Tae Kim of CNBC reports, Chanos says Valeant was biggest loser ever for hedge funds, topping Enron; Cost industry $40 billion:

Earlier this week, we started getting news about what top funds were buying and selling during the third quarter. I purposely waited till the end of the week to cover this topic as it's Friday and wanted to keep it fun and market oriented for some entertaining weekend reading.

Why begin with Jim Chanos? Because I have tremendous respect for him as a hedge fund manager and he's one of a few Greek Americans I truly admire. Unlike Ray Dalio of Bridgewater who I also respect a lot and wrote about earlier this week when Bob Prince came to Montreal, I never met Jim Chanos but I did visit his office back in 2002 and got to meet his late partner and former COO, Doug Millett, who sadly died three years ago after his battle with cancer (great guy, very smart and fun to be with, I really enjoyed our meeting).

Short-sellers were part of the directional funds I covered while working at the Caisse back then. They are often a murky group of people who shun the spotlight and given the long bias in markets, their returns are very volatile, but the truth is some of the most interesting meetings I ever had were with short-sellers because the very best of them really know their stuff and they're scary smart.

Chanos, the guy that exposed the fraud at Enron, is scary smart, when he goes after a company or sector, he's almost always right (less so when he goes after China but he might turn out to be right there too).

And Chanos is right about Valeant Pharmaceuticals (VRX), it has cost the hedge fund (and mutual fund) industry billions and some managers, like Bill Ackman of Pershing Square, are reeling more than others, married to this company (but Chanos made a killing shorting Valeant).

In their Bloomberg article, Hedge-Fund Love Affair Is Ending for U.S. Pensions, Endowments, John Gittelsohn and Janet Lorin note the following:

And if you look at the top holders of Valeant as of the end of Q3, you'll see other big funds are buying big stakes too (click on images):

As you can see, the who's who of the hedge fund world is long Valeant or increased their stake in Q3. Funds like Pershing Square, Paulson & Co, ValueAct, Poinstate Capital, Point72 Asset Management, Citadel, D.E. Shaw, are all long and some are adding to this position (probably as I write this comment). I even noticed a Montreal fund I love, Vital Proulx's Hexavest, significantly increased its stake in Valeant last quarter.

Now, full disclosure, I haven't touched Vaeant shares and thank God I didn't because this company keeps on disappointing. Ten days ago, after another cockroach earnings report, shares of Valeant hit a new 52-week low and I posted this on LinkedIn and Stocktwits (click on image):

The dust seems to be settling here (still too early to buy) and I sure hope Valeant isn't Canada's pharmaceutical version of Nortel (I lost a bundle there, ARGH, if I can only take back time!).

From the elite hedge funds that did increase their stake in this company, I noted that Pointstate Capital initiated a big new position. Poinstate is a big global macro fund ($10 billion +) with sizeable equity positions. I used to post links of their top holdings under L/S Equity but decided to move it over to global macro and family office under Stan Druckenmiller.

Poinstate is run by Zach Schreiber and the fund was seeded by legendary investor Stanley Druckenmiller after he closed his fund, Duquesne Capital Management, back in 2010 (Druckenmiller seeded it with a cool $1 billion).

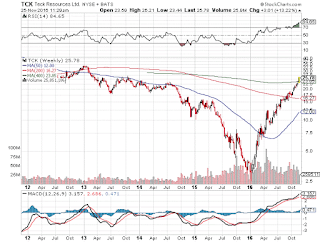

In January 2015, Bloomberg published an article stating Pointstate made a billion dollars shorting oil and Schreiber was predicting oil prices would go lower. Below, you can click on on image of him from that Bloomberg article (click on image):

Back in May, Schreiber said Poinstate was shorting the Saudi riyal, laying out a dark picture of the country’s economy, and he said said he’s betting on a rising US dollar and pairing it with the short on riyal (smart move and great timing).

Now, should you go out and buy Valeant because Poinstate initiated a position? Umm, HELL NO!! I've been warning all of you to use these 13F filings as a gauge or tool but not as a license to blindly follow hedge funds, may of which quite frankly are horribly underperforming the market.

Will Schreiber's bet on Valeant pay off? Maybe, who knows, at least he didn't buy a year ago and it will be interesting to see if Poinstate added to its position in Q4 when shares hit a new 52-week low.

