Andy Blatchford of the Canadadian Press reports, Rising Household Debt Risks Canada's Long-Term Economic Health: Confidential Memo:

When I last spoke to my father's financial advisor at RBC roughly a month ago, I instructed her to sell everything and shove all his money in US long bonds (TLT). She told me the exact same thing all the big banks are saying: "RBC thinks rates are rising over the next year and I would advise you not to invest in US long bonds."

I told her the Canadian dollar is high and with all due respect to RBC, my view is we need to prepare for a US slowdown, and I am increasingly worried about global deflation spreading to North America which is why I want to buy US Treasurys now."

I wasn't rude but all the big banks keep saying the same thing, "everything is fine, US economy is humming along, and rates are going to rise." Basically, the optimistic global reflation nonsense.

In my last comment on why Ray Dalio is worried about the dangerous divide, I laid out yet again six structural factors that lead me to believe we are headed for a prolonged period of debt deflation:

I discussed rising inequality as a major factor that will impact growth and keep rates at ultra-low levels for a very long time. The jobs crisis (high structural unemployment, not headline figures) and the global pension crisis will only exacerbate rising inequality as millions retire with little to no savings and ultimately succumb to pension poverty.

This is why I keep harping on policymakers to get their pension policy right by bolstering large, well-governed public defined-benefit pensions. In Canada, there are excellent private DB plans (HOOPP, CN, Air Canada) but I think we need a large public plan backstopped by the federal government for all workers who want to retire in dignity and securty.

Rising debt levels also exacerbate inequality as people take on more and more debt to buy a house they probably can't afford, lease expensive cars, and buy nice furniture using some payment plan to keep monthly payments low (even if they're getting milked on rates over the life of the plan).

In fact, Pete Evans of CBC News reports, Average Canadian mortgage nears $200K, up 5% in a year:

Now, using this tool and terms, a $200,000 mortgage translates into roughly $1,500 a month, which isn't the end of the world if you're a two-income household bringing in $120,000 a year.

However, if you start adding car expenses, food, clothing, gas, utility bills, cable and cell phone bills, car and house insurance, municipal and school taxes, trips, and more, you'll quickly realize you need to plan your expenses more carefully to make the mortgage payment every month and save money for your retirement.

More importantly, the median family income in Canada isn't $120,000, it's a lot less. As shown here, depending on where you live, the median is significantly lower.

This explains why Canadians are taking on more and more debt. Wage growth is muted so as the housing frenzy reached a bubble phase, Canadians worried they wouldn't be able to afford a house borrowed heavily from banks and subprime lenders to compete with foreign and domestic buyers.

Once they bought their house at overvalued levels, they had to pay a welcome tax and municipal taxes based on the municipal evaluation, which is based on current market prices.

This is another huge tax grab. In fact, a friend of mine shared this with me today:

This is what happened in Greece, as the country sunk into a deep depression, municipal taxes remained elevated (based on pre-crisis high evaluations) and people walked away from their homes, unable to pay the monthly payments and taxes (not to mention, renters weren't paying their rent, taking advantage of a lenient and farcical Greek justice system, so property owners really got screwed).

This brings me to another important point, a little disagreement I have with Garth Turner who publishes the very popular Greater Fool blog, all about the housing follies Canadians have succumbed to in their quest to own a nice house at all cost.

Garth has done great work, I often read his blog but we have a fundamental disagreement. You see, Garth buys the nonsense big banks are peddling, that rates are headed up, and he believes higher rates will kill the Canadian housing market for a long time. I believe debt deflation and soaring unemployment in an ultra-low rate environment will clobber the Canadian housing market for decades.

In fact, in a recent comment, After Mom, Garth stated this:

Also worth noting, while Ontario and British Columbia's new levies and measures have had a short-term negative effect on home prices, unless they significantly expand housing supply, prices will keep climbing in the future.

Things are not great in Canada. People drowning in debt will typically cut discretionary spending like restaurants, movies, shopping for clothes, electronic gizmos, trips, etc.

There is only so much debt one can take on before they pass the point of no return --where essentially they will be condemned to debt servitude for pretty much the rest of their life.

I'm increasingly worried about Canada's growing debt problem. There is no doubt it will impact the economy longer term, and possibly even in the near term.

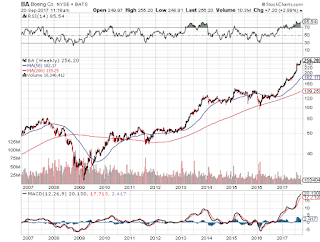

This is why I am long US long bonds (TLT), using the grossly inflated loonie to load up on US Treasurys. I am also long Canadian bonds and short the loonie.

And if my worst fears on global deflation come true, oil prices will plunge to record low levels, manufacturing and service sector unemployment will soar, and Canada will be in a crisis for many years. This is why Canada's growing debt problem is such a huge concern for policymakers.

