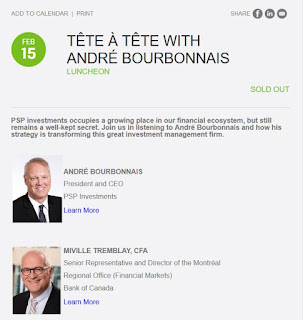

The President and CEO of PSP Investments, André Bourbonnais, was the invited guest at a CFA Montreal luncheon on Wednesday. He was interviewed by Miville Tremblay, Director and Senior Representative at the Bank of Canada in what proved to be a very engaging and fruitful discussion (click on image):

Before I give you my comments below -- and you should definitely read them to gain extra insights that I got after the luncheon was over -- let me first thank Mrs. Lynne Rouleau (hope I spelled her name right, she is super nice), André Bourbonnais's executive assistant who put me in touch with the people at the CFA Montreal to cover this luncheon.

I also want to thank Roxane Gélinas and Véronique Givois at CFA Montreal for finding me a spot in the corner to listen in and for sending me nice pictures like the one at the top of the comment and this one below (click on image):

Here you see Carl Robert of Intact Investments who is Vice-President of CFA Montreal, Miville Tremblay of the Bank of Canada, Sophie Palmer of Jarislowsky Fraser and President of CFA Montreal, and of course, André Bourbonnais, President and CEO of PSP, the guest of honor (you can see the governance of CFA Montreal here).

I am glad I attended this event as it was snowing hard Wednesday morning and I was afraid I'd have to cancel. But the snow stopped, told the cab driver to take the Decarie expressway which was miraculously empty (love it when that happens) and I got to the St-James Club right on time.

I happen to love this venue and sat next to a couple of nice journalists who also attended the luncheon. One of them, Pierre-Luc Trudel of Conseiller.ca, already wrote a nice short article (in French) on the luncheon, Cap sur le marché privé:

Anyway, Miville started things off by discussing the reflation trade, asking André Bourbonnais if he thinks low interest rates are here to stay. André (will avoid calling him Mr. Bourbonnais each and every time) said that if President Trump implements the good elements of his economic policy (deregulation, tax cuts, spending on infrastructure, etc.), rates will rise in the US and so will inflationary pressures. In this environment, the Fed doesn't want to fall behind the curve and will have to hike rates.

This is why in their bond portfolio, PSP is overweight corporate bonds and short-duration government bonds relative to long-duration government bonds [Note: Given my views on the reflation chimera, I wouldn't throw in the towel on long bonds and would pay close attention to top strategists like François Trahan of Cornerstone Macro who was in town for the last CFA Montreal luncheon. Make sure you watch Michael Kantrowitz's recent video clip on Risks Outlook: Away From The Current, Back To The Future.]

Now, to be fair, André Bourbonnais isn't an economist by training (he is a lawyer) and he openly stated that when he watches people like Ray Dalio or others stating conviction views on where the global economy is heading, he is impressed but he "wouldn't be able to sleep at night making high conviction calls based on anyone's macro views."

And, as you will see below, André has legitimate concerns on Europe and emerging markets, so he doesn't see rates rising back to historical levels and thinks we're in for a long slug ahead where rates will remain at historically low levels.

In fact, when asked about asset classes, he said "all assets classes will experience lower returns going forward." There is short-term momentum in stocks but when the music stops, watch out, it will be a tough environment for public and private markets. Still, despite the volatility, he thinks stocks can generate 6-7% over the long run.

Interestingly, André said that PSP and the Chief Actuary of Canada (Jean-Claude Ménard) are currently reviewing their long-term 4.1% real return target because it may be "too high". This has all sorts of political implications (ie. higher contribution rates for federal government and federal public sector employees) but he mentioned that the Chief Actuary is skeptical that this real return target can be achieved going forward (I totally agree).