[Note: I've been playing Valeant another way, looking at which companies will benefit when it starts shedding assets, which it will need to do to shore up its balance sheet. And I've profited nicely from some of these positions.]

Every quarter we get news coming out about what top hedge funds and other funds are buying and selling. Below, a few links running down some news articles covering Q3 13F filings:

For me, its a total waste of time as markets have moved a lot following the elections. I do go over their holdings but only for ideas and I look at the daily and weekly charts to determine whether or not to initiate a position.

More importantly, I am consumed by big macro trends, that's what drives my personal trading and why I'm very careful interpreting what the tops funds bought and sold last quarter.

In my recent post covering Bob Prince's trip to Montreal, I stated the following:

Let me end by sharing with you some of the insane action that took place with shipping stocks that went parabolic following the election (click on image from Wednesday's close):

And the next day (Thursday, click on image):

And we are back at it on Friday morning as Dryships (DRYS) is up roughly 48% on crazy action (wouldn't touch these shippers, be very careful as algos manipulate them from time to time).

You can read many articles on 13F filings on Barron's, Reuters, Bloomberg, CNBC, Forbes and other sites like Insider Monkey, Holdings Channel, and whale wisdom.

My favorite service for tracking top funds is Symmetric run by Sam Abbas and David Moon but there are other services offered by market folly and you can track tweets from Hedgemind and subscribe to their services too. I also like Dataroma which offers a lot of excellent and updated information on top funds and a lot more on insider activity and crowded trades (for free).

In addition to this, I regularly look at the YTD performance of stocks, the 12-month leaders, the 52-week highs and 52-week lows. I also like to track the most shorted stocks and highest yielding stocks in various exchanges and I have a list of stocks I track in over 100 industries/ themes to see what is moving in real time.

Enjoy going through the holdings of top funds below but be careful, it's a dynamic market where things constantly change and even the best of the best managers find it tough making money in these schizoid markets.

Those of you who would like me to work on a project to help you use this information correctly and hopefully make a lot of money in the process, can feel free to contact me at LKolivakis@gmail.com.

Top multi-strategy and event driven hedge funds

As the name implies, these hedge funds invest across a wide variety of hedge fund strategies like L/S Equity, L/S credit, global macro, convertible arbitrage, risk arbitrage, volatility arbitrage, merger arbitrage, distressed debt and statistical pair trading.

Unlike fund of hedge funds, the fees are lower because there is a single manager managing the portfolio, allocating across various alpha strategies as opportunities arise. Below are links to the holdings of some top multi-strategy hedge funds I track closely:

1) Citadel Advisors

2) Balyasny Asset Management

3) Farallon Capital Management

4) Peak6 Investments

5) Kingdon Capital Management

6) Millennium Management

7) Eton Park Capital Management

8) HBK Investments

9) Highbridge Capital Management

10) Highland Capital Management

11) Pentwater Capital Management

12) Och-Ziff Capital Management

13) Pine River Capital Capital Management

14) Carlson Capital Management

15) Magnetar Capital

16) Mount Kellett Capital Management

17) Whitebox Advisors

18) QVT Financial

19) Paloma Partners

20) Perry Capital

21) Weiss Multi-Strategy Advisors

22) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the best and most famous hedge fund manager. Global macros typically invest in bond and currency markets but the top macro funds are able to invest across all asset classes, including equities.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson and now Steve Cohen have converted their hedge funds into family offices to manage their own money and basically only answer to themselves (that is my definition of true investment success).

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation

8) Tiger Management (Julian Robertson)

9) Moore Capital Management

10) Point72 Asset Management (Steve Cohen)

11) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Market Neutral, Quant and CTA Hedge Funds

These funds use sophisticated mathematical algorithms to initiate their positions. They typically only hire PhDs in mathematics, physics and computer science to develop their algorithms. Market neutral funds will engage in pair trading to remove market beta.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Numeric Investors

6) Analytic Investors

7) Winton Capital Management

8) Graham Capital Management

9) SABA Capital Management

10) Quantitative Investment Management

11) Oxford Asset Management

Top Deep Value, Activist, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They include funds run by legendary investors like Warren Buffet, Seth Klarman, Ron Baron and Ken Fisher. Activist investors like to make investments in companies where management lacks the proper incentives to maximize shareholder value. They differ from traditional L/S hedge funds by having a more concentrated portfolio. Distressed debt funds typically invest in debt of a company but sometimes take equity positions.