Hope you enjoyed this comment. If you have anything to add, feel free to share your thoughts via email at LKolivakis@gmail.com.

Below, 680 NEWS senior business editor Mike Eppel reports on Canadian consumer loans. He's right, as long as Canadians can service this debt, they will be fine, but if that changes because of an internal or external shock, watch out, it will get very ugly, very fast.

Even debt-free Canadians could eventually feel a pinch from someone else's maxed-out credit cards, suggests research presented to senior officials at the federal housing agency.

Canada Mortgage and Housing Corp. board members received an update in March on the country's credit and housing trends.

The presentation contained a warning: the steady climb of the household debt-to-GDP level had put Canada's long-term economic growth prospects at risk.

The document pointed to a study that argued household debt accumulation eventually hampers economic growth over the longer term, eclipsing the nearer-term benefits of consumption.

The strong expansion of household spending, encouraged by a prolonged period of historically low borrowing rates, has created concerns over Canadians' record-high debt loads.

It has also been a major driver of economic growth.

The Canadian Press obtained a copy of the CMHC presentation via the Access to Information Act. It was included in a "confidential" memo to deputy finance minister Paul Rochon.

Citing international research, the CMHC presentation points to an estimate that says a one percentage point increase in household debt-to-GDP tends to lower growth in a country's real gross domestic product by 0.1 percentage points at least three years later.

The calculation, published in a January study by the Bank for International Settlements, was based on an average produced from the data of 54 countries from 1990 to 2015.

"Our results suggest that debt boosts consumption and GDP growth in the short run, with the bulk of the impact of increased indebtedness passing through the real economy in the space of one year," said the BIS report.

"However, the long-run negative effects of debt eventually outweigh their short-term positive effects, with household debt accumulation ultimately proving to be a drag on growth."

Only Australia has faster debt growthInterest rates are more likely to rise? I respect Doug Porter but all the bank economists have been saying the exact same thing, interest rates are likely to rise -- and they've all been wrong.

An accompanying chart in the CMHC presentation showed that between 2010 and 2016 Canada's household debt-to-GDP level rose by more than five percentage points. The household debt-to-GDP ratio increased from almost 93 per cent to just over 101 per cent at the end of 2016, Statistics Canada says.

A reduction of even 0.1 percentage points in the country's GDP can have an impact. For example, Canada saw year-over-year growth in real GDP last year of 1.3 per cent.

The chart listed eight developed countries and ranked Canada second, behind Australia, for having the biggest increase in household debt-to-GDP level over the six-year period.

BMO chief economist Doug Porter says he doesn't dispute the broader conclusion that a rising household debt-to-GDP level poses risks for growth.

But he's skeptical one can draw a direct line from the household debt-to-GDP directly to economic growth down the road. For one, he said interest rate levels must be factored in.

"I'd be very cautious about putting pinpoint accuracy on that," Porter said. "I think that's incredibly difficult to do."

However, Porter says the record levels of household debt piling up in Canada, like in many industrial-world economies, does suggest it will be tougher for the country to grow as quickly as it has in the past.

"The consumer spending and housing gains that we could reap from lower interest rates have basically been reaped," he said.

"And, if anything, interest rates are probably more likely to rise than fall from current levels. So, to me that suggests we just really can't count on the consumer to really pull the economy ahead as they have in recent years."

When I last spoke to my father's financial advisor at RBC roughly a month ago, I instructed her to sell everything and shove all his money in US long bonds (TLT). She told me the exact same thing all the big banks are saying: "RBC thinks rates are rising over the next year and I would advise you not to invest in US long bonds."

I told her the Canadian dollar is high and with all due respect to RBC, my view is we need to prepare for a US slowdown, and I am increasingly worried about global deflation spreading to North America which is why I want to buy US Treasurys now."

I wasn't rude but all the big banks keep saying the same thing, "everything is fine, US economy is humming along, and rates are going to rise." Basically, the optimistic global reflation nonsense.

In my last comment on why Ray Dalio is worried about the dangerous divide, I laid out yet again six structural factors that lead me to believe we are headed for a prolonged period of debt deflation:

- The global jobs crisis: High structural unemployment, especially youth unemployment, and less and less good paying jobs with benefits.

- Demographic time bomb: A rapidly aging population means a lot more older people with little savings spending less.

- The global pension crisis: As more and more people retire in poverty, they will spend less to stimulate economic activity. Moreover, the shift out of defined-benefit plans to defined-contribution plans is exacerbating pension poverty and is deflationary. Read more about this in my comments on the $400 trillion pension time bomb and the pension storm cometh. Any way you slice it, the global pension crisis is deflationary and bond friendly.

- Excessive private and public debt: Rising government and consumer debt levels are constraining public finances and consumer spending.

