Sheelah Kolhatkar of Bloomberg wrote a comment asking, Are Hedge Funds Still for Suckers?:

I won't mince my words. A lot of hedge fund billionaires owe their fabulous wealth to luck and the collective stupidity of institutional investors who have no business whatsoever investing in hedge funds. These "sophisticated investors" follow the unwise advice of their useless investment consultants which typically recommend the hottest hedge funds they should be avoiding and that's why they get burned.

And just how brutal are these markets for well-known hedge funds? Julia La Roche of Business Insider reports, Some of Wall Street's biggest hedge fund names are racing to rescue their year:

In fact, more and more hedge funds are stepping up their involvement in the $12.8 trillion Treasurys market, picking up the slack from Wall Street dealers and amassing a record amount of U.S. government debt:

Thankfully, all is not doom and gloom in the hedge fund industry. Rob Copeland of the Wall Street Journal reports, Giant hedge fund’s radical idea: Performance guaranteed or your money back:

I like this fund a lot and have gotten plenty of trading ideas by peering into its portfolio (Puma Biotechnology and Advaxis sold off strongly following Q2 13-F releases and the latter seems to be breaking out again while the former is still struggling a bit at these levels).

I like the fund's incentive model but they did it to collect a huge chunk of assets, which is why they can charge a lot less than the traditional 2% management fee. Still, unlike many other big funds, I can hardly accuse them of being big fat asset gatherers as they collect an incentive (performance) fee on trading profits above the S&P 500 returns. And as the article states, they pay back up to half of all fees if they fall short of the benchmark in the subsequent year.

Is the hedge fund industry doomed? I don't think so but there needs to be much better alignment of interests with investors. And let me be clear on this, many institutions have no business investing in hedge funds because they're not staffed properly to understand the risks of all these "sophisticated" alpha strategies. They're literally lambs going off to the slaughter, incapable of shaking off their hedge fund Stockholm Syndrome.

I know I sound like a broken record but stop falling in love with your hedge fund managers and start grilling them to understand the risks of their strategies going forward. When it comes to hedge funds, I feel like I'm watching the same terrible movie over and over again.

Every time the market plunges, I smell cigar smoke. It filled the halls where I once worked as an analyst for a hedge fund. The fund next door was primarily a short fund, betting heavily that certain stocks would go down. The further the market fell, the thicker the smoke.Indeed, more and more dumb money chasing after the pension rate-of-return fantasy is piling into hedge funds, private equity funds, and other alternative investments, praying for a miracle that will never come. Instead of following CalPERS' lead, many delusional U.S public pensions are getting robbed blind, paying huge fees to hedge funds and their Wall Street buddies, enriching these grossly overpaid"titans of finance"

A similar scenario has played out over the past month, when markets stopped what had become a vertiginous ascent, driven largely by a bubble of low interest rates, and started behaving erratically. Concerns about interest rates rising became more acute, and currency markets spiraled downward. Then China suddenly devalued the yuan, triggering a huge selloff. Panic was in the air. It was time for hedge funds to shine.

Based on the information available so far, though, that’s not exactly what happened. As I suggested here, maybe hedge funds are for suckers.

A number of the industry’s biggest names had a difficult, some might say brutal, time in August. It’s not surprising, considering that several days brought enormous swings in the market that caused even the most long-term-minded investors whiplash.

David Einhorn’s Greenlight Capital flagship fund fell 5.3 percent in August, putting it at –14 percent so far for 2015, according to Bloomberg News. Third Point, run by Daniel Loeb, saw a 5.2 percent decline in its main fund in August. Ray Dalio of Bridgewater Associates saw his macro fund decline 6.9 percent last month. These superstars performed more dramatically badly than the HFRX Global Hedge Fund Index, which was down 2.2 percent in August and 1.42 percent for the year. The Standard & Poor’s 500-stock index lost 6.3 percent in August and is down about 4 percent in the year to date.

Hedge funds were conceived as boutique investments for the wealthy designed to shield a slice of one’s portfolio from market volatility and provide steady returns. In exchange for this rather esoteric and highbrow service, most funds charge handsomely: a management fee of 2 percent of assets, plus 20 percent of the profits. The pricing model transformed a generation of stock traders into billionaires.

But while hedge funds overall have outperformed the broader market this year, it comes after years of lagging far behind. In 2012-14, when the S&P 500 rose 13 percent, 29.6 percent, and 13.5 percent, respectively, the HFRX index was up only a few percentage points each year, if that.

“August was a fair test, and many hedge funds had a tough time,” Simon Lack, author of The Hedge Fund Mirage, told the New York Times. They “failed to beat a 60/40 [stock and bond index] mix every single year since 2002, and they’re on track to repeat this year.”