1) Abrams Capital Management

2) Berkshire Hathaway

3) Baron Partners Fund (click here to view other Baron funds)

4) BHR Capital

5) Fisher Asset Management

6) Baupost Group

7) Fairfax Financial Holdings

8) Fairholme Capital

9) Trian Fund Management

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Associates

13) Jana Partners

14) Gabelli Funds

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Scout Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short those they think will fall. Along with global macro funds, they command the bulk of hedge fund assets. There are many L/S funds but here is a small sample of some well known funds.

1) Adage Capital Management

2) Appaloosa LP

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) JAT Capital Management

8) Coatue Management

9) Omega Advisors (Leon Cooperman)

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Karsh Capital Management

27) New Mountain Vantage

28) Andor Capital Management

29) Silver Point Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) T. Boone Pickens BP Capital

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Melvin Capital Partners

55) Owl Creek Asset Management

56) Portolan Capital Management

57) Proxima Capital Management

58) Tiger Global Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Viking Global Investors

63) Marshall Wace

64) York Capital Management

65) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech, healthcare, retail and other sectors like mid, small and micro caps. Here are some funds worth tracking closely.

1) Armistice Capital

2) Baker Brothers Advisors

3) Palo Alto Investors

4) Broadfin Capital

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Ghost Tree Capital

10) Sectoral Asset Management

11) Oracle Investment Management

12) Perceptive Advisors

13) Consonance Capital Management

14) Camber Capital Management

15) Redmile Group

16) RTW Investments

17) Bridger Capital Management

18) Southeastern Asset Management

19) Bridgeway Capital Management

20) Cohen & Steers

21) Cardinal Capital Management

22) Munder Capital Management

23) Diamondhill Capital Management

24) Cortina Asset Management

25) Geneva Capital Management

26) Criterion Capital Management

27) Daruma Capital Management

28) 12 West Capital Management

29) RA Capital Management

30) Sarissa Capital Management

31) SIO Capital Management

32) Senzar Asset Management

33) Sphera Funds

34) Tang Capital Management

35) Thomson Horstmann & Bryant

36) Venbio Select Advisors

37) Ecor1 Capital

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their sheer size makes them important players. Some asset managers have excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) Blackrock Fund Advisors

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase& Co.

13) Morgan Stanley

14) Manulife Asset Management

15) RCM Capital Management

16) UBS Asset Management

17) Barclays Global Investor

18) Epoch Investment Partners

19) Thornburg Investment Management

20) Legg Mason Capital Management

21) Kornitzer Capital Management

22) Batterymarch Financial Management

23) Tocqueville Asset Management

24) Neuberger Berman

25) Winslow Capital Management

26) Herndon Capital Management

27) Artisan Partners

28) Great West Life Insurance Management

29) Lazard Asset Management

30) Janus Capital Management

31) Franklin Resources

32) Capital Research Global Investors

33) T. Rowe Price

34) First Eagle Investment Management

35) Frontier Capital Management

36) Akre Capital Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Letko, Brosseau and Associates

2) Fiera Capital Corporation

3) West Face Capital

4) Hexavest

5) 1832 Asset Management

6) Jarislowsky, Fraser

7) Connor, Clark & Lunn Investment Management

8) TD Asset Management

9) CIBC Asset Management

10) Beutel, Goodman & Co

11) Greystone Managed Investments

12) Mackenzie Financial Corporation

13) Great West Life Assurance Co

14) Guardian Capital

15) Scotia Capital

16) AGF Investments

17) Montrusco Bolton

18) Venator Capital Management

Pension Funds, Endowment Funds, and Sovereign Wealth Funds

Last but not least, I track activity of some pension funds, endowment funds and sovereign wealth funds. I like to focus on funds that invest in top hedge funds and have internal alpha managers. Below, a sample of pension and endowment funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) British Columbia Investment Management Corporation (bcIMC)

7) Public Sector Pension Investment Board (PSP Investments)

8) PGGM Investments

9) APG All Pensions Group

10) California Public Employees Retirement System (CalPERS)

11) California State Teachers Retirement System (CalSTRS)

12) New York State Common Fund

13) New York State Teachers Retirement System

14) State Board of Administration of Florida Retirement System

15) State of Wisconsin Investment Board

16) State of New Jersey Common Pension Fund

17) Public Employees Retirement System of Ohio

18) STRS Ohio

19) Teacher Retirement System of Texas

20) Virginia Retirement Systems

21) TIAA CREF investment Management

22) Harvard Management Co.

