Dan Fitzpatrick of the Wall Street Journal reports, Franklin, Calpers Clash on Stockton Pension Issue:

Of course, as Steve Greenhut reports, CalPERS' victory in San Bernardino "is troubling news for any Californian who is not vested in a public pension system — more evidence that even in bankruptcy cities will not be able to reasonably trim their pension costs."

Meanwhile, Randy Diamond of Pensions & Investments reports, CalPERS passes $300 billion in assets for the first time:

Below, Americans For Prosperity Michigan Director Scott Hagerstrom discusses Detroit’s bankruptcy on Bloomberg's “In The Loop.” Detroit is a shit hole and I'm highly skeptical of its new hybrid pension plan solution. If you want to know where these bankrupt cities are heading, look at this 2012 documentary below, How to Make Money Selling Drugs (embedded trailer and full version). They're all heading down the drug and crime crapper!

Two U.S. investment titans are clashing over whether public pensions should be protected in municipal bankruptcy, a major test that has implications for workers, investors and distressed cities across the country.On the value of the collateral, Robin Respaut of Reuters reports, Stockton bankruptcy judge says city's collateral not worthless:

Payments into pension funds are usually considered sacrosanct, but fights are breaking out around the U.S. over who gets priority when a municipality seeks protection from creditors. The latest battle involves the bankruptcy of Stockton, Calif., and pits mutual-fund giant Franklin Templeton Investments against California Public Employees' Retirement System, the largest public pension fund in the U.S.

The firms disagree on whether Stockton's retirement contributions should be reduced to free up money for a loan repayment. U.S. Bankruptcy Court Judge Christopher Klein in Sacramento could rule on the dispute as early as Tuesday.

Many troubled municipalities are grappling with how to bring down pension costs while municipal-bond holders are trying to figure out how to protect their interests before or during a municipal insolvency. Franklin Templeton is separately challenging a new law in Puerto Rico allowing some troubled public agencies to restructure their debt, saying it violates the U.S. Constitution.

A ruling that Stockton's pensions can be curtailed could embolden more cities to use bankruptcy as a way to seek retirement concessions. In December the judge overseeing Detroit's bankruptcy case ruled that pensions aren't entitled to "extraordinary protection" despite state constitutional safeguards against benefit cuts. Calpers has argued in court that the ruling on Detroit's city-run retirement systems doesn't apply to California's state-run plan.

The outcome in Stockton "is being watched by everyone," said Suzanne Kelly, co-founder of Scottsdale, Ariz., pension strategy and restructuring firm Kelly Garfinkle Strategic Restructuring LLC. If the judge rules that pensions can be curtailed, Ms. Kelly added, it could push cities "on the brink" to see bankruptcy as a "feasible option."

Franklin Templeton, which manages assets of more than $908 billion, is the lone creditor challenging Stockton's plan to end a two-year run through bankruptcy, arguing the northern California port city wants to unfairly slice a debt repayment while leaving public pension contributions intact. The city is offering the San Mateo, Calif., firm about $350,000, or less than 1%, back on a $35 million loan that paid for fire stations, a police station, bridges, street improvements and parks.

"The meager recovery that the city is attempting to cram down," said a Franklin Templeton spokeswoman, "has left us with no choice but to object so that we can deliver a fair recovery for our investors."

The state's retirement system, known by the acronym Calpers, has responded by arguing pension payments are guaranteed by California law and can't be cut. Stockton contributes roughly $30 million a year to Calpers, which controls retirement money for municipal workers across California and has assets of roughly $300 billion.

A Calpers actuary testified in May that Stockton would be faced with a hefty fee if it chose to terminate its relationship with the retirement system. The amount would be $1.6 billion, according to Calpers. "How will that get Franklin more money?" said John Knox, an attorney representing the city of Stockton. "It boggles the mind."

The bankruptcy judge is expected to rule on the value of the collateral supporting Franklin Templeton's $35 million loan: two golf courses and a park. It isn't known if he also will rule on the larger question of whether pensions can be reduced.

Stockton, with a population of roughly 300,000, needs the judge to approve its plan to repay creditors before it can exit from bankruptcy. It filed in June 2012 after taking on too much debt and losing tax revenue to the real-estate bust. It was the second-largest financial failure by a U.S. city and one of several California cities—San Bernardino, Vallejo and Mammoth Lakes— to seek bankruptcy protection in recent years.

The judge in Stockton, California's bankruptcy on Tuesday ruled that the city has collateral worth $4 million with which it could pay holdout creditor Franklin Templeton, dismissing the city's contention its collateral was worthless.And Roger Phillips of the Stockton Record reports, Bankruptcy ruling on hold until Oct. 1:

At the same time, U.S. Bankruptcy Judge Christopher Klein made no ruling on Tuesday on whether the California Public Employees' Retirement System, or Calpers, should be made to accept less than the entire amount it is owed while bondholders take losses in the case.