When the discussion shifted to private markets, that's when it got very interesting because André Bourbonnais is an expert in private markets and he stated many excellent points:

I'm not blaming Gordon for this, that's his style, but I agree with André Bourbonnais that PSP can no longer stay under the radar, nor should it. It's a major Canadian pension fund growing by leaps and bounds and it needs to be more engaged with its local community and help shape and grow Montreal's financial industry as much as it can (as long as the alignment of interests are there) and just be more active and present in the local community.

I quite enjoyed this exchange between André Bourbonnais and Miville Tremblay. At the end of the luncheon, I went to introduce myself but he was swarmed by people so I couldn't shake his hand and properly introduce myself. Instead, I emailed him right after to tell him I enjoyed this exchange and hopefully we can meet on another occasion. He was nice and emailed me back saying he looked forward to reading my comment.

One person I did run into at the end of the luncheon and was glad to see was Neil Cunningham, PSP's Senior Vice President, Global Head of Real Estate Investments. Neil came to me and while I recognized him, he shed a lot of weight and looked great. He told me he's laying off the carbs and booze, exercising and sleeping more (he looked better than when I last saw him at PSP in 2006 and his wife is right, skinny ties are better and in style).

Anyway, Neil and I chatted about the luncheon and he shared some interesting tidbits with me that you will only read here, so pay attention:

Neil is a great guy, I've been critical on PSP's silly real estate benchmark which his predecessor implemented but there's no denying he's one of the best institutional real estate investors in the world (and woud outperform even with a tougher RE benchmark).Before I give you my comments below -- and you should definitely read them to gain extra insights that I got after the luncheon was over -- let me first thank Mrs. Lynne Rouleau (hope I spelled her name right, she is super nice), André Bourbonnais's executive assistant who put me in touch with the people at the CFA Montreal to cover this luncheon.

I also want to thank Roxane Gélinas and Véronique Givois at CFA Montreal for finding me a spot in the corner to listen in and for sending me nice pictures like the one at the top of the comment and this one below (click on image):

Here you see Carl Robert of Intact Investments who is Vice-President of CFA Montreal, Miville Tremblay of the Bank of Canada, Sophie Palmer of Jarislowsky Fraser and President of CFA Montreal, and of course, André Bourbonnais, President and CEO of PSP, the guest of honor (you can see the governance of CFA Montreal here).

I am glad I attended this event as it was snowing hard Wednesday morning and I was afraid I'd have to cancel. But the snow stopped, told the cab driver to take the Decarie expressway which was miraculously empty (love it when that happens) and I got to the St-James Club right on time.

I happen to love this venue and sat next to a couple of nice journalists who also attended the luncheon. One of them, Pierre-Luc Trudel of Conseiller.ca, already wrote a nice short article (in French) on the luncheon, Cap sur le marché privé:

Avec des perspectives de rendements relativement modestes dans l’ensemble des catégories d’actif au cours des prochaines années, Investissements PSP cherche à diminuer son exposition aux marchés publics pour générer de la valeur.The article above is in French but don't worry, I will translate the main points below. In fact, from where I was sitting in the corner, I couldn't see André Bourbonnais and Miville Tremblay, but it didn't matter as I was furiously jotting notes down in English as they spoke in French (thank goodness my parents pushed all three kids to study in French private high schools as my time at Le Collège Notre Dame was tough but very rewarding. My brother studied at Brébeuf where he had Justin Trudeau as a classmate and my sister studied at Villa Ste-Marceline. All three are great schools).

À long terme, l’objectif du quatrième plus grand investisseur institutionnel canadien est d’investir 50 % de son actif dans les marchés publics et 50 % dans les marchés privés, ce qui comprend notamment l’immobilier, les infrastructures, la dette privée et le placement privé.

« Nous étions relativement en retard par rapport à d’autres grandes caisses de retraite canadiennes dans certaines catégories d’actifs, principalement les infrastructures et les dettes privées », a expliqué mercredi le président et chef de la direction d’Investissements PSP, André Bourbonnais, devant les membres de CFA Montréal.