- Rising inequality: Hedge fund gurus cannot appreciate this because they live in an alternate universe, but widespread and rising inequality is deflationary as it constrains aggregate demand. The pension crisis will exacerbate inequality and keep a lid on inflationary pressures for a very long time.

- Technological shifts: Think about Amazon, Uber, Priceline, AI, robotics, and other technological shifts that lower prices and destroy more jobs than they create.

I discussed rising inequality as a major factor that will impact growth and keep rates at ultra-low levels for a very long time. The jobs crisis (high structural unemployment, not headline figures) and the global pension crisis will only exacerbate rising inequality as millions retire with little to no savings and ultimately succumb to pension poverty.

This is why I keep harping on policymakers to get their pension policy right by bolstering large, well-governed public defined-benefit pensions. In Canada, there are excellent private DB plans (HOOPP, CN, Air Canada) but I think we need a large public plan backstopped by the federal government for all workers who want to retire in dignity and securty.

Rising debt levels also exacerbate inequality as people take on more and more debt to buy a house they probably can't afford, lease expensive cars, and buy nice furniture using some payment plan to keep monthly payments low (even if they're getting milked on rates over the life of the plan).

In fact, Pete Evans of CBC News reports, Average Canadian mortgage nears $200K, up 5% in a year:

Canadians owe more than ever before on their mortgages, but fewer and fewer borrowers are falling behind on their payments.Note, $200,000 is an average of all households who pay a mortgage. That number varies because people who entered the housing market in the last five years have a considerably higher mortgage. They're the ones most vulnerable to a significant housing downturn.

That's one of the major takeaways from a report published Tuesday from credit monitoring firm TransUnion, which looked at every active credit file across the country to gauge the financial health of borrowers and consumers.

TransUnion found that as of the end of June, the average Canadian mortgage had $198,781 left on it, a figure that has increased by almost five per cent in the previous 12 months. That's in part a factor of high housing prices, which have prompted people to borrow more than ever to finance a home.

But it's not just that people are borrowing more — more people are borrowing, too.

"The total number of active mortgage accounts grew annually to 6.0 million, an increase of 1.2 per cent from last year," TransUnion said.

While Canadians may be borrowing more to get into the real estate market, thus far they seem to be staying on top of their debts, as delinquency rates dropped to 0.56 per cent for the third quarter in a row.

Credit agencies consider a debt to be delinquent if the borrower is more than two months behind on payments. A delinquency rate of 0.56 per cent means barely one of every 200 mortgage holders was more than 60 days behind on their mortgage payment as of the end of June.

"Despite increases in mortgage debt, serious delinquency rates remain low with very little volatility observed over the past two years," Matt Fabian, TransUnion Canada's director of research and analysis, said in a release. "Consumers have so far been able to manage their mortgage obligations despite the increasing balance levels."

Overall consumer debt climbing

But mortgages aren't the only type of debt that's growing fast. The average Canadian owed $22,154 on top of any mortgage at the end of June, TransUnion said, a figure that has grown by 2.7 per cent in the previous 12 months.

The average credit card balance was at $2,840 at the end of June, and on average, people owed $19,087 against their car, if they owned one. Some 23.7 million Canadians have at least one credit card, and there are 3.3 million auto loans across the country.

The fastest growing type of debt, meanwhile, is installment loans, which are unsecured, high-interest, short-term loans, such as the ones often offered to buy home furnishings and other big ticket items. Among the 6.4 million Canadians who had one as of the end of June, the average balance was $20,466 — up 5.5 per cent in the past year.

The delinquency rate for that type of debt is also the highest at four per cent, TransUnion said.

Now, using this tool and terms, a $200,000 mortgage translates into roughly $1,500 a month, which isn't the end of the world if you're a two-income household bringing in $120,000 a year.

However, if you start adding car expenses, food, clothing, gas, utility bills, cable and cell phone bills, car and house insurance, municipal and school taxes, trips, and more, you'll quickly realize you need to plan your expenses more carefully to make the mortgage payment every month and save money for your retirement.

More importantly, the median family income in Canada isn't $120,000, it's a lot less. As shown here, depending on where you live, the median is significantly lower.

This explains why Canadians are taking on more and more debt. Wage growth is muted so as the housing frenzy reached a bubble phase, Canadians worried they wouldn't be able to afford a house borrowed heavily from banks and subprime lenders to compete with foreign and domestic buyers.

Once they bought their house at overvalued levels, they had to pay a welcome tax and municipal taxes based on the municipal evaluation, which is based on current market prices.

This is another huge tax grab. In fact, a friend of mine shared this with me today:

For the first time ever, I contested my municipal evaluation.He's probably right and don't forget, when house prices go down, your municipal taxes based on inflated prices (evaluations) won't go down, not unless there is a depression, and even that might not impact them.