23) Norges Bank

24) Nordea Investment Management

25) Korea Investment Corp.

26) Singapore Temasek Holdings

27) Yale Endowment Fund

Below, CNBC's Kate Kelly reports the latest from 13F filings. Kelly also reports on hedge-fund titan Stanley Druckenmiller's optimism in the markets, including his tech shopping spree and big bet on the emerging markets last quarter (he wasn't the only one to buy big tech names and emerging markets back in Q3; also read my comment on Trump and emerging markets).

Third, Valeant is worth double the current price, says Bill Miller, LMM LLC chairman & CIO, discussing why he likes this pharma play.

Fourth, CNBC's Dominic Chu discusses what is fueling shipping gains, and urges caution. The "Fast Money" traders weigh in. Here is what I predicted a couple of days ago on Stocktwits concerning this algorithmic, high-frequency led orgy driving these parabolic moves in shipping stocks (click on image):

Lastly, Julian Robertson, Tiger Management founder, recently discussed opportunities in biotech, Apple, self-driving cars, and Netflix. Good discussion, well worth listening to his views as he raises many excellent points. remember who told you to load up on biotech before the elections!

On that note, please remember to show your support for this blog by donating or subscribing via PayPal at the top right-hand side under my picture. Thank you and have a great weekend!

Short-seller Jim Chanos lambasted his hedge fund industry peers for investing in drug company Valeant, saying it is was based on a business model which was a "big lie."You need to be a CNBC pro subscriber to read the rest of this article here.

"Valeant epitomizes everything that went wrong with the marketplace," Chanos said at the Evidence-Based Investing conference in New York on Tuesday. It was "the largest single security loss hedge funds have incurred, greater than Lehman, Enron, AIG."

The founder and managing partner of Kynikos Associates estimated the $1 trillion long-short hedge fund industry lost $40 billion being long Valeant. The stock ticked off a number of factors that Chanos looks for in a potential short such as growth by acquisition, fraudulent accounting and crowded shareholder base.

Valeant's business model was "based on the big lie...that it could buy neglected orphan drugs going off patent, that you can purchase portfolio of drugs as opposed to develop them," he said. The stock is down 80 percent this year as investors await the outcome of government investigations into its business practices.

Chanos is known for his bearish calls against high-flying companies like Enron and has been outspoken about his bets against Tesla Motors and Alibaba. Short selling is a form of trading in which traders can bet against a company by selling shares they do not own and buy them back later at a lower price to make a profit.

The money manager also revealed the area of the market he hates the most right now...

Earlier this week, we started getting news about what top funds were buying and selling during the third quarter. I purposely waited till the end of the week to cover this topic as it's Friday and wanted to keep it fun and market oriented for some entertaining weekend reading.

Why begin with Jim Chanos? Because I have tremendous respect for him as a hedge fund manager and he's one of a few Greek Americans I truly admire. Unlike Ray Dalio of Bridgewater who I also respect a lot and wrote about earlier this week when Bob Prince came to Montreal, I never met Jim Chanos but I did visit his office back in 2002 and got to meet his late partner and former COO, Doug Millett, who sadly died three years ago after his battle with cancer (great guy, very smart and fun to be with, I really enjoyed our meeting).

Short-sellers were part of the directional funds I covered while working at the Caisse back then. They are often a murky group of people who shun the spotlight and given the long bias in markets, their returns are very volatile, but the truth is some of the most interesting meetings I ever had were with short-sellers because the very best of them really know their stuff and they're scary smart.

Chanos, the guy that exposed the fraud at Enron, is scary smart, when he goes after a company or sector, he's almost always right (less so when he goes after China but he might turn out to be right there too).