Pour « rattraper son retard », Investissements PSP a par exemple décidé de miser sur la dette privée en ouvrant en 2015 un bureau dédié à cette catégorie d’actif à New York. « Le talent et le réseau dans la dette privée est vraiment à New York », a-t-il affirmé.

Des occasions intéressantes se trouvent aussi du côté des infrastructures, mais M. Bourbonnais émet tout de même une mise en garde. « Les investisseurs ont tendance à les substituer aux obligations, mais ils sous-estiment souvent les risques associés à cette catégorie d’actif. »

Il privilégie également les investissements dans les projets d’infrastructures déjà opérationnelles par rapport à ceux encore au stade de développement. « Les caisses de retraite sont de bons propriétaires, mais peut-être pas de bons développeurs », a-t-il dit, tout en admettant que les primes pour les projets en développement sont beaucoup plus intéressantes.

La fin de l’environnement de bas taux?

Déréglementation, baisses d’impôt et investissement dans les infrastructures publiques, voilà des éléments de la politique de Donald Trump qui, s’ils sont réalisés, engendreront une poussée inflationniste aux États-Unis, qui à son tour favorisera une hausse des taux d’intérêt.

C’est pour cette raison qu’André Bourbonnais explique favoriser des portefeuilles de titres à revenu fixe flexibles à durée « relativement courte » où les obligations de sociétés sont surpondérées par rapport aux obligations gouvernementales. « Mais dans une perspective historique, même avec une hausse des taux de 100 points de base, on demeurerait dans un environnement de taux bas », a-t-il relativisé.

Du côté des actions, on anticipe des rendements d’environ 6 ou 7 % sur un horizon de 10 ans. Dans ce contexte, la gestion active permettra-elle d’aller chercher de la valeur ajoutée? « Nous faisons de la gestion active à l’interne pour aller capter de la valeur là où il y a de l’inefficience, dans les marchés émergents et les petites capitalisations, par exemple », a expliqué M. Bourbonnais.

Mais dans les marchés où l’offre est plus grande, comme les actions canadiennes, Investissements PSP privilégie les mandats de gestion externes ou encore la gestion passive. L’investisseur prévoit d’ailleurs réduire sa répartition en actions canadiennes au cours des prochaines années, la faisant passer de 30 % à environ 10 à 15 % de son actif total.

Anyway, Miville started things off by discussing the reflation trade, asking André Bourbonnais if he thinks low interest rates are here to stay. André (will avoid calling him Mr. Bourbonnais each and every time) said that if President Trump implements the good elements of his economic policy (deregulation, tax cuts, spending on infrastructure, etc.), rates will rise in the US and so will inflationary pressures. In this environment, the Fed doesn't want to fall behind the curve and will have to hike rates.

This is why in their bond portfolio, PSP is overweight corporate bonds and short-duration government bonds relative to long-duration government bonds [Note: Given my views on the reflation chimera, I wouldn't throw in the towel on long bonds and would pay close attention to top strategists like François Trahan of Cornerstone Macro who was in town for the last CFA Montreal luncheon. Make sure you watch Michael Kantrowitz's recent video clip on Risks Outlook: Away From The Current, Back To The Future.]

Now, to be fair, André Bourbonnais isn't an economist by training (he is a lawyer) and he openly stated that when he watches people like Ray Dalio or others stating conviction views on where the global economy is heading, he is impressed but he "wouldn't be able to sleep at night making high conviction calls based on anyone's macro views."

And, as you will see below, André has legitimate concerns on Europe and emerging markets, so he doesn't see rates rising back to historical levels and thinks we're in for a long slug ahead where rates will remain at historically low levels.

In fact, when asked about asset classes, he said "all assets classes will experience lower returns going forward." There is short-term momentum in stocks but when the music stops, watch out, it will be a tough environment for public and private markets. Still, despite the volatility, he thinks stocks can generate 6-7% over the long run.