The valuation applied by the City of Montreal was ridiculously overstated (by at least 15%). The whole process is a bit of a sham. You have to pay $500 to contest and it is not reimbursable if you win.

Of course, the City benefits by exaggerating valuations so their incentive to err on the exaggerated end is high. I won the challenge (hands down). They didn't even put up a fight which tells that I didn't go far enough.

Somebody should really do a study which compares how municipal taxes have increased over time on an inflation adjusted basis. What is ridiculous is that the municipalities used to offer services but now charge extra for everything. I bet that taxes have increased way beyond inflation.

This is what happened in Greece, as the country sunk into a deep depression, municipal taxes remained elevated (based on pre-crisis high evaluations) and people walked away from their homes, unable to pay the monthly payments and taxes (not to mention, renters weren't paying their rent, taking advantage of a lenient and farcical Greek justice system, so property owners really got screwed).

This brings me to another important point, a little disagreement I have with Garth Turner who publishes the very popular Greater Fool blog, all about the housing follies Canadians have succumbed to in their quest to own a nice house at all cost.

Garth has done great work, I often read his blog but we have a fundamental disagreement. You see, Garth buys the nonsense big banks are peddling, that rates are headed up, and he believes higher rates will kill the Canadian housing market for a long time. I believe debt deflation and soaring unemployment in an ultra-low rate environment will clobber the Canadian housing market for decades.

In fact, in a recent comment, After Mom, Garth stated this:

When a reporter asked me this week what major cities housing refugees from Vancouver or Toronto should explore to find “a bargain”, the answer was simple. None. There are no bargains just before real estate values decline. Only wealth traps. Especially for first-time buyers who cannot afford losses.I seized on that last passage to post this comment:

The reason is simple and it’s called B-20. The forgettable name is “Residential Mortgage Insurance Underwriting Practices and Procedures” and it emanates from the banks’ regulator, OSFI. Freaked out at the size and growth in mortgage debt, along with what looks like a rapid decline in the quality of that debt, OSFI has proposed tough new borrowing guidelines which it says, “will be issued in autumn 2017, and will come into effect shortly thereafter.”

It sure looks like a game-changer, as this pathetic blog heroically explains. The main consequence will be a stress test every person taking out or renewing a mortgage must pass, proving they can afford payments at current rate +2%. If financial circumstances have eroded or house equity faded, it’ll be current rate +3%. If you want a home loan from one of the Big Six, that’s the rule sometime after Thanksgiving.

Why is this happening?

Because (a) interest rates will be upped by the Bank of Canada another four to six times over the coming years, (b) mortgage debt is out of control and a third of borrowers say last month’s single quarter-point hike is already hurting them, and (c) down payment money from the Bank of Mom has completed screwed things up. Parental cash has purposefully skirted rules designed to protect people from borrowing too much. It’s love gone awry.

“Why is this happening? Because (a) interest rates will be upped by the Bank of Canada another four to six times over the coming years”Garth responded:

Really? Want to bet on that? Garth, read my blog comments because you still think rising rates are what’s going to kill the great Canadian housing bubble. You and others who think rates are headed up have been wrong and continue to claim this. You don’t see the big global deflation tsunami headed our way and how high debt and higher unemployment will kill the housing market for decades, NOT rising rates. Agree with rest of your comments.

Actually restricted credit, not higher rates, will be the true enemy of real estate. But the cost of money, nonetheless, will increase.No doubt, tighter restrictions will hurt many trying to get a loan, and my biggest fear is those dual-income households drowning in debt, barely making their mortgage payments. Never mind what TransUnion says, if one member loses their job, mortgage delinquencies will rise significantly.

Also worth noting, while Ontario and British Columbia's new levies and measures have had a short-term negative effect on home prices, unless they significantly expand housing supply, prices will keep climbing in the future.

Things are not great in Canada. People drowning in debt will typically cut discretionary spending like restaurants, movies, shopping for clothes, electronic gizmos, trips, etc.

There is only so much debt one can take on before they pass the point of no return --where essentially they will be condemned to debt servitude for pretty much the rest of their life.

I'm increasingly worried about Canada's growing debt problem. There is no doubt it will impact the economy longer term, and possibly even in the near term.

This is why I am long US long bonds (TLT), using the grossly inflated loonie to load up on US Treasurys. I am also long Canadian bonds and short the loonie.

And if my worst fears on global deflation come true, oil prices will plunge to record low levels, manufacturing and service sector unemployment will soar, and Canada will be in a crisis for many years. This is why Canada's growing debt problem is such a huge concern for policymakers.

Hope you enjoyed this comment. If you have anything to add, feel free to share your thoughts via email at LKolivakis@gmail.com.

Below, 680 NEWS senior business editor Mike Eppel reports on Canadian consumer loans. He's right, as long as Canadians can service this debt, they will be fine, but if that changes because of an internal or external shock, watch out, it will get very ugly, very fast.