The CBC reports, 'There will be war' over pension changes, retirees warn:

Nonetheless, retirees are right to feel angry, betrayed and hoodwinked. There were no public consultations whatsoever and the cuts to their benefits were not explained to them properly.

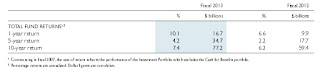

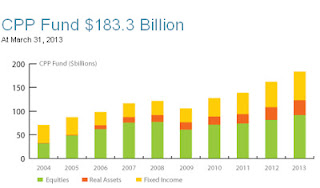

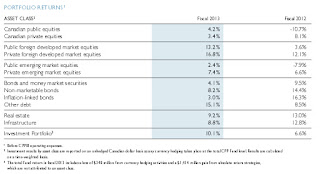

Another thing worth looking into was whether their plan was properly managed over the last twenty years. That $1 billion shortfall no doubt got worse as interest rates hit record lows, but there were concerns that the plan wasn't being managed properly for many years (many issues have now been addressed but the performance lagged their Canadian peers).

Why is it important to keep an eye on New Brunswick's pension war? Because some think New Brunswick has the answer to Canada's pension funding crisis and that shared-risk plans are the future and will likely spread across Canada as their benefits become better known.

While I agree with shared-risk plans, which was one of the recommendations of the committee looking into Quebec's retirement plans, also think we need to look more closely at pension governance and improving the way these plans manage their investments and communicate their results.

The situation in New Brunswick is grim but hardly dire. The government bungled it up by not holding public consultations and can hardly be surprised by the backlash from retirees rightly concerned about cuts to their pension benefits, money which they paid into the plan for many years.

Below, angry civil service pensioners in Moncton tell finance minister reforms are 'illegal' and declare war over cuts to their pensions. Unfortunately, this scene will be playing out throughout Canada in the future which is why I urge finance ministers to bolster our retirement as soon as possible.

Opposition to proposed pension reforms continued to gather strength on Thursday afternoon as Finance Minister Blaine Higgs met with hundreds of angry retired civil servants in Moncton.

About 600 people attended the public information session about switching to the shared-risk model, including Betty Smith, a retired teacher and member of the Pension Coalition of New Brunswick.

"What they are doing is unacceptable, we will not accept it," said Smith. "There will be war in the province before this is over."

Under the provincial government’s reforms, the future pension risk would be shared by both sides.

Guaranteed cost-of-living increases will also be eliminated for pensioners and instead be dependent upon market performance.

'All we want is what we paid for — nothing more, nothing less.'—Betty Smith, retired teacher

Smith, who spent 12 years teaching and 33 years in the classroom, said she worked too hard to see her pension plan change.

"What they are doing is illegal, very illegal," she said.

"All we want is what we paid for — nothing more, nothing less. Shared-risk is great on a go-forward basis, not the way it's going now."

"We paid dearly for what we have today, and the money has been squandered by the governments. And they want to get more of our money. And we're not going to put up with it," Smith said.

Higgs 'embarrassed' about lack of consultationsCBC also reports, Pension reforms for retirees not illegal, expert says:

The finance minister was also peppered with questions about a lack of communication and consultation on the changes.

Higgs, who is touring the province, visiting seven cities in four days, acknowledged their concerns and apologized to the crowd several times.

"I have not been involved in the process to this level til this point," he said. "I am embarrassed to be in this position at this time, where discussions were not held to the degree where they should have been."

Higgs was defensive, however, when it came to threats that his government will suffer consequences at the polls over the unpopular pension changes.

That type of threat has scared previous governments and put the province deeper and deeper into debt, he said.

"For me and for my colleagues, we didn't join this to just have this province to continue to spiral down this hole. We joined it to say can we start to recover."

Under the current plan, the risk of any market downturns is borne by the provincial government alone. Under the reforms, the risk would be shared by both sides.

The proposed model, unveiled last May by Premier David Award, also includes increased contribution levels and higher age of retirement phased in slowly over a period of time.