The California Public Employees’ Retirement System last year announced it was pulling its entire $4 billion out of hedge fund investments, arguing that they’re hard to understand and too expensive to justify the returns they provide. Expectations at that time ran high that other big pension funds and endowments would follow. The opposite happened.

There is now almost $3 trillion invested in hedge funds. Perhaps this latest market upheaval has a silver (another underperformer) lining, and more investors will ask if they’re worth it.

I won't mince my words. A lot of hedge fund billionaires owe their fabulous wealth to luck and the collective stupidity of institutional investors who have no business whatsoever investing in hedge funds. These "sophisticated investors" follow the unwise advice of their useless investment consultants which typically recommend the hottest hedge funds they should be avoiding and that's why they get burned.

And just how brutal are these markets for well-known hedge funds? Julia La Roche of Business Insider reports, Some of Wall Street's biggest hedge fund names are racing to rescue their year:

August was a brutal month for some of the biggest names in the hedge fund industry.

In some cases, losses in August wiped out gains for the year, and now it will be a race against time to rebound and finish the year in the black.

Bloomberg News' Simone Foxman reports that billionaire hedge fund manager John Paulson, who runs the $19 billion Paulson & Co., got crushed in August.

Here's a rundown of how some of his funds performed:Paulson had his second-worst performance ever last year, with his Advantage Plus fund falling 36% and his Advantage fund falling 29%. In 2014, Paulson Partners ended the year up 0.8%, while the Enhanced fund fell 1.6%.

- Paulson Partners fell 4.2% in August, leaving the fund up 6.5% for the year.

- Paulson's Advantage Fund fell 4.9% in August, and it is now down 3.6% for the year.

- Paulson's Special Situations Fund fell 8.4% in August, and it is now down about 12% for the year.

Paulson, of course, isn't alone.

Activist investor Nelson Peltz's Trian Partners fell 4.8% in August, leaving the fund down 3.45% for the year, Reuters' Lawrence Delevingne and Michael Flaherty reported.

Peltz has had just one losing year: His fund lost 19% during the financial crisis in 2008.

Activist investors Dan Loeb, David Einhorn, and Bill Ackman all took a hit in August, too.

Here's the rundown:There's a broad perception that hedge funds are created to manage risk and generate returns in all market environments. The wild market swings in August made it clear, however, that in the short run it doesn't always work that way.

- Loeb's Third Point Off Shore fund, which employs an event-driven and value investing strategy, fell 5.2% and was last up just 0.1% for the year.

- Einhorn's Greenlight Capital flagship fund fell 5.3% in August, bringing the fund down 14% for the year.

- Ackman's Pershing Square Holdings fell 9.2% in August, leaving the fund down 0.1% for the year.

The average hedge fund was down 2.2% in August, according to data from Hedge Fund Research, compared with the S&P 500, which fell 6.2%. August was a wild month for the stock market overall, with the Volatility Index (VIX) hitting its highest level in four years while markets got clobbered on August 24.There's no question some big name hedge funds are taking a beating this year, prompting a slew of negative articles and academic research questioning their value. Some are warning to beware of small hedge funds but I'm more worried of large hedge funds taking on huge leverage to snap up Treasurys.

"People call us a hedge fund," Ackman said on CNBC on Friday. "From an industry perspective, we need to explain better what a hedge fund is."

"I can't tell you where any of our stocks are going to be next month," Ackman said on CNBC, adding that he thought the businesses his fund owned like Mondelez would be much more valuable in the long-term.

So far in September, Ackman's fund is up 0.4%, leaving the fund up 0.3% for the year.

In fact, more and more hedge funds are stepping up their involvement in the $12.8 trillion Treasurys market, picking up the slack from Wall Street dealers and amassing a record amount of U.S. government debt:

Asset managers domiciled in the Caribbean, seen as a proxy for hedge funds, held $318.5 billion of U.S. government debt as of midyear, an all-time high, the most recent Treasury data show. The barons of risk-taking are adding liquidity to the market as securities firms have stepped back because of heightened regulations after the financial crisis.I wonder how many public pension funds are also levering up their bond portfolio as they engage in risk parity strategies that are getting clobbered this year. More interestingly, Institutional Investor reports that hedge funds are now filling the gap in the U.S. municipal bond market to diversify their credit exposure (that's the next big blowup in the making).

The money managers are poised for swings in fixed-income prices as the debate rages over when the Federal Reserve will raise interest rates. Treasurys’ volatility surged to a six-month high in August amid China’s currency devaluation and a global equities rout. The turbulence rewarded bets on sharper price fluctuations in bonds amid global instability and diverging central bank policies.

“There are a lot of cross currents in the marketplace and a lot of competing macro calls,” said Jason Evans, co-founder of NineAlpha Capital, a New York hedge fund specializing in U.S. government debt.

