Kirk Falconer of PE Hub Network reports, bcIMC to acquire European credit business Hayfin from PE owners:

Well, bcIMC isn't PSP, and there is a bit more transparency there but you can feel the new culture with Gordon at the helm is much more tight-lipped. There is nothing evil or sinister behind this veil of secrecy, Gordon's philosophy was always the only press release that counts is the annual report.

But regular communication is part of good governance. Other large Canadian public pension funds are much more transparent and proactive in getting their message out, embracing social media platforms like Twitter, LinkedIn, and YouTube, but in order to do this, you need to have content (interviews, articles, etc.).

That's not Gordon Fyfe's style. He shuns the media and doesn't like giving interviews to Bloomberg, CNBC or other news outlets. In the last ten years, I think he only gave one rare interview. Like I said, it's not his style, he keeps information close to his chest and doesn't like discussing operations apart from when he has to in the Annual Report.

Not surprisingly, Gordon did have the good sense to hire Jim Pittman from PSP to head Private Equity at bcIMC (Jim left PSP on his own, on good terms, and took some time to think about his next move).

Jim is a very smart and nice guy, worked hard at PSP to develop fund investments, co-investments, and direct investments. He too is reserved by nature and shuns the spotlight. You won't find any interview or even a picture of him on the internet apart from some AVCJ Forum that took place back in 2013 which he attended (click on image):

That is Jim on the upper left side when he was VP at PSP Investments (for some reason, bcIMC doesn't post bios or pictures of their senior executives and board members on its website).

Anyways, enough about that, let me get into this deal. It's obvious that Jim Pittman knows Hayfin Capital Management and its senior managers extremely well. Headquartered in London, Hayfin has offices in Amsterdam, Frankfurt, Luxembourg, Madrid, Paris, New York and Tel Aviv. It specializes in sourcing, structuring and managing European private debt investments while operating complementary business lines across corporate, maritime and alternative credit.

In the press release announcing the bcIMc deal, Jim states he knows the "Hayfin team since inception",which leads me to believe he and Derek Murphy (the former head of PE at PSP) seeded this credit platform or more likely, they got together with Ontario Teachers', OMERS and others to seed it.

Either way, it doesn't matter now that bcIMC has agreed to acquire the majority shareholding in Hayfin from the existing consortium of institutional shareholders (remember, it's a small club in Canada, all the senior pension fund managers know each other very well).

Does the deal make sense for all parties? Well, obviously if they agreed to the terms bcIMC offered them or else they wouldn't sign off on this deal.

What does bcIMC get from this deal exactly? It can allocate more money into the European private debt market through an experienced partner that knows the space well and share in its success as it owns the majority shares now. It is also likely is getting preferential treatment on fees that others won't get (unless there is some clause against this).

What is the outlook for European private debt? That's a good question. Barring a total collapse of the Eurozone, which looks increasingly likely, there are many structural issues plaguing Europe's debt markets and smart investors are trying to capitalize on them.

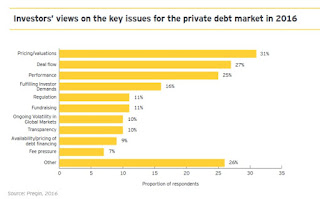

Those of you that don't know about private debt as an asset should read this ICG report, The Rise of Private debt as An Asset Class. Preqin puts out an annual report on private debt markets (you can read a sample from last year's report here). And more specifically to Europe, EY put out a report back in October looking at the outlook for European private debt which provides interesting insights, like key issues for investors (click on chart which is from Preqin):

Notice the top four concerns are pricing/ valuations, deal flow, performance and fulfilling investor demands. Interestingly, regulation is a concern but nothing urgent since unlike the United States where President Trump is moving full steam ahead to deregulate the financial services industry, in Europe, things move extremely slowly on the regulatory front.

Private debt is a complicated asset class in terms of barriers to entry for large pensions. It's hard for Canadian pension funds to directly compete with specialized credit funds or platforms which is why they prefer to partner up with them to allocate into this space, sometimes hiring groups that worked at investment banks to work for them or just seeding their operations.

Back in November, I discussed how PSP Investments seeded a European credit fund, AlbaCore Capital, run by David Allen who used to work at CPPIB and was head of European investments at GoldenTree Asset Management in London before joining that pension fund.

PSP invested a significant stake in this investment to develop its European private debt capabilities. It obviously believes in this asset class over the long run even if there are concerns about the future of the Eurozone, valuations, deal flows, etc.

