Arlene Jacobius of Pensions & Investments reports, Ontario Teachers CEO calls alternative investments ‘too expensive’:

I've known Ron long enough to tell you he doesn't make big proclamations to get his name in the papers. He's been thinking long and hard of what increased competition from global pensions and sovereign wealth funds means for Ontario Teachers and other big investors.

And Ron is always thinking about risks that lurk ahead -- like 18 to 24 months ahead! I remember a time when he came over to the Caisse and talked about his investment approach in front of Henri-Paul Rousseau, Gordon Fyfe and others. On the plane ride over to Montreal, he had jotted some notes on a napkin which would form the basis of his strategy and he had forgotten the napkin in the conference room on the 11th floor. Gordon called me to go pick it up from the conference room and bring it to him outside as they shared a ride after the meeting (I didn't peek, I swear!).

So why is Ron Mock sounding the alarm on alternatives? Maybe he's worried that we are about to experience a significant shift in Fed policy which will undermine America's risky recovery and hurt real estate and infrastructure assets. Or maybe he's worried of global deflation which will be even more devastating to risk assets, especially illiquid alternatives. Or maybe he just thinks things are getting out of whack and this huge influx of sovereign wealth and pension money chasing yield at all cost is bidding up prices of private market investments to ridiculous levels.

I don't know exactly what he's thinking but he reads my blog regularly and he knows my thoughts as I've personally expressed them to him. I love what Tom Barrack, the king of real estate who cashed out before the crisis said at the time: "There's too much money chasing too few good deals, with too much debt and too few brains."

In January 2013, I openly questioned whether pensions are taking on too much illiquidity risk, and used insights from Jim Keohane, president and CEO of the Healthcare of Ontario Pension Plan (HOOPP) to make some points. Jim shared the following back then:

But even if the Fed doesn't raise rates anytime soon, the advent of global deflation should give big investors enough worries to pause and think about their entire strategy toward alternatives. Is it time to stick a fork in private equity? Are hedge fund fees ridiculously high? Is real estate the mother of all alternatives bubble, ready to burst and wreak havoc on public pensions and sovereign wealth funds?

On that last question, Tom Barrack (yup, the same guy from above), came out at the Milken conference to warn of amateurs investing in riskier assets:

Barbara Corcoran, founder at The Corcoran Group, talked about New York City real estate on Bloomberg, the lack of affordable housing in the city and why the market may be in a new bubble. She thinks things are fine but she's so blatantly talking up her business.

And it's not just New York. The same nutty thing is going on in London and other real estate hot spots around the world as the world's elite fight with global pensions and sovereign wealth funds for prime real estate assets. What a joke, this is definitely going to end badly and a bunch of amateurs are going to get their heads handed to them.

Below, Ron Mock, the president of Ontario Teachers' Pension Plan, talks about hedge funds, private equity, the eurozone crisis and the Canadian economy with CNBC (January 2015). I also embedded an Economist interview with Ron from the Canada Summit (December, 2014). Listen to his comments on how "going global introduces a whole other layer of complexity."

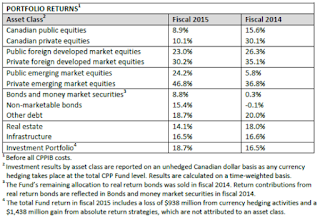

Ontario Teachers’ Pension Plan, Toronto, is starting to step back from investing in alternative investments such as real estate and infrastructure because they are “too expensive,” said Ron Mock, president and CEO of the C$154.4 billion ($126.4 billion) pension fund, while speaking on a panel at the Milken Institute Global Conference in Beverly Hills, Calif., on Wednesday.In order to better appreciate the context of Ron Mock's remarks, I highly recommend you read my overview of Teachers' 2014 results where he shared a lot of insights on their asset-liability approach to investing.

“There’s a lot of money crowded into the broadly defined alternatives space,” Mr. Mock said. “We find it too expensive. It’s time for us to step back.”

