Timothy W. Martin of the Wall Street Journal reports, Giant California Teachers Pension, Calstrs, Posts Worst Result Since 2008 Crisis:

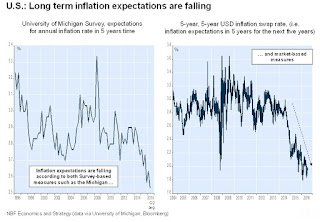

In fact, as I write my comment, Krishen Rangasamy, senior economist at the National Bank of Canada sent me his Hot Chart on US long-term inflation expectations (click on image):

The point I'm trying to make is with US inflation expectations falling and the 10-year Treasury note yield hovering around 1.58%, all pensions will be lucky to return 5% annualized over the next ten years, never mind 7.5%, that is a pipe dream unless of course they crank up the risk exposing their funds to significant downside risks.

Taking more risk when your unfunded liabilities are growing by 27 percent (CalSTRS) or 59 percent (CalPERS) is not a given because if markets crash, those unfunded liabilities will soar past the point of no return (think Illinois Teachers pensions).

Anyways, let's get back to covering CalSTRS's fiscal year results. CalSTRS put out a press release announcing its fiscal 2015-16 results:

You can read more CalSTRS press releases here including one that covers research from University of California, Berkeley which shows that for the vast majority of teachers, the California State Teachers’ Retirement System Defined Benefit pension provides a higher, more secure retirement income compared to a 401(k)-style plan. (I don't need convincing of that but they need to significantly improve the funded status to make these pensions sustainable over the long run).

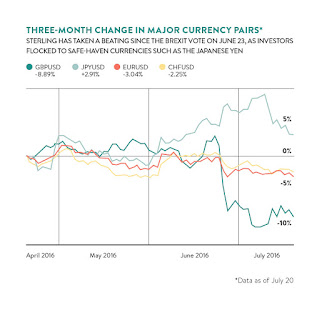

Below, a CNBC discussion on the Brexit vote impact on investments and retirement funds with Christopher Ailman, California State Teachers Retirement System (CalSTRS) CIO.

Ailman said he's worried about the UK and Europe and he's right. The Brexit vote was Europe's Minsky moment and while short-term, everything seems fine, longer-term, things are less clear, especially if global deflation sets in. If that happens, all pensions will need to lower their investment assumptions quite significantly.

The nation’s second-largest public pension posted its slimmest returns since the 2008-2009 financial crisis because of heavy losses in stocks.John Gittelsohn of Bloomberg also reports, Calstrs Investments Gain 1.4% as Pension Fund Misses Goal:

The California State Teachers’ Retirement System, or Calstrs, earned 1.4% for the fiscal year ended June 30, according to a Tuesday news release. The result is the lowest since a 25% loss in fiscal 2009 and well below Calstrs’ long-term investment target of 7.5%. Calstrs oversees retirement benefits for 896,000 teachers.

The soft returns by Calstrs, which manages $189 billion, foreshadow tough times for other U.S. pension plans as they grapple with mounting retirement obligations and years of low interest rates. On Monday the largest U.S. pension, the California Public Employees’ Retirement System, said it earned 0.6% on its investments. Other large plans are posting returns in the low single-digits.

Calstrs did report big gains in real estate and fixed income. But its holdings of U.S. and global stocks—which represent more than half of its assets—declined by 2.3%.

The fund earned 2.9% on its private-equity investments, falling short of its internal benchmark by 1.7 percentage points. Real estate rose 11.1% but lagged behind the internal target.

Calstrs investment chief Christopher Ailman said the fund’s portfolio “is designed for the long haul and “we look at performance in terms of decades, not years.”

Over the past five years, Calstrs has posted returns of 7.7%. But the gain drops to 5.6% over 10 years and 7.1% over 20 years.

The California State Teachers’ Retirement System, the second-largest U.S. public pension fund, earned 1.4 percent in the 12 months through June, missing its return target for the second straight year.

Calstrs seeks to earn 7.5 percent on average over time to avoid falling further behind in its obligations to 896,000 current and retired teachers and their families. The fund, which had $188.7 billion in assets as of June 30, averaged returns of 7.8 percent over the last three years, 7.7 percent over five years, 5.6 percent over 10 years and 7 percent over 20 years.

“The Calstrs portfolio is designed for the long haul,” Chief Investment Officer Christopher Ailman said Tuesday in a statement. “We look at performance in terms of decades, not years. The decade of the 2010s has so far been a good performer, averaging 10.3 percent net.”