There are more trading opportunities for hedge funds since securities firms curbed risk-taking in the face of higher capital requirements set by the Basel Committee on Banking Supervision and the Dodd-Frank Act in the U.S.

The 22 primary dealers that trade Treasurys with the Fed cut their inventories by 46 percent to $78.7 billion as of last month, from a peak of $146 billion in 2013, Fed data show.

“The pendulum has swung a little from the banks to the buy side, including both traditional asset managers and hedge funds,” Evans said.

Thankfully, all is not doom and gloom in the hedge fund industry. Rob Copeland of the Wall Street Journal reports, Giant hedge fund’s radical idea: Performance guaranteed or your money back:

Hedge-fund managers have long clung to a doctrine of high fees in good years and bad, minting billionaires and riling investors along the way.

A pair of former Harvard University endowment executives have built the world’s largest stock-focused hedge fund with the opposite approach. Robert Atchinson and Phillip Gross let investors in their $28 billion Adage Capital Management LP keep almost all of their trading gains—and promise refunds if the fund’s performance falters (click on image).

By hedge-fund standards, the practice is nearly unheard of, and this year it may be particularly costly. Adage has underperformed the S&P 500 through August. If they can’t turn things around by the end of the year, Messrs. Atchinson and Gross may hand out the biggest refunds in their firm’s history.Adage Capital Management is one of many top funds I track every quarter. You can view its latest holdings from Q2 2015 here. You can also visit their website here.

Hedge-fund managers typically collect about 2% of investors’ assets under management every year and about 20% of profits—whether they beat the markets or not.That has put the industry under increasing pressure for what is viewed by critics as a heads-I-win, tails-you-lose proposition. Even managers who fall short of their benchmarks can earn hefty paychecks simply by riding markets higher.

At Adage, Messrs. Atchinson and Gross charge 0.50% of assets, less than at even many actively managed mutual funds. They also pay themselves only for trading profits that beat the S&P 500, including dividends—they take 20% of the returns above the S&P. And they pay back up to half of those fees if they fall short of the benchmark in the subsequent year.

Its system pays off for Adage in one important way: It collects its full incentive fees even if it loses money, as long as it beats the benchmark. Most fund managers collect performance fees only if they produce positive absolute returns.

Adage is getting harder to dismiss as an anomaly. The firm has nearly doubled in size over the past four years and is now one of the world’s 10 largest hedge funds.Its approach also reflects a bigger structural change in the industry. Many of the public retirement plans and other institutional investors that have poured money into hedge funds for years have hit their limits on what they can allocate to the sector. To keep the gas pedal on growth, hedge-fund managers are increasingly recasting themselves as something closer to staid money managers like Fidelity Investments. In many cases, that means taking a different tack on fees.

For instance, a new wave of single-bet deals, known as co-investments when sold by firms like Magnetar Capital LLC and Trian Fund Management LP, often carry half-off prices on performance fees compared with traditional hedge funds.

“That’s how I think the world should look,” said Jack Meyer, the former head of Harvard’s endowment. Mr. Meyer’s $10 billion Convexity Capital Management LP only collects performance fees when it exceeds a market benchmark. “I’m surprised it has taken the world so long to get there,” he said.

Despite the drumbeat for change, hedge funds as a group haven’t altered their practices. Money continues to pour into the $2.9 trillion industry as plenty of wealthy investors still appear willing to pay high fees for access to complicated strategies and the promise of protection against market swoons. The average hedge fund charges a 17.7% annual incentive fee, down from 19.3% at the start of 2008, according to HFR Inc.

Still, the industry has come under an unusual amount of pressure that threatens its ways of doing business long term. The California Public Employees’ Retirement System, the nation’s largest public pension, said last fall it would eliminate its entire $4 billion investment in hedge funds due in part to concerns about high costs, and other public pensions have followed suit.

From offices high in Boston’s John Hancock Tower, Adage’s founders preside over an operation that bears little resemblance to most hedge funds. There is no central trading desk or bullpen area to swap ideas, people familiar with the firm said.

Investment analysts, 26 in total including the founders, work silently in separate offices ringing the floor. Six golf putting holes dot the space, people familiar with the firm said, though they are rarely used except for a half-hour tournament each December in which the winner gets no money. A person who has been inside described it as a “library.”

Adage’s founders still make plenty of money. Last year, the founders and staff split an estimated $400 million in gross earnings after the firm’s main fund rose 18.4%, people familiar with the matter said. Still, that is less than a third of the more than $1 billion they would have collected under a typical hedge-fund fee structure.

The founders break from tradition in small ways, too. Mr. Atchinson drives a seven-year-old Nissan Altima, and Mr. Gross takes the Peter Pan bus to his summer home on Cape Cod.