And Chanos is right about Valeant Pharmaceuticals (VRX), it has cost the hedge fund (and mutual fund) industry billions and some managers, like Bill Ackman of Pershing Square, are reeling more than others, married to this company (but Chanos made a killing shorting Valeant).

In their Bloomberg article, Hedge-Fund Love Affair Is Ending for U.S. Pensions, Endowments, John Gittelsohn and Janet Lorin note the following:

While the redemptions represent only about 1 percent of hedge funds’ total assets, the threat of withdrawals has given investors leverage on fees.Let me put it bluntly, Bill Ackman's fortunes are riding on Valeant, it's that simple. Luckily for him, he's not the only one betting big on this company. Legendary investor Bill Miller appeared on CNBC three days ago to say battered Valeant stock worth double the current price.

Firms from Brevan Howard to Caxton Associates and Tudor Investment Corp. have trimmed fees amid lackluster performance.

William Ackman’s Pershing Square Capital Management last month offered a new fee option that includes a performance hurdle: It keeps 30 percent of returns but only if it gains at least 5 percent, according to a person familiar with the matter.

The offer came after Pershing Square’s worst annual performance, a net loss of 20.5 percent in 2015. Pershing Square spokesman Fran McGill declined to comment.

“They had a terrible year and they have to be extremely worried about a loss of assets under management,” said Tom Byrne, chairman of the New Jersey State Investment Council, which had about $200 million with Pershing Square as of July 31. “You’re losing clients because your prices are too high? Lower your price. That’s capitalism.”

And if you look at the top holders of Valeant as of the end of Q3, you'll see other big funds are buying big stakes too (click on images):

As you can see, the who's who of the hedge fund world is long Valeant or increased their stake in Q3. Funds like Pershing Square, Paulson & Co, ValueAct, Poinstate Capital, Point72 Asset Management, Citadel, D.E. Shaw, are all long and some are adding to this position (probably as I write this comment). I even noticed a Montreal fund I love, Vital Proulx's Hexavest, significantly increased its stake in Valeant last quarter.

Now, full disclosure, I haven't touched Vaeant shares and thank God I didn't because this company keeps on disappointing. Ten days ago, after another cockroach earnings report, shares of Valeant hit a new 52-week low and I posted this on LinkedIn and Stocktwits (click on image):

The dust seems to be settling here (still too early to buy) and I sure hope Valeant isn't Canada's pharmaceutical version of Nortel (I lost a bundle there, ARGH, if I can only take back time!).

From the elite hedge funds that did increase their stake in this company, I noted that Pointstate Capital initiated a big new position. Poinstate is a big global macro fund ($10 billion +) with sizeable equity positions. I used to post links of their top holdings under L/S Equity but decided to move it over to global macro and family office under Stan Druckenmiller.

Poinstate is run by Zach Schreiber and the fund was seeded by legendary investor Stanley Druckenmiller after he closed his fund, Duquesne Capital Management, back in 2010 (Druckenmiller seeded it with a cool $1 billion).

In January 2015, Bloomberg published an article stating Pointstate made a billion dollars shorting oil and Schreiber was predicting oil prices would go lower. Below, you can click on on image of him from that Bloomberg article (click on image):

Back in May, Schreiber said Poinstate was shorting the Saudi riyal, laying out a dark picture of the country’s economy, and he said said he’s betting on a rising US dollar and pairing it with the short on riyal (smart move and great timing).

Now, should you go out and buy Valeant because Poinstate initiated a position? Umm, HELL NO!! I've been warning all of you to use these 13F filings as a gauge or tool but not as a license to blindly follow hedge funds, may of which quite frankly are horribly underperforming the market.

Will Schreiber's bet on Valeant pay off? Maybe, who knows, at least he didn't buy a year ago and it will be interesting to see if Poinstate added to its position in Q4 when shares hit a new 52-week low.

[Note: I've been playing Valeant another way, looking at which companies will benefit when it starts shedding assets, which it will need to do to shore up its balance sheet. And I've profited nicely from some of these positions.]