For bcIMC and PSP, they are firmly entrenched now in European private debt, and hopefully these partnerships will help them deliver great returns in an increasingly competitive space facing all sort of issues.

One thing is for sure, Tim Flynn, Hayfin's CEO, is an experienced credit manager who knows European private debt markets extremely well:

How will bcIMC's investment into Hayfin and PSP's investment into AlbaCore end up? I hope it ends up well for their beneficiaries but there will be a few hitches and challenges along the way.

Still, private debt is an important asset class for many institutional investors looking to improve their returns and take advantage of regulatory and structural issues hindering European and US debt markets.

Take the time to watch this clip at Citywire’s first Modern Investor forum where they brought together five institutional players to size up the investment case for private debt. You can read the accompanying article here.

Also, the financial crisis continues to leave its mark on European banks. And as yet, there are no apparent business solutions in sight. US institutions though are doing better, reporting high levels of assets. Take the time to watch this DW clip here.

Below, CNBC's Wilfred Frost reports on the effect on banks following President Donald Trump's executive order on financial regulation.

And Gildas Surry, senior analyst at Axiom Alternative Investments, talks about regulation in the banking sector for Europe, in light of Trump’s interest in rolling back the Dodd-Frank law.

US and global banks took off on Friday after the signing of the executive order to deregulate was announced but I think smart money is taking my advice to unload here and even start shorting these banks as they will struggle as rates come right back down to record lows in the second half of the year.

In a deflationary environment, I expect private debt markets all over the world will flourish and funds in this space will be a lot more active confronting the challenges and opportunities as they arise. The smart ones with the right long-term partners will be able to structure their loans and deals properly to make money no matter what hits them.

Lastly, UBC students organized an epic snowball fight on Monday. The city got walloped with snow all weekend, meaning there was more than enough powder for the hundreds who showed up to play.

Hayfin Capital Management LLP, a European private debt investment firm, has agreed to be acquired by British Columbia Investment Management Corp (bcIMC). No financial terms were disclosed, however, Sky News reported the deal’s value to be about £215 million (US$268 million). The Canadian pension fund bought a majority stake in Hayfin from the company’s founding shareholders: TowerBrook Capital Partners, PSP Investments, Ontario Municipal Employees Retirement System (OMERS) and Future Fund. London-based Hayfin, established in 2009, said bcIMC will commit “significant capital” to its managed funds and support its long-term growth.Mark Kleinman of Sky News also reports, Canadian pensioners swoop on Quorn lender Hayfin in £215m deal:

PRESS RELEASE

Hayfin’s institutional shareholding sold to bcIMC

January 31st 2017

Hayfin Capital Management LLP (“Hayfin” or “the firm”), a leading European credit platform with €8.2bn in assets under management, today announces that British Columbia Investment Management Corporation (“bcIMC”) has agreed to acquire the majority shareholding in the firm from the existing consortium of institutional shareholders. The transaction will support Hayfin’s long-term growth plans and simplify its ownership structure, with Hayfin’s management and employees remaining substantive shareholders alongside bcIMC.

bcIMC, a Canadian investment manager which manages approximately C$122bn in assets, is acquiring 100% of the shares owned by Hayfin’s current institutional shareholders – TowerBrook Capital Partners, PSP Investments (“PSP”), the Ontario Municipal Employees Retirement System (“OMERS”), and The Future Fund. bcIMC is also committing significant capital to the funds that Hayfin currently manages and will be supportive of the future development of the business. Hayfin’s principal focus will remain managing assets for third parties; the day-to-day independence of the Hayfin team over operations, investments, and personnel will be unaffected by the change in ownership.

Tim Flynn, CEO of Hayfin Capital Management, commented: “This long-term investment from bcIMC will provide the access to capital and streamlined ownership structure to realise our ambition of becoming Europe’s leading credit platform. What won’t change under the new ownership arrangements is the independence of Hayfin’s experienced team of credit investment professionals, or our commitment to delivering high-quality returns for the third-party investors whose capital we manage.”

Jim Pittman, Senior Vice President of Private Equity at bcIMC stated: “We see this as a strategic long-term investment in a leading company that has the potential to generate value-added returns for our clients. Having known the Hayfin team since inception, I’m confident in their strategy and ability to further expand their business and raise additional capital through their funds.” He continued, “Our investment in Hayfin provides bcIMC with access to one of Europe’s leading credit platforms as both a majority shareholder and an investor in its funds across the spectrum of credit products.”

