Rob Kozlowski of Pensions & Investments reports, CPPIB to aid China with pension reform, other issues:

What are my thoughts? I generally think any bilateral trade agreement with China is a good thing, and the fact the Chinese seized this opportunity to forge stronger ties with Canada's largest pension fund speaks volumes on the respect they have for Canada's large, well-governed pensions.

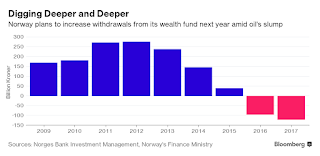

A couple of weeks ago, I discussed the global pension crunch, highlighting the problems Chinese policymakers face with their state pensions, many of which are chronically underfunded and need to be shored up as the population ages and benefits need to be paid out.

In April, I discussed China's pension gamble, criticizing the use of pensions to inflate stock prices higher as an irresponsible policy which will hurt the Chinese market in the long run.

What can the Chinese learn from CPPIB? A lot. First and foremost, they cam learn the benefits of good governance and why it's crucial for their state pensions' long-term success. Admittedly, good governance isn't something that comes easily in China where the government interferes in everything but this is something that needs to be changed.

Second, they can learn all about the benefits of three major structural advantages that are inherent to the CPP Fund – long horizon, scale, and certainty of assets; and three developed advantages that result from strategic choices they have made – internal expertise, expert partners, and Total Portfolio Approach (click on image below).

Together, these advantages provide CPPIB with a distinct perspective for investment decision-making.

Most importantly, China's large pensions can forge ties with CPPIB and invest alongside it in big private market deals in China, Asia and elsewhere. This is a win-win for all parties which is why I'm glad they signed this memorandum of understanding.

Unfortunately, all is not well between Canada and China. In particular, I'm a bit concerned when I read Joe Oliver, the former Conservative minister of finance, writing a comment in the National Post saying, We have no choice but to slap a tax on Toronto houses being bought by foreigners.

Really? Apart from being discriminatory against foreigners (ie., Chinese), these taxes don't address the root cause of lack of affordable housing in Vancouver and Toronto -- the lack of supply!! -- and they were hastily implemented to appease the poor and middle class without careful consideration how they will negatively impact the economies of British Columbia and Ontario.

A friend of mine who lived in Vancouver and moved back to Montreal put it succinctly when he read CIBC said that Ontario will need to implement foreign buyer tax on housing:

Anyways, enjoy your weekend and remember, behind the trade agreement with China, there's an equally important agreement on the pension front which will aslo benefit Chinese and Canadians. This is undeniably great news for both countries.

Below, Chinese Premier Li Keqiang is on Parliament Hill for the first visit to Canada by a Chinese leader in six years. Canadian Prime Minister Justin Trudeau says Canada is exploring a free trade agreement with China, as he hosts his Chinese counterpart in Ottawa.

And take the time to listen to an AVCJ interview with Mark Machin, President and CEO of CPPIB, which took place last year when he was head of international and Asian investments. Listen carefully to his comments and you will realize why China is forging ties with CPPIB to reform its pensions.

Canada Pension Plan Investment Board, which manages the assets of the C$287.3 billion ($217.4 billion) Canada Pension Plan, Ottawa, signed a memorandum of understanding with the National Development and Reform Commission of the People’s Republic of China to offer its expertise to the country on a variety of issues, a CPPIB news release said Thursday.Jacqueline Nelson of the Globe and Mail also discusses this agreement here (subscription required). You can read the news release on CPPIB's website here.

The memorandum of understanding includes the CPPIB assisting China’s policymakers “as they address the challenges of China’s aging population, including pension reform and the promotion of investment in the domestic senior care industry from global investors,” the news release said.

“As we continue to deploy capital in important growth markets like China for the benefit of CPP contributors and beneficiaries, there is significant value for a long-term investor like CPPIB in sharing information, experience and successful practices with policymakers as they work toward improving policy frameworks,” said Mark Machin, CPPIB’ president and CEO, in the news release. “We are (honored) to have the opportunity to share our perspective and expertise with Chinese policymakers to tackle the issues of providing for an aging population.”

CPPIB will offer joint training, workshops and pension reform research as well, the news release said.