Every quarter we get news coming out about what top hedge funds and other funds are buying and selling. Below, a few links running down some news articles covering Q3 13F filings:

- Some Of The Most Notable Changes This 13F Season

- Soros dissolves SPDR Gold trust shares in third-quarter, Paulson stays in (good move George)

- Why George Soros Tripled His Amazon Investment in Q3 and how he's now bullish on China (not sure if he dumped those positions and there is more to his holdings than emerging markets).

- Warren Buffett Reports Buying 3 Airline Stocks, Cuts Walmart (anther good move but take profits on those airlines as they have gone parabolic!)

- Billionaire David Tepper Re-Buys Apple, Ups FB Stake: 13F Filing (FB, AAPL)

- Billionaire John Paulson Trims JNJ, Teva, Adds CVS: 13F Filing (JNJ, CVS)

For me, its a total waste of time as markets have moved a lot following the elections. I do go over their holdings but only for ideas and I look at the daily and weekly charts to determine whether or not to initiate a position.

More importantly, I am consumed by big macro trends, that's what drives my personal trading and why I'm very careful interpreting what the tops funds bought and sold last quarter.

In my recent post covering Bob Prince's trip to Montreal, I stated the following:

[...] at one point a rising US dollar impedes growth and is deflationary and if you ask me, the rise of protectionism will cost America jobs and rising unemployment is deflationary, so even if Trump spends like crazy on infrastructure, the net effect on growth and deflation is far from clear.I want people to first and foremost understand the big macro environment, then worry about which stocks the "gurus" are buying and selling.

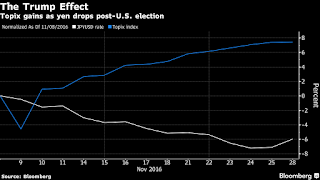

All this to say I respectfully disagree with Ray Dalio, Bob Prince and the folks at Bridgewater which is why I recommended investors sell the Trump rally, buy bonds on the recent backup in yields and proceed cautiously on emerging markets as the US dollar strengthens and could wreak a deflationary tsunami in Asia which will find its way back on this side of the Atlantic.

Unlike Ray Dalio and others, I just don't see the end of the bond bull market and I'm convinced we have not seen the secular low in long bond yields as global deflation risks are not fading, they are gathering steam and if Trump's administration isn't careful, deflation will hit America too.

This is why I continue to be long the greenback and would take profits or even short emerging market (EEM), Chinese (FXI), Metal & Mining (XME) and Energy (XLE) shares on any strength. And despite huge volatility, I remain long biotech shares (IBB and equally weighted XBI) and keep finding gems in this sector by examining closely the holdings of top biotech funds.

And in a deflationary, ZIRP & NIRP world, I still maintain nominal bonds (TLT), not gold, will remain the ultimate diversifier and Financials (XLF) will struggle for a long time if a debt deflation cycle hits the world (ultra low or negative rates for years aren't good for financials).

As far as Ultilities (XLU), REITs (IYR), Consumer Staples (XLP), and other dividend plays (DVY), they have gotten hit lately partly because of a backup in yields but also because they ran up too much as everyone chased yield (might be a good buy now but be careful, high dividend doesn't mean less risk!). Interestingly, however, high yield credit (HYG) continues to perform well which bodes well for risk assets.

Let me end by sharing with you some of the insane action that took place with shipping stocks that went parabolic following the election (click on image from Wednesday's close):

And the next day (Thursday, click on image):

And we are back at it on Friday morning as Dryships (DRYS) is up roughly 48% on crazy action (wouldn't touch these shippers, be very careful as algos manipulate them from time to time).

You can read many articles on 13F filings on Barron's, Reuters, Bloomberg, CNBC, Forbes and other sites like Insider Monkey, Holdings Channel, and whale wisdom.

My favorite service for tracking top funds is Symmetric run by Sam Abbas and David Moon but there are other services offered by market folly and you can track tweets from Hedgemind and subscribe to their services too. I also like Dataroma which offers a lot of excellent and updated information on top funds and a lot more on insider activity and crowded trades (for free).

In addition to this, I regularly look at the YTD performance of stocks, the 12-month leaders, the 52-week highs and 52-week lows. I also like to track the most shorted stocks and highest yielding stocks in various exchanges and I have a list of stocks I track in over 100 industries/ themes to see what is moving in real time.