The financial terms of the deal are undisclosed. Completion of the transaction is subject to regulatory approval.

A giant Canadian pension fund will this week swoop to take control of a UK-based lender which counts The Racing Post and Quorn, the meat substitute food manufacturer, among its clients.I love when I read bcIMC "could not be reached," it reminds me of the old tight-lipped days at PSP Investments when Gordon Fyfe was at the helm and they hardly ever put out a press release unless the organization had to by law.

Sky News has learnt that the British Columbia Investment Management Corporation (BCIMC) will announce on Tuesday that it has agreed to buy a majority stake in Hayfin Capital Management in a deal worth roughly £215m.

The deal will underline a growing appetite to invest in alternative lenders, many of which have been established over the last decade to exploit gaps left by traditional banks.

A regulatory clampdown after the 2008 financial crisis has made it harder for conventional banks to lend to companies on economically attractive terms, paving the way for the emergence of competitors such as Hayfin and Ares Capital Management.

Sources said that BCIMC, which manages more than C$120bn (£73.2bn) of assets, would buy out Hayfin's existing institutional shareholders: Towerbrook Capital Partners, Australia's sovereign wealth fund and two other Canadian pension funds.

Hayfin's management and employees will retain their shareholdings following the deal.

The company, which has €8.2bn (£7bn) under management, has built a successful business by lending money to medium-sized European companies since its launch by former Goldman Sachs partners in 2009.

It has lent more than €9bn (£7.7bn) since it was set up, with other corporate customers including Sunseeker, the luxury yacht-builder.

It also operates a strategy called special opportunities, and has business lines in maritime credit and healthcare, as well as offering asset management services to institutional clients.

The deal with Hayfin is expected to see the British Columbia-based fund commit significant funds for its expansion, although the London-headquartered lender will retain day-to-day autonomy over its operations and investments.

Insiders said the deal was attractive to Hayfin's management because it would simplify the company's ownership structure, as well as providing a platform for future growth.

In 2015, Hayfin sold its portfolio of owned assets to The Future Fund, Australia's state-backed investor.

A Hayfin spokeswoman declined to comment on Monday, while BCIMC could not be reached.

Well, bcIMC isn't PSP, and there is a bit more transparency there but you can feel the new culture with Gordon at the helm is much more tight-lipped. There is nothing evil or sinister behind this veil of secrecy, Gordon's philosophy was always the only press release that counts is the annual report.

But regular communication is part of good governance. Other large Canadian public pension funds are much more transparent and proactive in getting their message out, embracing social media platforms like Twitter, LinkedIn, and YouTube, but in order to do this, you need to have content (interviews, articles, etc.).

That's not Gordon Fyfe's style. He shuns the media and doesn't like giving interviews to Bloomberg, CNBC or other news outlets. In the last ten years, I think he only gave one rare interview. Like I said, it's not his style, he keeps information close to his chest and doesn't like discussing operations apart from when he has to in the Annual Report.

Not surprisingly, Gordon did have the good sense to hire Jim Pittman from PSP to head Private Equity at bcIMC (Jim left PSP on his own, on good terms, and took some time to think about his next move).

Jim is a very smart and nice guy, worked hard at PSP to develop fund investments, co-investments, and direct investments. He too is reserved by nature and shuns the spotlight. You won't find any interview or even a picture of him on the internet apart from some AVCJ Forum that took place back in 2013 which he attended (click on image):

That is Jim on the upper left side when he was VP at PSP Investments (for some reason, bcIMC doesn't post bios or pictures of their senior executives and board members on its website).

Anyways, enough about that, let me get into this deal. It's obvious that Jim Pittman knows Hayfin Capital Management and its senior managers extremely well. Headquartered in London, Hayfin has offices in Amsterdam, Frankfurt, Luxembourg, Madrid, Paris, New York and Tel Aviv. It specializes in sourcing, structuring and managing European private debt investments while operating complementary business lines across corporate, maritime and alternative credit.

In the press release announcing the bcIMc deal, Jim states he knows the "Hayfin team since inception",which leads me to believe he and Derek Murphy (the former head of PE at PSP) seeded this credit platform or more likely, they got together with Ontario Teachers', OMERS and others to seed it.

Either way, it doesn't matter now that bcIMC has agreed to acquire the majority shareholding in Hayfin from the existing consortium of institutional shareholders (remember, it's a small club in Canada, all the senior pension fund managers know each other very well).