The memorandum was signed Thursday as part of bilateral agreements between China and Canada. In January, the CPPIB was designated by the China Securities Regulatory Commission for renminbi qualified foreign institutional investor status, granting it broad access to China’s capital markets.

What are my thoughts? I generally think any bilateral trade agreement with China is a good thing, and the fact the Chinese seized this opportunity to forge stronger ties with Canada's largest pension fund speaks volumes on the respect they have for Canada's large, well-governed pensions.

A couple of weeks ago, I discussed the global pension crunch, highlighting the problems Chinese policymakers face with their state pensions, many of which are chronically underfunded and need to be shored up as the population ages and benefits need to be paid out.

In April, I discussed China's pension gamble, criticizing the use of pensions to inflate stock prices higher as an irresponsible policy which will hurt the Chinese market in the long run.

What can the Chinese learn from CPPIB? A lot. First and foremost, they cam learn the benefits of good governance and why it's crucial for their state pensions' long-term success. Admittedly, good governance isn't something that comes easily in China where the government interferes in everything but this is something that needs to be changed.

Second, they can learn all about the benefits of three major structural advantages that are inherent to the CPP Fund – long horizon, scale, and certainty of assets; and three developed advantages that result from strategic choices they have made – internal expertise, expert partners, and Total Portfolio Approach (click on image below).

Together, these advantages provide CPPIB with a distinct perspective for investment decision-making.

Most importantly, China's large pensions can forge ties with CPPIB and invest alongside it in big private market deals in China, Asia and elsewhere. This is a win-win for all parties which is why I'm glad they signed this memorandum of understanding.

Unfortunately, all is not well between Canada and China. In particular, I'm a bit concerned when I read Joe Oliver, the former Conservative minister of finance, writing a comment in the National Post saying, We have no choice but to slap a tax on Toronto houses being bought by foreigners.

Really? Apart from being discriminatory against foreigners (ie., Chinese), these taxes don't address the root cause of lack of affordable housing in Vancouver and Toronto -- the lack of supply!! -- and they were hastily implemented to appease the poor and middle class without careful consideration how they will negatively impact the economies of British Columbia and Ontario.

A friend of mine who lived in Vancouver and moved back to Montreal put it succinctly when he read CIBC said that Ontario will need to implement foreign buyer tax on housing:

No surprise. This is now a political issue. It is about fighting for the poor rather than protecting the wealth generated by the influx of Chinese. The government has now started the snowball and it will be difficult to reverse.I bring this issue up because while critics love pointing the finger at Chinese policymakers when they make dumb decisions, maybe we Canadians need to reflect more on the bonehead moves our policymakers take to "defend the poor and working class" (exactly the opposite will happen as Chinese move to Seattle but maybe this will boost Calgary and Montreal's real estate market).

Very shortsighted thinking. There were many ways to tackle the problem which could have accomplished both objectives (protect wealth and restore some balance to the market). It would have taken longer and been less dramatic.

Everyone outside of Vancouver assumes that this is simply a demand-side issue and that by curbing "Chinese" demand, the problem will go away. It won't. It will certainly cause a temporary haircut at the upper end of the market but even after a 50% haircut, the average Joe will not have the means to buy property.

The only way to solve this is to create supply and to do this, the government needs to release land from the agricultural land reserve for development of affordable single family housing. They have done it before (in White Rock).

They also need to allow construction up and over the mountains on the North Shore. Yes this means cutting down trees and laying havoc to the landscape but there really is not a lot of choice here.

What they are doing now is basically driving away the Chinese and their investment dollars. When you look at the BC economy, they really can not afford to do this.

Anyways, enjoy your weekend and remember, behind the trade agreement with China, there's an equally important agreement on the pension front which will aslo benefit Chinese and Canadians. This is undeniably great news for both countries.

Below, Chinese Premier Li Keqiang is on Parliament Hill for the first visit to Canada by a Chinese leader in six years. Canadian Prime Minister Justin Trudeau says Canada is exploring a free trade agreement with China, as he hosts his Chinese counterpart in Ottawa.

And take the time to listen to an AVCJ interview with Mark Machin, President and CEO of CPPIB, which took place last year when he was head of international and Asian investments. Listen carefully to his comments and you will realize why China is forging ties with CPPIB to reform its pensions.