alpha" fees for leveraged beta, or worse, sub-beta performance. Moreover, I agree with Steve Cohen and Julian Robertson, there is too much talent in the game, watering down overall returns, but there are also plenty of bozos and charlatans in the industry which have no business calling themselves hedge fund managers.Earlier this month, I wrote about why ATP is bucking the hedge fund trend (to redeem assets) and explained why smart investors (like ATP and OTPP) are firmly committed to their hedge fund program which they take seriously by staffing it appropriately.

But all these self-righteous investment experts jumping on the 'bash the hedge funds' bandwagon annoy me and if we get a prolonged deflationary cycle where markets head south of go sideways for a decade or longer, I'd love to see where they will be with their "keep buying low cost ETFs" advice (Buffett, Munger and Bogle will be long gone by then but Siedle and Seides will still be around).

I believe in the Ron Mock school of thought. When it comes to hedge funds and other assets, including boring old long bonds, always diversify as much as possible and pay for alpha that is truly worth paying for (ie. that you cannot replicate cheaply internally).

I will repeat what Ron told me a long time when we first met in 2002: "Beta is cheap. You can swap into any equity or bond index for a few basis points to get beta exposure. Real uncorrelated alpha is worth paying for but it's very hard to find."

What else? Last year, I discussed how private equity discovered Warren Buffett, a strategy to mitigate the treacherous times that lie ahead in the industry. A lot of people don't know that some of the biggest returns at Berkshire Hathaway don't come from public markets but from private equity deals typically done through great partners like 3G Capital.

But there is no denying Warren Buffett is one of the greatest stock investors ever which is why I track Bershire's holdings closely when I go over top funds' quarterly activity (click on image):

I'll bring to your attention the positions that caught my attention. First, Buffett took a big position in Goldman Sachs (GS) in the third quarter, which was a great move from a fundamental (betting rates would rise no matter who wins election) and technical basis (click on chart):

Do you see that beautiful double bottom off the 400-week moving average? That was the time to LOAD UP on Goldman's shares (I'm sure Buffett's team loaded up before that double bottom).

Second, Buffett made great money off Deere (DE), one of the top-performing large cap stocks in the United States which recently blew Street estimates away, sending the stock to new 52-week highs (click on image):

Now, I wouldn't touch Goldman or Deere shares here. In fact, I would be taking my profits and preparing to short them at these levels but it goes to show you, the Oracle of Omaha still has the Midas touch when it comes to picking winners (he also picks losers, like IBM and Wal Mart but shed a big stake in the giant retailer in Q3).

I will leave you with another chart that blew me away this year, one of Teck Resources (TCK) which hit a low of $2.56 (US) earlier this year and is now trading close to $26 dollars (US) after an incredible V-shaped recovery (click on image):

Buffett doesn't invest in resource stocks but I am sharing this with you because Daniel Brosseau and Peter Letko of Letko Brosseau & Associates -- the "Oracles of Montreal" -- had bought a huge stake in Teck late last year, added more early in the year making it their largest holding, and enjoyed huge gains on this position (they started dumping Teck in Q3 so don't bother chasing it here, I would be shorting this one in 2017).

All this to say, Buffett's adage of buying fear and selling greed makes perfect sense (more in hindsight however as buying fear in the thick of things takes big cojones and deep pockets, both of which Buffett has).

Lastly, go read my recent comment on Trumping the bond market to get more of my macro thinking on bonds and the global economy and what I see lying ahead. Unlike Mr. Buffett, I don't think bond yields are too low and I'm worried as the US dollar gains steam, it will wreak havoc on emerging markets and the US economy.

Below, an incredible Bloomberg clip where Carlyle's David Rubenstein interviews Warren Buffett on The David Rubenstein Show. Take the time to watch this interview and show it to your kids and grand kids, it's really worth watching it together with them over the holiday weekend.

Hope you enjoyed this comment, as always, please remember to kindly donate or subscribe to this blog via PayPal on the top right-hand side under my picture to show your appreciation and support the work that goes into these blog comments (you need to view web version if reading it on your cell phone to see the right-hand side properly).

Have a great weekend and Happy US Thanksgiving!