Government officials have previously said the pension changes would not cut the benefits in place for retirees.

But a government actuary at the Saint John meeting acknowledged cost-of-living increases will be eliminated for pensioners and instead be dependent upon market performance.

The Public Service Superannuation Act (PSSA), which covers employees who work directly for government departments and NB Power, currently has a $1 billion shortfall.

It included 13,441 pensioners as of March 31, 2012. Their average annual pension was $20,603.

A meeting was also held in Miramichi on Thursday night.

Meetings are also scheduled for:

- Bathurst, April 19, 1 p.m.-3 p.m., Collège communautaire du Nouveau-Brunswick amphitheatre, Room 286C, 75 Youghall Dr.

- Campbellton, April 19, 6 p.m.-8 p.m.: Collège communautaire du Nouveau-Brunswick gymnasium, 47 du Village Ave.

- Edmundston, April 20, 1 p.m.-3 p.m.: Clarion Hotel, Banquet Room, 100 Rice St.

A pension law expert says he doubts retired civil servants will be able to convince the courts that proposed pension changes in New Brunswick are a breach of contract.

"All contractual arrangements between employers and employees and retirees are governed by the Pension Benefits Act," said James Pierlot, who is based in Toronto.

"So the government does have the legal power to change how that functions. And indeed, to introduce shared-risk pension plans as it has done. So it that sense, no, there is no illegality here," he said.

Anger among pensioners has continued to grow this week as Finance Minister Blaine Higgs held a series of public meetings across the province to explain the changes.

Under the current plan, retired civil servants are sheltered by the provincial government from any risk of market downturns.

Under the reforms, however, the risk would be shared by both sides.

Guaranteed cost-of-living increases will also be eliminated for pensioners and instead, be dependent upon market performance.

Many pensioners have argued it's unfair for them to lose benefits they've already paid for.

Current employees hardest hitJames is right, there is nothing illegal being done here and younger employees will bear the brunt of the new plan. They will not enjoy the retirement benefits of current retirees.

Pierlot says it's understandable that retirees are upset about the changes, but they will be the least affected.

It is current employees who will bear the brunt of the new plan, he said.

"And the younger they are, the more modest their pensions are going to be going forward. They're facing later retirement ages, lower benefits, et cetera. Whereas any reductions or risks faced by retirees is considerably less."

Premier David Alward announced the government was overhauling the pension system last May, saying the current plan is not sustainable.

The new plan will see increased contribution levels and a higher age of retirement phased in. The targeted retirement age would be moved to 65 from 60 over a 40-year period.

Nonetheless, retirees are right to feel angry, betrayed and hoodwinked. There were no public consultations whatsoever and the cuts to their benefits were not explained to them properly.

Another thing worth looking into was whether their plan was properly managed over the last twenty years. That $1 billion shortfall no doubt got worse as interest rates hit record lows, but there were concerns that the plan wasn't being managed properly for many years (many issues have now been addressed but the performance lagged their Canadian peers).

Why is it important to keep an eye on New Brunswick's pension war? Because some think New Brunswick has the answer to Canada's pension funding crisis and that shared-risk plans are the future and will likely spread across Canada as their benefits become better known.

While I agree with shared-risk plans, which was one of the recommendations of the committee looking into Quebec's retirement plans, also think we need to look more closely at pension governance and improving the way these plans manage their investments and communicate their results.

The situation in New Brunswick is grim but hardly dire. The government bungled it up by not holding public consultations and can hardly be surprised by the backlash from retirees rightly concerned about cuts to their pension benefits, money which they paid into the plan for many years.

Below, angry civil service pensioners in Moncton tell finance minister reforms are 'illegal' and declare war over cuts to their pensions. Unfortunately, this scene will be playing out throughout Canada in the future which is why I urge finance ministers to bolster our retirement as soon as possible.

.bmp)

.bmp)