Instead, Ontario Teachers executives are investing “between the asset classes where we found the most interesting deals today,” he said.

For example, Ontario Teachers is an investor in the U.K. and Irish lotteries for their stable cash flows and high rate of return, which can be improved with technological upgrades, Mr. Mock said.

“(The lottery investment) is almost like an infrastructure asset,” he said.

Even though Ontario Teachers is being more cautious in its infrastructure investments, Canada’s eight pension funds are “dying to come into the U.S. to fund (the country’s) infrastructure needs” using direct investments, Mr. Mock said. “We are working with the government because there are impediments.”

But Mr. Mock said sovereign wealth funds and pension plans are untapped capital pools for global infrastructure.

Hiromichi Mizuno, executive managing director and chief investment officer of Japan’s ¥137 trillion ($1.15 trillion) Government Pension Investment Fund, Tokyo, also said on the panel that the pension fund has a 5% cap rather than a target allocation for alternative investments. This means Japan’s pension fund executives can invest in alternative investments opportunistically rather than try to meet a target allocation.

I've known Ron long enough to tell you he doesn't make big proclamations to get his name in the papers. He's been thinking long and hard of what increased competition from global pensions and sovereign wealth funds means for Ontario Teachers and other big investors.

And Ron is always thinking about risks that lurk ahead -- like 18 to 24 months ahead! I remember a time when he came over to the Caisse and talked about his investment approach in front of Henri-Paul Rousseau, Gordon Fyfe and others. On the plane ride over to Montreal, he had jotted some notes on a napkin which would form the basis of his strategy and he had forgotten the napkin in the conference room on the 11th floor. Gordon called me to go pick it up from the conference room and bring it to him outside as they shared a ride after the meeting (I didn't peek, I swear!).

So why is Ron Mock sounding the alarm on alternatives? Maybe he's worried that we are about to experience a significant shift in Fed policy which will undermine America's risky recovery and hurt real estate and infrastructure assets. Or maybe he's worried of global deflation which will be even more devastating to risk assets, especially illiquid alternatives. Or maybe he just thinks things are getting out of whack and this huge influx of sovereign wealth and pension money chasing yield at all cost is bidding up prices of private market investments to ridiculous levels.

I don't know exactly what he's thinking but he reads my blog regularly and he knows my thoughts as I've personally expressed them to him. I love what Tom Barrack, the king of real estate who cashed out before the crisis said at the time: "There's too much money chasing too few good deals, with too much debt and too few brains."

In January 2013, I openly questioned whether pensions are taking on too much illiquidity risk, and used insights from Jim Keohane, president and CEO of the Healthcare of Ontario Pension Plan (HOOPP) to make some points. Jim shared the following back then:

I find this whole discussion quite interesting. I agree with the commentary of the former pension fund manager. Private assets are just as volatile as public assets. When private assets are sold the main valuation methodology for determining the appropriate price is public market comparables, so you would be kidding yourself if you thought that private market valuations are materially different than their public market comparables. Just because you don’t mark private assets to market every day doesn’t make them less volatile, it just gives you the illusion of lack of volatility.

Another important element which seems to get missed in these discussions is the value of liquidity.At different points in time having liquidity in your portfolio can be extremely valuable. One only needs to look back to 2008 to see the benefits of having liquidity. If you had the liquidity to position yourself on the buy side of some of the distressed selling which happened in 2008 and early 2009, you were able to pick up some unbelievable bargains.

Moving into illiquid assets increases the risk of the portfolio and causes you to forgo opportunities that arise from time to time when distressed selling occurs - in fact it may cause you to be the distressed seller!Liquidity is a very valuable part of your portfolio both from a risk management point of view and from a return seeking point of view.You should not give up liquidity unless you are being well compensated to do so.Current private market valuations do not compensate you for accepting illiquidity, so in my view there is not a very compelling case to move out of public markets and into private markets at this time.Interestingly, nothing has changed since Jim shared those comments. If anything, things have gotten much worse from a valuation perspective and risks are higher than ever now that the Fed is hinting it's ready to start raising rates if economic data improves.