Interestingly, André said that PSP and the Chief Actuary of Canada (Jean-Claude Ménard) are currently reviewing their long-term 4.1% real return target because it may be "too high". This has all sorts of political implications (ie. higher contribution rates for federal government and federal public sector employees) but he mentioned that the Chief Actuary is skeptical that this real return target can be achieved going forward (I totally agree).

When the discussion shifted to private markets, that's when it got very interesting because André Bourbonnais is an expert in private markets and he stated many excellent points:

- Real estate is an important asset class to "protect against inflation and it generates solid cash flows" but "cap rates are at historic lows and valuations are very stretched." In this environment, PSP is selling some of their real estate assets (see below, my discussion with Neil Cunningham) but keeping their "trophy assets for the long run because if you sell those, it's highly unlikely you will be able to buy them back."

- Same thing in private equity, they are very disciplined, see more downside risks with private companies so they work closely with top private equity funds (partners) who know how to add operational value, not just financial engineering (leveraging a company us to then sell assets).

- PSP is increasingly focused on private debt as an asset class, "playing catch-up" to other large Canadian pension funds (like CPPIB where he worked for ten years prior to coming to PSP). André said there will be "a lot of volatility in this space" but he thinks PSP is well positioned to capitalize on it going forward. He gave an example of a $1 billion deal with Apollo to buy home security company ADT last February, a deal that was spearheaded by David Scudellari, Senior Vice President, Principal Debt and Credit Investments at PSP Investments and a key manager based in New York City (see a previous comment of mine on PSP's global expansion). This deal has led to other deals and since then, they have deployed $3.5 billion in private debt already (very quick ramp-up).

- PSP also recently seeded a European credit platform, David Allen‘s AlbaCore Capital, which is just ramping up now. I am glad Miville asked André about these "platforms" in private debt and other asset classes because it was confusing to me. Basically, hiring a bunch of people to travel the world to find deals is "operationally heavy" and not wise. With these platforms, they are not seeding a hedge fund or private equity fund, they own 100% of the assets in these platforms, negotiate better fees but pump a lot of money in them, allowing these external investment managers to focus 100% of their time on investment performance, not marketing (the more I think about, this is a very smart approach).

- Still, in private equity, PSP invests with top funds and pays hefty fees ("2 and 20 is very costly so you need to choose your partners well"), however, they also do a lot of co-investments (where they pay no fees or marginal fees), lowering the overall fees they pay. André said "private equity is very labor intensive" which is why he's not comfortable with purely direct investments, owning 100% of a company (said "it's too many headaches") and prefers investing in top funds where they also co-invest alongside them on larger transactions to lower overall fees (I totally agree with this approach in private equity for all of Canada's mighty PE investors). But he said to do a lot of co-investments to lower overall fees, you need to hire the right people who monitor external PE funds and can analyze co-investment deals quickly to see if they are worth investing in (sometimes they're not). He gave the example of a $300 million investment with BC Partners which led to $700 million in co-investments, lowering the overall fees (that is fantastic and exactly the right approach).

- In infrastructure, André said "they can deploy a lot of capital" and "direct investing is more straightforward" giving the example of a toll road where once it's operational, they know the cash flows and can gauge risks and don't need to invest through a fund. However, he also discussed a platform for PSP's airports where they need expertise to better manage these infrastructure investments.

- He said the risks in infrastructure are "grossly underestimated" and just like real estate, another long term asset class, valuations are very stretched. "Too many investors see infrastructure as a substitute to bonds and underestimate the risks in these assets."