Klein's ruling on the collateral in the case of Stockton, which filed for bankruptcy in June 2012, followed a trial that concluded last month and centered around Franklin's objection to the city proposing to repay it less than a penny on the dollar for a debt of about $36 million.

The city's collateral against bonds held by Franklin includes two golf courses, a community center and a park, which the city had estimated had no value while Franklin had pegged their value at $6.12 million to $17.34 million.

"Of course one of the problems with appraisals is everyone comes in with an appraisal that supports their position," Klein said from the bench on Tuesday. "Judges have long figured out that they need to be skeptical with their opinions."

Klein challenged Calpers, Stockton and its public employees to counter his reading of the California Public Employees' Retirement Law, which he understood to spell out that Calpers itself could not be impaired in bankruptcy but employees' pensions could be.

"It seems to me if you're going to take away part of an individual's pension, the individual employee is the creditor and Calpers is in effect a servicing agency," said Klein. "It looks to me like Calpers does not bear the financial risk of a shortfall in payments. Instead the structure of the (law) places that risk on the employee."

Klein questioned a $1.6 billion termination fee that Calpers has said it could impose on Stockton if the city ended its contract with the $285.2 billion pension fund.

"It really makes me wonder whether this so-called lien is the kind of thing that could be enforced," said Klein. "I'm going to need some explanation about why I should take that lien seriously."

The question of how Calpers, the largest U.S. pension fund, should be treated is of keen interest for investors and bond issuers in the $3.7 trillion U.S. municipal bond market.

The treatment of pension systems has been uneven in the handful of recent municipal bankruptcy cases.

In the case of Detroit, the largest-ever Chapter 9 insolvency case that will go to trial later this summer, the city has proposed that city pension funds share some of the loss.

But in Vallejo, California, which emerged from bankruptcy in 2011, Calpers was left whole.

The next hearing is scheduled for Oct. 1.

Federal Judge Christopher Klein will not rule on Stockton's bankruptcy exit plan until at least October as he continues scrutinizing California's public-employee pension system, but he did make a determination Tuesday that rendered city-owned recreational facilities safe from creditors.Judge Klein is a smart man, I doubt he'll make a "boneheaded mistake." This case will be one of many that municipal bondholders, public pensions and cities teetering on bankruptcy will scrutinize.

During a 150-minute court session that ended a five-week hiatus in the bankruptcy trial, Klein said he may rule on Stockton's plan on Oct. 1. If he approves the plan, the city will emerge from bankruptcy after 27 months.

But between now and October, Klein said he wants the city to provide "a somewhat more focused analysis" of why he should confirm its proposal, called a plan of adjustment.

The judge said he continues to contemplate Stockton's decision to craft a plan that does not call for a reduction of the city's financial obligations to the California Public Employees' Retirement System.

Had Stockton sought to terminate its CalPERS contract, though, it could have cost the city in excess of $1.5 billion - more than double its annual budget.

Klein said Tuesday he "might very well conclude the CalPERS contract would be rejected and that the $1.5 billion lien is not enforceable." He added, "but that does not necessarily mean this plan of adjustment is not necessarily confirmable. It might be perfectly well confirmable."

Stockton's lead bankruptcy attorney, Marc Levinson, said Klein "is thinking about it. I don't believe he's made up his mind. He's asking counsel to give input. This is a judge who loves input."

Spokesman Brad Pacheco issued a statement on behalf of CalPERS.

"In fulfillment of our fiduciary duty, CalPERS will continue to protect the benefits promised to our members," he said.

"We welcome the opportunity to respond to the questions Judge Klein raised in court (Tuesday), to discuss the implications of the California laws that govern pensions and that create a stable retirement system that provides significant value to cities and their employees."

Former Stockton City Manager Dwane Milnes, who heads a group of retirees that formed as a result of the city's bankruptcy, said he heard nothing from Klein that the judge hadn't previously said.

"Nobody should be surprised by what he said," Milnes added. "What he said was consistent. He wants to be convinced."

Klein indicated his goal is to wrap up the case at the October hearing.

"Ideally I'd like to be able to make findings that would conclude the matter," he said.

The judge did make one ruling Tuesday of great significance to Stockton. Klein set the value of the collateral Stockton put up to secure a $35 million loan from Franklin Templeton Investments in 2009 at slightly more than $4 million.