But even if the Fed doesn't raise rates anytime soon, the advent of global deflation should give big investors enough worries to pause and think about their entire strategy toward alternatives. Is it time to stick a fork in private equity? Are hedge fund fees ridiculously high? Is real estate the mother of all alternatives bubble, ready to burst and wreak havoc on public pensions and sovereign wealth funds?

On that last question, Tom Barrack (yup, the same guy from above), came out at the Milken conference to warn of amateurs investing in riskier assets:

Too many investors have moved outside their areas of expertise as they seek higher returns, posing dangers for riskier assets, according to Colony Capital Inc. Executive Chairman Thomas Barrack Jr.

“Everybody is outside of their own asset class,” Barrack said in a Bloomberg Television interview Tuesday with Erik Schatzker and Stephanie Ruhle at the Milken Institute Global Conference in Beverly Hills, California. “When amateurs enter the marketplace for all of this, you are going to get an abundance of something and it is usually not good.”

Central banks globally have pushed investors into higher-yielding assets by reducing interest rates and purchasing bonds. The Standard & Poor’s 500 Index reached an all-time high on Friday and sovereign debt in Europe is trading at negative yields.

“Institutional investors that are in this endless search for yield are ignoring the risk peril of all the consequences of those things,” he said.

Investors with an abundance of liquidity have used real estate as a safe haven, Barrack, 68, said. Apartments in New York City and London are serving as a “safe deposit box” for foreign investors, he said. The influx of money, particularly from international players seeking less risk, has pushed up property values.

“Real estate has become the last bastion,” he said. “The liquidity in the world has created this flurry for solidity. If you do not think there is a bubble at that level, you are going to be mistaken.”

Little Experience

Capitalization rates, a measure of real estate investment yield that falls as prices rise, are being driven down by buyers with less experience in property investing, Sam Zell, the billionaire chairman of Equity Group Investments, said during a Global Conference panel discussion about real estate.

“Capital investment in the last 10 to 20 years is all about allocation,” said Zell, 73. “It’s not a whole bunch of amateurs, but a bunch of people that may not have a lot of experience in real estate, but with a whole lot of money.”

To protect themselves from possible future losses, real estate investors should look for “equity-type returns” in the capital stack, Barrack said during the panel discussion.

“Floating debt can choke and kill you quickly,” he said.

Stagnant RentsGot to love Tom Barrack, he just says it like it is. Real estate, which has long been touted as the best asset class, might have seen its best days ever as the future looks increasingly gloomy for a lot of reasons, especially if America's risky recovery falters next year.

While commercial-property prices have risen, office rents in most urban downtowns, with the exception of New York City, are effectively at the same levels as 20 years ago, Barrack said.

Including such expenses as leasing commissions, tenant improvements and property taxes, “if you effectuate down in current dollars, true office rents are about the same as in 1995,” he said in the television interview.

Colony Capital oversaw about $24 billion of equity before Barrack combined it with Colony Financial Inc. this year. His firm in recent years has owned Michael Jackson’s Neverland Ranch, invested in single-family rental homes and distressed mortgages.

“When the masses start entering the water and thinking they can navigate the waves, I get out,” said Barrack.

Barbara Corcoran, founder at The Corcoran Group, talked about New York City real estate on Bloomberg, the lack of affordable housing in the city and why the market may be in a new bubble. She thinks things are fine but she's so blatantly talking up her business.

And it's not just New York. The same nutty thing is going on in London and other real estate hot spots around the world as the world's elite fight with global pensions and sovereign wealth funds for prime real estate assets. What a joke, this is definitely going to end badly and a bunch of amateurs are going to get their heads handed to them.

Below, Ron Mock, the president of Ontario Teachers' Pension Plan, talks about hedge funds, private equity, the eurozone crisis and the Canadian economy with CNBC (January 2015). I also embedded an Economist interview with Ron from the Canada Summit (December, 2014). Listen to his comments on how "going global introduces a whole other layer of complexity."