- André praised Michael Sabia for venturing into greenfield infrastructure projects like the REM Montreal project but said that these projects are risky. Still, he added "their risk premium is compelling relative to brownfield projects which have gotten very pricey." He was happy to see Jim Leech was tapped to get things going on the federal infrastructure bank and they look forward to seeing if this bank can reduce the risk for pensions to invest in greenfield infrastructure projects in Canada (by the way, scratch Michael Sabia off the list to head this new infrastructure bank, his mandate was just renewed for another four years at the Caisse, most likely to allow him to see the completion of the REM project, his baby). He also said PSP is open to participating in US greenfield infrastructure projects if the terms and risk are right.

- In venture capital, it's more difficult because "PSP cannot invest in scale to move the needle" but it's looking at setting up technology platforms to invest in trends like artificial intelligence (AI) and other emerging technologies like robotics (I love biotech, think there are great undervalued public and private biotech companies out there but you need to team up with top biotech and VC funds to find them).

- Over the long-term, PSP's asset mix will move to 50% in private markets (real estate, private equity, private debt and infrastructure) and 50% in public markets.

- PSP is different from CPPIB, one the largest global investors in hedge funds with close to $14 billion in hedge fund assets, because PSP's hedge fund portfolio is very concentrated and funded via an overlay (portable alpha) strategy (just like Ontario Teachers', remember what Ron Mock said: "Beta is cheap, you can swap into any bond or stock index for a few basis points but real alpha is worth paying for").

- He said that unlike the Caisse, PSP has no mandate to invest in the local economy and local emerging managers will be evaluated against all their managers all over the world. Their objective is clear: "To maximize returns without taking undue risk". This means it will be tougher for Quebec's emerging managers to emerge but if they are good, PSP will invest in them (I would recommend emerging managers look elsewhere for assets).

- PSP doesn't engage in market timing. It invests in private and public markets over the long run. There are numerous geopolitical concerns (US, Russia, North Korea, Europe, Brexit, Middle East, etc.) and "fat tail risks" but these are constantly there so you need to take a long-term view.

- Having said this, there are cycles and swings in all asset classes, but it's "hard to sell your real estate and infrastructure holdings ahead of a Brexit vote" (not that you'd want to), so for obvious reasons, when risks are high, there is more activity in public markets where liquidity is much better and it's easier to tinker with the asset mix.

- Because of its size, $130 billion and growing fast, PSP has decided not to hedge currency risk going forward (like CPPIB, smart move) and even though liabilities are in Canadian dollars, it is looking to reduce its exposure to Canadian equities from 30% to 15% (another smart move).

- Interestingly, in emerging markets, André said "they're not overweight" and he "doesn't have a very clear view" even after spending a lot of time in China and India. He gave the example of all the hoopla surrounding Brazil years ago and look at where they are now. I agree and have always thought there was so much nonsense and exaggerated claims on the "BRICs" and even remember attending a Barclays conference in 2005 on commodities and BRICs where everyone was trying to sell me their glowing story. I came back and recommended to PSP's board that it not invest in commodities as an asset class for many reasons (that decision alone saved PSP billions in losses and had senior managers back then listened to my warnings on the credit crisis, they would have avoided billions more in losses!). Also, given my views on the reflation chimera and US dollar crisis, I would be actively shorting emerging markets (EEM), Chinese (FXI), Industrials (XLI), Metal & Mining (XME), Energy (XLE) and Financial (XLF) shares on any strength here (book your profits while you still can). The only sector I like and trade now, and it's very volatile, is biotech (XBI) and technology (XLK) is doing well, for now. If you want to sleep well, buy US long bonds (TLT) and thank me later this year.

- I believe André said the internal/ external mix for active managers for all assets is 75%/ 25% but please don't quote me on that as I am not sure.

I'm not blaming Gordon for this, that's his style, but I agree with André Bourbonnais that PSP can no longer stay under the radar, nor should it. It's a major Canadian pension fund growing by leaps and bounds and it needs to be more engaged with its local community and help shape and grow Montreal's financial industry as much as it can (as long as the alignment of interests are there) and just be more active and present in the local community.