Does the deal make sense for all parties? Well, obviously if they agreed to the terms bcIMC offered them or else they wouldn't sign off on this deal.

What does bcIMC get from this deal exactly? It can allocate more money into the European private debt market through an experienced partner that knows the space well and share in its success as it owns the majority shares now. It is also likely is getting preferential treatment on fees that others won't get (unless there is some clause against this).

What is the outlook for European private debt? That's a good question. Barring a total collapse of the Eurozone, which looks increasingly likely, there are many structural issues plaguing Europe's debt markets and smart investors are trying to capitalize on them.

Those of you that don't know about private debt as an asset should read this ICG report, The Rise of Private debt as An Asset Class. Preqin puts out an annual report on private debt markets (you can read a sample from last year's report here). And more specifically to Europe, EY put out a report back in October looking at the outlook for European private debt which provides interesting insights, like key issues for investors (click on chart which is from Preqin):

Notice the top four concerns are pricing/ valuations, deal flow, performance and fulfilling investor demands. Interestingly, regulation is a concern but nothing urgent since unlike the United States where President Trump is moving full steam ahead to deregulate the financial services industry, in Europe, things move extremely slowly on the regulatory front.

Private debt is a complicated asset class in terms of barriers to entry for large pensions. It's hard for Canadian pension funds to directly compete with specialized credit funds or platforms which is why they prefer to partner up with them to allocate into this space, sometimes hiring groups that worked at investment banks to work for them or just seeding their operations.

Back in November, I discussed how PSP Investments seeded a European credit fund, AlbaCore Capital, run by David Allen who used to work at CPPIB and was head of European investments at GoldenTree Asset Management in London before joining that pension fund.

PSP invested a significant stake in this investment to develop its European private debt capabilities. It obviously believes in this asset class over the long run even if there are concerns about the future of the Eurozone, valuations, deal flows, etc.

For bcIMC and PSP, they are firmly entrenched now in European private debt, and hopefully these partnerships will help them deliver great returns in an increasingly competitive space facing all sort of issues.

One thing is for sure, Tim Flynn, Hayfin's CEO, is an experienced credit manager who knows European private debt markets extremely well:

Mr Flynn serves as Hayfin’s Chief Executive Officer. Prior to joining Hayfin, Mr Flynn was a partner at Goldman Sachs, where he co-headed the European Leveraged Finance and Acquisition Finance businesses. Mr Flynn was also a member of Goldman Sachs’ firm-wide Capital Committee.His team is equally experienced and again, this isn't an easy space for pensions to just start lending directly. They need the expertise of these funds which have developed long standing relationships with key players.

Before joining Goldman Sachs, Mr Flynn was a corporate finance lawyer at Sullivan & Cromwell, a New York-based law firm.

Mr Flynn graduated from Columbia Law School, where he was a Harlan Fiske Stone Scholar and an Editor of the Columbia Law Review. Mr Flynn graduated from Georgetown University with a Bachelor of Science.

How will bcIMC's investment into Hayfin and PSP's investment into AlbaCore end up? I hope it ends up well for their beneficiaries but there will be a few hitches and challenges along the way.

Still, private debt is an important asset class for many institutional investors looking to improve their returns and take advantage of regulatory and structural issues hindering European and US debt markets.

Take the time to watch this clip at Citywire’s first Modern Investor forum where they brought together five institutional players to size up the investment case for private debt. You can read the accompanying article here.

Also, the financial crisis continues to leave its mark on European banks. And as yet, there are no apparent business solutions in sight. US institutions though are doing better, reporting high levels of assets. Take the time to watch this DW clip here.

Below, CNBC's Wilfred Frost reports on the effect on banks following President Donald Trump's executive order on financial regulation.

And Gildas Surry, senior analyst at Axiom Alternative Investments, talks about regulation in the banking sector for Europe, in light of Trump’s interest in rolling back the Dodd-Frank law.

US and global banks took off on Friday after the signing of the executive order to deregulate was announced but I think smart money is taking my advice to unload here and even start shorting these banks as they will struggle as rates come right back down to record lows in the second half of the year.

In a deflationary environment, I expect private debt markets all over the world will flourish and funds in this space will be a lot more active confronting the challenges and opportunities as they arise. The smart ones with the right long-term partners will be able to structure their loans and deals properly to make money no matter what hits them.

Lastly, UBC students organized an epic snowball fight on Monday. The city got walloped with snow all weekend, meaning there was more than enough powder for the hundreds who showed up to play.