Enjoy going through the holdings of top funds below but be careful, it's a dynamic market where things constantly change and even the best of the best managers find it tough making money in these schizoid markets.

Those of you who would like me to work on a project to help you use this information correctly and hopefully make a lot of money in the process, can feel free to contact me at LKolivakis@gmail.com.

Top multi-strategy and event driven hedge funds

As the name implies, these hedge funds invest across a wide variety of hedge fund strategies like L/S Equity, L/S credit, global macro, convertible arbitrage, risk arbitrage, volatility arbitrage, merger arbitrage, distressed debt and statistical pair trading.

Unlike fund of hedge funds, the fees are lower because there is a single manager managing the portfolio, allocating across various alpha strategies as opportunities arise. Below are links to the holdings of some top multi-strategy hedge funds I track closely:

1) Citadel Advisors

2) Balyasny Asset Management

3) Farallon Capital Management

4) Peak6 Investments

5) Kingdon Capital Management

6) Millennium Management

7) Eton Park Capital Management

8) HBK Investments

9) Highbridge Capital Management

10) Highland Capital Management

11) Pentwater Capital Management

12) Och-Ziff Capital Management

13) Pine River Capital Capital Management

14) Carlson Capital Management

15) Magnetar Capital

16) Mount Kellett Capital Management

17) Whitebox Advisors

18) QVT Financial

19) Paloma Partners

20) Perry Capital

21) Weiss Multi-Strategy Advisors

22) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the best and most famous hedge fund manager. Global macros typically invest in bond and currency markets but the top macro funds are able to invest across all asset classes, including equities.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson and now Steve Cohen have converted their hedge funds into family offices to manage their own money and basically only answer to themselves (that is my definition of true investment success).

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation

8) Tiger Management (Julian Robertson)

9) Moore Capital Management

10) Point72 Asset Management (Steve Cohen)

11) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Market Neutral, Quant and CTA Hedge Funds

These funds use sophisticated mathematical algorithms to initiate their positions. They typically only hire PhDs in mathematics, physics and computer science to develop their algorithms. Market neutral funds will engage in pair trading to remove market beta.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Numeric Investors

6) Analytic Investors

7) Winton Capital Management

8) Graham Capital Management

9) SABA Capital Management

10) Quantitative Investment Management

11) Oxford Asset Management

Top Deep Value, Activist, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They include funds run by legendary investors like Warren Buffet, Seth Klarman, Ron Baron and Ken Fisher. Activist investors like to make investments in companies where management lacks the proper incentives to maximize shareholder value. They differ from traditional L/S hedge funds by having a more concentrated portfolio. Distressed debt funds typically invest in debt of a company but sometimes take equity positions.

1) Abrams Capital Management

2) Berkshire Hathaway

3) Baron Partners Fund (click here to view other Baron funds)

4) BHR Capital

5) Fisher Asset Management

6) Baupost Group

7) Fairfax Financial Holdings

8) Fairholme Capital

9) Trian Fund Management

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Associates

13) Jana Partners

14) Gabelli Funds

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Scout Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short those they think will fall. Along with global macro funds, they command the bulk of hedge fund assets. There are many L/S funds but here is a small sample of some well known funds.

1) Adage Capital Management

2) Appaloosa LP

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) JAT Capital Management

8) Coatue Management

9) Omega Advisors (Leon Cooperman)

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Karsh Capital Management

27) New Mountain Vantage

28) Andor Capital Management

29) Silver Point Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) T. Boone Pickens BP Capital

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Melvin Capital Partners

55) Owl Creek Asset Management

56) Portolan Capital Management

57) Proxima Capital Management

58) Tiger Global Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Viking Global Investors

63) Marshall Wace

64) York Capital Management

65) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech, healthcare, retail and other sectors like mid, small and micro caps. Here are some funds worth tracking closely.