I quite enjoyed this exchange between André Bourbonnais and Miville Tremblay. At the end of the luncheon, I went to introduce myself but he was swarmed by people so I couldn't shake his hand and properly introduce myself. Instead, I emailed him right after to tell him I enjoyed this exchange and hopefully we can meet on another occasion. He was nice and emailed me back saying he looked forward to reading my comment.

One person I did run into at the end of the luncheon and was glad to see was Neil Cunningham, PSP's Senior Vice President, Global Head of Real Estate Investments. Neil came to me and while I recognized him, he shed a lot of weight and looked great. He told me he's laying off the carbs and booze, exercising and sleeping more (he looked better than when I last saw him at PSP in 2006 and his wife is right, skinny ties are better and in style).

Anyway, Neil and I chatted about the luncheon and he shared some interesting tidbits with me that you will only read here, so pay attention:

- On rates going up in the US, he said that was only a partial answer because while the US is doing well, the rest of the world isn't firing on all cyclinders. He did say that Germany just posted a record trade surplus and it's in their interest to maintain the Eurozone intact, so he is cautiously optimistic on Europe.

- On private equity fees, he agreed with André Bourbonnais, PSP doesn't have negotiating power with top PE funds because "let's say they raise a $14 billion fund and we take a $500 million slice and negotiate a 10 basis reduction on fees, that's not 10 basis points on $500 million, that's 10 basis points on $14 billion because everyone has a most favored nation (MFN) clause, so top private equity funds don't negotiate lower fees with any pension or sovereign wealth fund. They can just go to the next fund on their list."

- He said that 20 partners account for over 80% of PSP's real estate portfolio and he spends a lot of time visiting them to figure out any changes in their strategy and execution. "You know the deal Leo, they throw a pitch book in front of you but I toss it aside and request a a meeting with the CEO and senior partners to dig deeper in their strategy." I know exactly what he means which is why I always requested to meet with senior people at the hedge funds I invested with and grilled them so hard, at the end of the meeting, they either loved me or hated me but I wasn't there to schmooze and have fun (only after I grilled them and they still wanted to see my face did I go grab a beer or dinner with them). Neil said he spends a lot of time traveling for face to face meetings which are far better than any other way of communicating (agreed).

- Interestingly, he told me that real estate will do fine in a rising rate environment "as long as it is accompanied with higher inflation". No inflation or deflation is bad for real estate assets.

- He said he is always selling assets every year because sometimes the platforms they use get too big, so they decide to shed assets to large funds -- like CPPIB which bought half of PSP's New Zealand real estate portfolio -- and to smaller pensions when it's a smaller transaction.

- I told Neil he should get in touch with David Rogers at Caledon Capital Management who helps small to mid size pensions invest in private equity and infrastructure because I'm sure they will get along and might be able to help each other. Then I told him I should be helping Caledon on these deals and get pad for it! -:)

- But Neil isn't selling "trophy assets" like 1250 René-Lévesque West in Montreal which he rightly considers the best office building in the city with an important long-term tenant (PSP).

- I told him along with Daniel Garant, PSP's Executive Vice President and Chief Investment Officer, he's one of the only surviving senior managers from the Gordon Fyfe era, everyone else is gone. He told me: "that's true but Daniel and I just focus on delivering performance and that's why we're still around." I then asked him how long he'll be doing this, to which he responded "as long as I'm still having fun."

On that note, let me thank Neil, André Bourbonnais, Miville Tremblay (did a great job) and the rest of the CFA Montreal members who did an outstanding job organizing this luncheon (everything was perfect).

Please kindly remember to show your support for this blog by donating or subscribing on the top right-hand side under my picture. Thank you.

Below, once again, take the time to watch this clip of André Bourbonnais discussing long term perspective from a Deloitte Director's Series event that took place last year. Listen carefully to what he says, he knows his stuff even if he sometimes forgets he's now working at PSP, not CPPIB! -:)