U.S. pension funds have struggled to meet investing goals amid stock volatility, shrinking bond returns and slowing emerging-market growth at a time when retirees are living longer and health-care costs are rising. Long-term unfunded liabilities may ultimately need to be closed by higher employee withholding rates, reduced benefits or bigger taxpayer contributions.

The California Public Employees’ Retirement System, the nation’s largest pension fund with $302 billion in assets, earned 0.6 percent for the latest fiscal year, according to figures released Monday. Calpers trails its assumed annualized 7.5 percent rate of return for the past three-, five-, 10-, 15- and 20-year periods.

Calstrs and Calpers are bellwethers for public pension funds because of their size and investment approach. Both have pressured money managers to reduce fees while also using their influence as shareholders to lobby for environmental, social and corporate-governance reforms.

Calstrs returned 4.8 percent in the previous fiscal year after gaining 19 percent in 2014. Over the last decade, the teacher system’s returns ranged from a 23 percent gain in 2011 to a 25 percent loss in 2009.

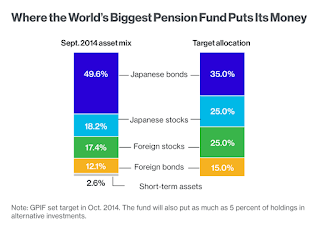

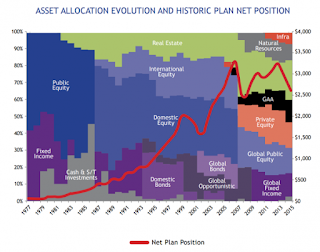

Asset AllocationOf course, professor Nation is right, CalPERS, CalSTRS and pretty much all other delusional US public pensions clinging to some pension-rate-of-return fantasy are going to have to lower their investment assumptions going forward. The same goes for all pensions.

The fund’s investments in stocks fell 2.3 percent last year, while fixed income and real estate both rose 11 percent and private equity increased 2.9 percent. As of June 30, Calstrs had about 55 percent of its assets in global stocks, 17 percent in fixed-income, 14 percent in real estate, 8.7 percent in private equity with the balance in cash and other financial instruments.

While Calstrs outperformed its benchmark index for equities by 0.2 percent last year, its returns trailed in every other category.

Since 2014, Calstrs’s unfunded liability has grown an estimated 27 percent to $69.2 billion while Calpers’s gap has increased 59 percent to $149 billion, according to Joe Nation, a professor of the practice of public policy at Stanford University. Both retirement systems’ assumptions of 7.5 percent returns are based on wishful thinking, he said.

“The assumption is we’re going to have a period like the 1990s again,” Nation said. “And there are very few people who believe that you’ll get the equity returns over the next five or 10 years that we saw in the 1990s.”

In fact, as I write my comment, Krishen Rangasamy, senior economist at the National Bank of Canada sent me his Hot Chart on US long-term inflation expectations (click on image):

While U.S. financial conditions and economic data have improved lately with consensus-topping June figures for employment, industrial output and retail spending, that’s not to say the Fed is ready to resume rate hikes. Brexit has raised downside risks to global economic growth and the FOMC will appreciate the potential spillover effects to the U.S. economy. But perhaps more concerning to the Fed is that its persistent failures to hit its inflation target ─ for four consecutive years now, the annual core PCE deflator has been stuck well below the Fed’s 2% target ─ is starting to disanchor inflation expectations.

As today’s Hot Charts show, both survey-based and market-based measures are showing sharp declines in inflation expectations. The University of Michigan survey even shows the lowest ever quarterly average for long-term inflation expectations. So, while markets are now pricing in a decent probability of a Fed interest rate hike later this year, we remain of the view that the FOMC should refrain from tightening monetary policy until at least 2017.I agree, the Fed would be nuts to raise rates as long as global deflation remains the chief threat but some think it needs to raise rates a bit in case it needs to lower them again in the future (either way, I remain long the USD in the second half of the year).

The point I'm trying to make is with US inflation expectations falling and the 10-year Treasury note yield hovering around 1.58%, all pensions will be lucky to return 5% annualized over the next ten years, never mind 7.5%, that is a pipe dream unless of course they crank up the risk exposing their funds to significant downside risks.

Taking more risk when your unfunded liabilities are growing by 27 percent (CalSTRS) or 59 percent (CalPERS) is not a given because if markets crash, those unfunded liabilities will soar past the point of no return (think Illinois Teachers pensions).