“That’s just how they approach life in general,” said Timothy Peterson, founder of Regiment Capital Advisors LP and a former Harvard colleague of the founders. “They feel very comfortable not being the center of attention.”

Because of its unusual practices, Adage is viewed by its large investors as its own breed. The University of California system’s $98 billion endowment has $1.4 billion riding on Adage—more than in any other stock investment except for three low-cost index funds, which it considers to be in the same category. Endowment Senior Managing Director Scott Chan said, “a lot of people would call them a hedge fund,” but that he isn’t particularly concerned about the distinction.

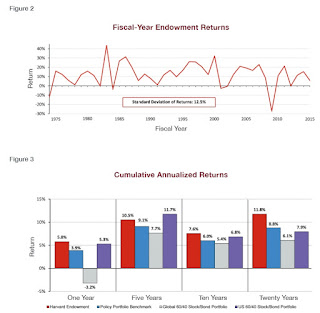

Since it was started with $3.8 billion in October 2001, Adage has produced an average annualized return, after fees, of about 9.7%, beating the S&P 500’s 6.4% pace, including dividends. The average stock-focused hedge fund averaged 5.3%. Adage is down 3.53% this year through the end of August, worse than the benchmark’s drop of 2.88%, including dividends.

Until this year, Adage fell short of the benchmark and passed out refunds only twice. That happened in 2002 and 2008, after it lagged behind the S&P 500 by 0.18 percentage point and 0.75 percentage point, respectively.

Unlike most hedge funds, which juggle a variety of offsetting bets, Adage holds far more bullish bets than bearish ones and keeps its proportion of the wagers static. Bets on industries must be equal, percentagewise, to that sector’s representation in the S&P 500. That means the firm’s more than 1,500 stock positions tend to ride the ups and downs of the benchmark. Any difference comes from individual stock picks, such as the firm’s roughly $500 million position in Puma Biotechnology Inc., which has more than quadrupled in value since the start of 2013.

Messrs. Atchinson and Gross met as investment analysts in the mid-1980s at Harvard’s endowment. Mr. Atchinson, 57 years old, traded mostly aerospace and defense firms, while Mr. Gross, 55, focused on drug companies and other health-care stocks.

When Mr. Meyer took charge of the endowment in 1990, he put his traders on notice: Beat the benchmark or find a new job. Many left. Messrs. Atchinson and Gross took on the challenge, initially topping the benchmark by 0.50 percentage point and more in subsequent years. They got rich—Harvard paid them a bonus of around 4% of their outperformance, at peak amounting to more than $10 million apiece—but drew scorn from some alumni and professors unhappy about the hefty paydays for an academic institution.

In part because of the scrutiny, Mr. Atchinson persuaded Mr. Gross to leave in 2001. They took with them an 18-person team and $1.8 billion day-one investment from Harvard in exchange for an agreement, since phased out, to tithe a portion of their firm’s future earnings to the school.

The founders’ move from academia to hedge funds came with an added bonus: a chance to refashion themselves as symbols of frugality after years of criticism for their pay. Adage’s unique position, with one foot inside the lucrative hedge-fund industry and one foot out of it, is perhaps most plain on weekends during the summer.

Like many hedge-fund managers, Mr. Atchinson, who goes by Bob, heads to his vacation home on Nantucket. Unlike his peers, Mr. Atchinson usually hops on a commercial Cape Air flight. When he does fly private, it is on “Air Mom,” his name for the single-engine turboprop in which he owns a one-eighth share and often ferries around his mother.

Back at Boston’s Logan Airport on Monday mornings, he waits for a taxi to take him into the office.

I like this fund a lot and have gotten plenty of trading ideas by peering into its portfolio (Puma Biotechnology and Advaxis sold off strongly following Q2 13-F releases and the latter seems to be breaking out again while the former is still struggling a bit at these levels).

I like the fund's incentive model but they did it to collect a huge chunk of assets, which is why they can charge a lot less than the traditional 2% management fee. Still, unlike many other big funds, I can hardly accuse them of being big fat asset gatherers as they collect an incentive (performance) fee on trading profits above the S&P 500 returns. And as the article states, they pay back up to half of all fees if they fall short of the benchmark in the subsequent year.

Is the hedge fund industry doomed? I don't think so but there needs to be much better alignment of interests with investors. And let me be clear on this, many institutions have no business investing in hedge funds because they're not staffed properly to understand the risks of all these "sophisticated" alpha strategies. They're literally lambs going off to the slaughter, incapable of shaking off their hedge fund Stockholm Syndrome.

I know I sound like a broken record but stop falling in love with your hedge fund managers and start grilling them to understand the risks of their strategies going forward. When it comes to hedge funds, I feel like I'm watching the same terrible movie over and over again.