1) Armistice Capital

2) Baker Brothers Advisors

3) Palo Alto Investors

4) Broadfin Capital

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Ghost Tree Capital

10) Sectoral Asset Management

11) Oracle Investment Management

12) Perceptive Advisors

13) Consonance Capital Management

14) Camber Capital Management

15) Redmile Group

16) RTW Investments

17) Bridger Capital Management

18) Southeastern Asset Management

19) Bridgeway Capital Management

20) Cohen & Steers

21) Cardinal Capital Management

22) Munder Capital Management

23) Diamondhill Capital Management

24) Cortina Asset Management

25) Geneva Capital Management

26) Criterion Capital Management

27) Daruma Capital Management

28) 12 West Capital Management

29) RA Capital Management

30) Sarissa Capital Management

31) SIO Capital Management

32) Senzar Asset Management

33) Sphera Funds

34) Tang Capital Management

35) Thomson Horstmann & Bryant

36) Venbio Select Advisors

37) Ecor1 Capital

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their sheer size makes them important players. Some asset managers have excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) Blackrock Fund Advisors

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase& Co.

13) Morgan Stanley

14) Manulife Asset Management

15) RCM Capital Management

16) UBS Asset Management

17) Barclays Global Investor

18) Epoch Investment Partners

19) Thornburg Investment Management

20) Legg Mason Capital Management

21) Kornitzer Capital Management

22) Batterymarch Financial Management

23) Tocqueville Asset Management

24) Neuberger Berman

25) Winslow Capital Management

26) Herndon Capital Management

27) Artisan Partners

28) Great West Life Insurance Management

29) Lazard Asset Management

30) Janus Capital Management

31) Franklin Resources

32) Capital Research Global Investors

33) T. Rowe Price

34) First Eagle Investment Management

35) Frontier Capital Management

36) Akre Capital Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Letko, Brosseau and Associates

2) Fiera Capital Corporation

3) West Face Capital

4) Hexavest

5) 1832 Asset Management

6) Jarislowsky, Fraser

7) Connor, Clark & Lunn Investment Management

8) TD Asset Management

9) CIBC Asset Management

10) Beutel, Goodman & Co

11) Greystone Managed Investments

12) Mackenzie Financial Corporation

13) Great West Life Assurance Co

14) Guardian Capital

15) Scotia Capital

16) AGF Investments

17) Montrusco Bolton

18) Venator Capital Management

Pension Funds, Endowment Funds, and Sovereign Wealth Funds

Last but not least, I track activity of some pension funds, endowment funds and sovereign wealth funds. I like to focus on funds that invest in top hedge funds and have internal alpha managers. Below, a sample of pension and endowment funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) British Columbia Investment Management Corporation (bcIMC)

7) Public Sector Pension Investment Board (PSP Investments)

8) PGGM Investments

9) APG All Pensions Group

10) California Public Employees Retirement System (CalPERS)

11) California State Teachers Retirement System (CalSTRS)

12) New York State Common Fund

13) New York State Teachers Retirement System

14) State Board of Administration of Florida Retirement System

15) State of Wisconsin Investment Board

16) State of New Jersey Common Pension Fund

17) Public Employees Retirement System of Ohio

18) STRS Ohio

19) Teacher Retirement System of Texas

20) Virginia Retirement Systems

21) TIAA CREF investment Management

22) Harvard Management Co.

23) Norges Bank

24) Nordea Investment Management

25) Korea Investment Corp.

26) Singapore Temasek Holdings

27) Yale Endowment Fund

Below, CNBC's Kate Kelly reports the latest from 13F filings. Kelly also reports on hedge-fund titan Stanley Druckenmiller's optimism in the markets, including his tech shopping spree and big bet on the emerging markets last quarter (he wasn't the only one to buy big tech names and emerging markets back in Q3; also read my comment on Trump and emerging markets).

Third, Valeant is worth double the current price, says Bill Miller, LMM LLC chairman & CIO, discussing why he likes this pharma play.

Fourth, CNBC's Dominic Chu discusses what is fueling shipping gains, and urges caution. The "Fast Money" traders weigh in. Here is what I predicted a couple of days ago on Stocktwits concerning this algorithmic, high-frequency led orgy driving these parabolic moves in shipping stocks (click on image):

Lastly, Julian Robertson, Tiger Management founder, recently discussed opportunities in biotech, Apple, self-driving cars, and Netflix. Good discussion, well worth listening to his views as he raises many excellent points. remember who told you to load up on biotech before the elections!

On that note, please remember to show your support for this blog by donating or subscribing via PayPal at the top right-hand side under my picture. Thank you and have a great weekend!