Anyways, let's get back to covering CalSTRS's fiscal year results. CalSTRS put out a press release announcing its fiscal 2015-16 results:

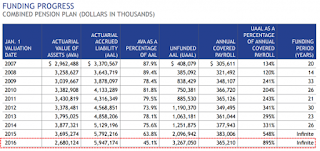

The California State Teachers’ Retirement System remains on track for full funding by the year 2046 after announcing today that it ended the 2015-16 fiscal year on June 30, 2016 with a 1.4 percent net return. The three-year net return is 7.8 percent, and over five years, 7.7 percent net.A few brief remarks on the results below:

The overall health and stability of the fund depends on maintaining adequate contributions and achieving long-term investment goals. The CalSTRS funding plan, which was put in place in June 2014 with the passage of Assembly Bill 1469 (Bonta), remains on track to fully fund the system by 2046.

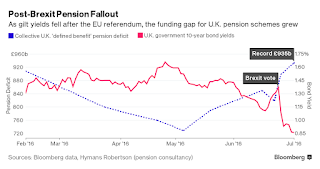

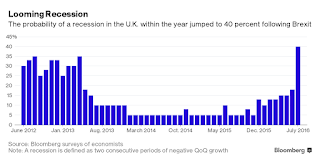

CalSTRS investment returns for the 2015-16 fiscal year came in at 1.4 percent net of fees. However, the three-and-five year performance for the defined benefit fund still surpass the 7.5 percent average return required to reach its funding goals over the next 30 years. Volatility in the equity markets and the recent June 23 U.K. referendum to exit the European Union, also known as Brexit, left CalSTRS’ $188.7 billion fund about where it started the fiscal year in July 2015.

“We expect the contribution rates enacted in AB 1469 and our long-term investment performance to keep us on course for full funding,” said CalSTRS Chief Executive Officer Jack Ehnes. “We review the fund’s progress every year through the valuation and make necessary adjustments along the way. Every five years we’ll report our progress to the Legislature, a transparency feature valuable for any such plan.”

The 2015-16 fiscal year’s investment portfolio performance marks the second consecutive year of returns below the actuarially assumed 7.5 percent. Nonetheless, CalSTRS reinforces that it is long-term performance which will make the most significant impact on the system’s funding, not short-term peaks and valleys.

CalSTRS continues to underscore and emphasize the long-term nature of pension funding as it pertains to investment performance and the need to look beyond the immediate impacts of any single year’s returns. And although meeting investment assumptions is very important to the overall funding picture, it is just one factor in keeping the plan on track. Factors such as member earnings and longevity also play important roles.

“Single-year performance and short-term shocks, such as Brexit, may catch headlines but the CalSTRS portfolio is designed for the long haul. We look at performance in terms of decades, not years,” said CalSTRS Chief Investment Officer Christopher J. Ailman. “The decade of the 2010s has so far been a good performer, averaging 10.3 percent net.”

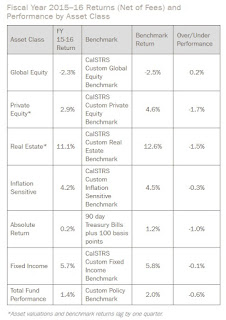

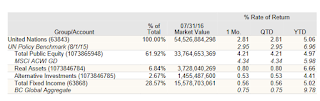

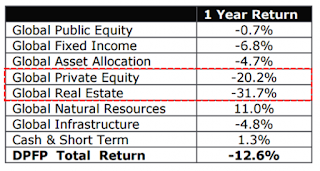

CalSTRS’ net returns reflect the following longer-term performance:Fiscal Year 2015–16 Returns (Net of Fees) and Performance by Asset Class (click on image):

- 7.8 percent over three years

- 7.7 percent over five years

- 5.6 percent over 10 years

- 7.1 percent over 20 years

As of June 30, 2016, the CalSTRS investment portfolio holdings were 54.8 percent in U.S. and non-U.S. stocks, or global equity; 16.9 percent in fixed income; 8.7 percent in private equity; 13.9 percent in real estate; 2.8 percent in inflation sensitive and absolute return assets; and 2.9 percent in cash.