Levinson said Stockton most likely will pay that amount to Franklin as a lump sum, though he indicated there is a chance the city will seek to pay over time. The attorney did say the city has ruled out turning over possession of the collateral to Franklin.

"It's a choice between cash, and cash over time, and I strongly suspect it will be the former," Levinson said.

Franklin's attorney, James Johnston, declined to comment on the judge's ruling. At stake in the decision were the city's hold on Oak Park (including its ice rink), as well as the Van Buskirk and Swenson golf courses. Franklin is the one bankruptcy creditor with which the city did not reach a pretrial settlement.

Months ago, a Franklin expert had assessed the value of the properties at just under $15 million if the investment giant took permanent possession of them. The city argued that the facilities have no value, mainly because they need millions of dollars in repairs and maintenance.

In the end, the judge set a value of $4,052,000, about 15 percent below what the Franklin expert had deemed as the properties' value if held until 2053.

As for his CalPERS remarks, Klein called his findings "preliminary" and said he is taking great care with a final decision because he doesn't want to make "a boneheaded mistake."

Levinson's team, as well as CalPERS attorneys, will work now to prepare briefs for the court that bolster their positions heading into October. Klein, meanwhile, has plenty of time to ponder the issue and said he still can be "persuaded" one way or the other.

"I've been sharing with you my thinking," he said toward the end of Tuesday's hearing. "I have not made any formal decisions."

Of course, as Steve Greenhut reports, CalPERS' victory in San Bernardino "is troubling news for any Californian who is not vested in a public pension system — more evidence that even in bankruptcy cities will not be able to reasonably trim their pension costs."

Meanwhile, Randy Diamond of Pensions & Investments reports, CalPERS passes $300 billion in assets for the first time:

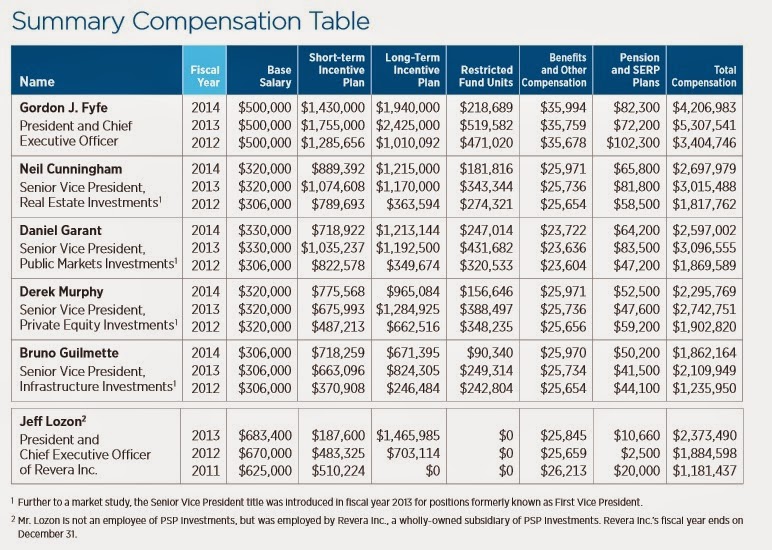

The asset size of CalPERS, the largest defined benefit pension plan in the U.S., crossed the $300 billion mark for the first time.So, CalPERS's assets hit $300 billion but their liabilities stand close to $400 billion. If stocks and interest rates plummet, they're cooked! No wonder they're fighting hard to keep every dollar they can from bankrupt cities.

California Public Employees’ Retirement System, Sacramento, reached $300.4 billion on Wednesday, spokesman Brad Pacheco said in an e-mailed statement.

Mr. Pacheco said in the statement that recent performance of the stock market has helped the pension fund achieve the milestone, but he also expressed caution about the future.

“While this is good news, there is still much more work to be done,” Mr. Pacheco said. “CalPERS has approximately 70% of the assets necessary to pay long-term retirement benefits. When our assets fell during the downturn, our pension liabilities never stopped accruing.”

CalPERS assets had reached $253 billion on Dec. 31, 2007, but one year later, assets had dropped by more than a quarter to $183.3 billion.

The Federal Thrift Savings Plan, Washington, is the only U.S. retirement plan with more assets than CalPERS; its defined contribution plans had combined total assets of $403 billion as of March 1.

Below, Americans For Prosperity Michigan Director Scott Hagerstrom discusses Detroit’s bankruptcy on Bloomberg's “In The Loop.” Detroit is a shit hole and I'm highly skeptical of its new hybrid pension plan solution. If you want to know where these bankrupt cities are heading, look at this 2012 documentary below, How to Make Money Selling Drugs (embedded trailer and full version). They're all heading down the drug and crime crapper!