About CalSTRS

The California State Teachers’ Retirement System, with a portfolio valued at $188.7 billion as of June 30, 2016, is the largest educator-only pension fund in the world. CalSTRS administers a hybrid retirement system, consisting of traditional defined benefit, cash balance and voluntary defined contribution plans. CalSTRS also provides disability and survivor benefits. CalSTRS serves California’s 896,000 public school educators and their families from the state’s 1,700 school districts, county offices of education and community college districts.

- Just like CalPERS and other large public pensions with a large asset allocation to global equities, CalSTRS has a lot of beta in its portfolio. This means when global stocks take a beating or slump, their Fund will underperform pensions with less beta in their portfolio (like CPPIB, PSP, Ontario Teachers, etc.). Conversely, when global stocks soar, they will outperform these pensions. But when stocks get hit, all pensions suffer in terms of performance (some a lot more than others).

- Also similar to CalPERS, Private Equity had meager returns of 2.9%, underperforming its benchmark which returned 4.6%. CalPERS's PE portfolio returned less (1.7%) but outperformed its benchmark by 253 basis points which signals "benchmark gaming" to me. You should all read Yves Smith's comment, CalPERS Reported That It Made Less in Private Equity Than Its General Partners Did (Updated: As Did CalSTRS), to get more background and understand the key differences. One thing is for sure, my comment earlier in November 2015 on a bad omen for private equity was timely and warned all you the good days for PE are over.

- CalSTRS's performance in Real Estate (11.1%) significantly outperformed that of CalPERS (7.1%) but it under-performed its benchmark which returned 12.6%. Note that CalPERS realized losses on the final disposition of legacy assets in the Opportunistic program which explains this relative underperformance.

- More interesting, however, is how both CalPERS and CalSTRS use a real estate benchmark which reflects the opportunity cost, illiquidity and risk of the underlying investments. I'm mentioning this because private market assets at CalPERS and CalSTRS are valued as of the end of March, just like PSP and CPPIB. But you'll recall I questioned the benchmark PSP uses to value its RE portfolio when I went over its fiscal 2016 results and this just makes my point. Again, this doesn't take away from PSP's outstanding results in Real Estate (14.4%) as they beat the RE benchmark CalPERS and CalSTRS use, just not by such a wide margin.

- Fixed Income returned less at CalSTRS (5.7%) than at CalPERS (9.3%) but it uses a custom benchmark which is different from that of the latter. Still, with 17% allocated to Fixed Income, bonds helped CalSTRS buffer the hit from global equities.

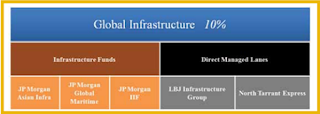

- Inflation Sensitive Assets returned 4.2% but CalSTRS doesn't break it down to Infrastructure, Natural Resources, etc. so I can't compare it to CalPERS's results.

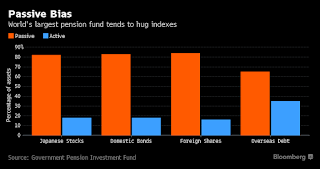

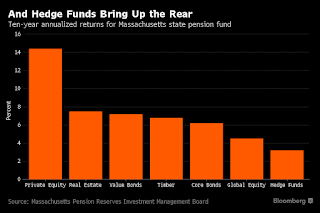

- Absolute Return returned a pitiful 0.2%, underperforming its benchmark by 100 basis points (that benchmark is low; should be T-bills + 500 or 300 basis points). Ed Mendell wrote a comment, As CalPERS Exits Hedge Funds, CalSTRS Adds More, explaining some of the differences in their approach on hedge funds. CalSTRS basically just started investing in large global macro and quant funds and squeezes them hard on fees. The party in Hedge Fundistan is definitely over and while many investors are running for the exits, most stay loyal to them, paying outrageous fees for mediocre returns.

You can read more CalSTRS press releases here including one that covers research from University of California, Berkeley which shows that for the vast majority of teachers, the California State Teachers’ Retirement System Defined Benefit pension provides a higher, more secure retirement income compared to a 401(k)-style plan. (I don't need convincing of that but they need to significantly improve the funded status to make these pensions sustainable over the long run).

Below, a CNBC discussion on the Brexit vote impact on investments and retirement funds with Christopher Ailman, California State Teachers Retirement System (CalSTRS) CIO.

Ailman said he's worried about the UK and Europe and he's right. The Brexit vote was Europe's Minsky moment and while short-term, everything seems fine, longer-term, things are less clear, especially if global deflation sets in. If that happens, all pensions will need to lower their investment assumptions quite significantly.